2011 LD-T INSTRUCTIONS

ACCOUNTING DIVISION

STATE OF ARKANSAS

DEPARTMENT OF INSURANCE

FOREIGN LIFE, ACCIDENT AND HEALTH COMPANIES

IMPORTANT INFORMATION************************************************

It is necessary to include your 5-digit NAIC number in the spaces provided. Do not use the federal identification

number in place of your NAIC number.

If you are expecting a refund, please mark “REFUND DUE” on top of page 1.

You are required to file a copy of: 1) the Jurat’s Page 2) Annual Statement Direct Business Page reflecting Arkansas

premiums 3) Schedule T from the annual statement and 4) Proof of credits taken on filing.

GENERAL FILING INFORMATION & CHECKLIST

Completing the return:

The return must be typed or legible print on our forms. No Exceptions, we do not accept software company

forms or substitutions.

Forms

NO AUTHORITY EXISTS FOR GRANTING ANY EXTENSION OF TIME FOR FILING OR PAYMENT.

print on 8 ½ x 11 sheet of paper.

Sending in the return:

Mail your return and check to:

Arkansas Insurance Department

Attn: Accounting Division

1200 West Third Street

Little Rock, AR 72201-1904

If you overnight your return, use the same address. Do not include the instructions with your return and

remittance.

Contact Information: Phone: 501-371-2605

Website:

Filing Period:

For calendar year ending 12/31/11 the Annual tax forms, related premium taxes and filing fees are due on or before

March 1, 2011.

Postmark Dates:

The Arkansas Insurance Department does not accept the postmark date for filing requirements. All tax

forms must be received in our department on or before 03/01/12. If your company uses a carrier other than the U.S.

Postal Service, the Department still expects the filing on or before 03/01/11. All tax forms are subject to penalty ($100

a day) in accordance with ACA. 26-57-607.

DO NOT INCLUDE WITH THE PREMIUM TAX FILINGS:

CORPORATE FRANCHISE TAX

Remit to the Office of the Secretary of State, Attention: Lisa Bruno,

1401 Capitol Ave., Victory Bldg., Suite 250, Little Rock AR 72201.

MAIL TO ADDRESS ON THE FORM

MANDATORY L&H GUARANTY

If you have any questions, direct inquiries to (501) 371-2776 or

FUND INFORMATION SHEET

, click on Divisions, then Liquidation.

MAIL TO ADDRESS ON THE FORM

MANDATORY ARKANSAS

If you have any questions, direct inquiries to (501) 370-2659 or

COMPREHENSIVE HEALTH INS

POOL (CHIP)

MAIL TO ADDRESS ON THE FORM

1

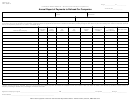

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9