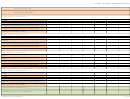

2011 Instructions To Complete The Dc Combined Report Page 11

ADVERTISEMENT

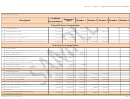

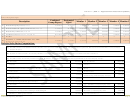

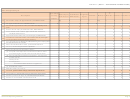

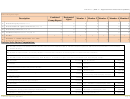

Schedule 3

Interest Expense Offset for Tax-Exempt Interest Income

Name of Designated Agent

1.

Source

a. Interest expense. Total interest expense deducted in determining federal taxable income

(1)

$375,000

b. Interest expense disallowed under IRC Sections 265 and 291

c. Interest expense from a pass-through entity

d. Interest expense of foreign corporations included in the combined report

$375,000

e. Subtotal. Add lines a through d.

f.

Interest expense of corporations included in the consolidated federal return but not part of the combined report

filed with District

$375,000

g. Total interest expense. Subtract line f from line e.

2. Total tax-exempt income (interest on qualifying obligations of the United States and interest on qualifying

(2)

75,000

obligations of the District)

3. Total income (amount reported on the federal return(s), total income from Sch. C Form 5471 and partnership total

(3)

10,480,000

income and distributive amounts)

0.0071565

4. Divide line 2 by line 3.

$2,684

5. Multiply line 1g by line 4. This is the amount of the Interest Expense Offset.

(1)

Schedule 3

(2)

Schedule 2

(3)

Schedule 3 Total Incomes

$10,460,000

Schedule 2 Interest exempt under the IRC

20,000

Total Income

$10,480,000

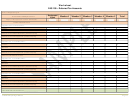

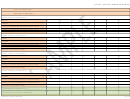

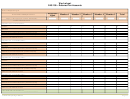

Combined Reporting Schedules

Page 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37