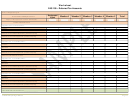

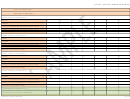

2011 Instructions To Complete The Dc Combined Report Page 23

ADVERTISEMENT

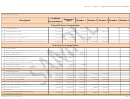

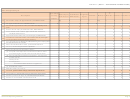

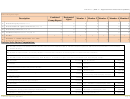

Schedule 1

District of Columbia Combined Report

Tax Year

_________

Fiscalized

_________

Name of Designated Agent

Ending

Y/N

_________ _________ ________ ________ _________ ________

Taxpayer Identification Number (FEIN/SSN)

*

Combined

Intercompany

Total Before

Designated

Description

Member 1 Member 2

Member 3 Member 4 Member 5

Agent

Group Report

Eliminations

Eliminations

1

$

($)

$

$

$

$

$

$0

$0

Gross Receipts,

minus returns and allowances

2

0

0

Cost of Goods Sold,

Attach Schedule 7

3

0

0

Gross Profit from sales and/or operations,

Line 1 minus Line 2

4

Dividends,

0

0

0

0

Attach Schedule 8

5

0

0

0

0

Interest,

Attach Statement

6

0

0

0

0

0

Gross Rental Income,

Attach Schedule 9

7

0

0

0

0

0

0

Gross Royalties,

Attach Statement

8

0

0

0

0

0

0

(a) Net Capital Gain,

Attach Schedule 4

0

0

0

0

0

(b) Ordinary Gains (Loss),

Attach copy of federal Form 4797

9

( )

0

0

0

Other income

, include Line 47 and Attach Statement

0

0

10

( )

Total Gross Income,

Add Line 3 - 9

11

Compensation of officers,

use Schedule C format from Form D-20

0

0

0

12

0

0

0

Salaries and wages

13

Repairs

0

0

0

0

0

0

14

0

0

0

0

0

0

0

0

Bad debts

15

( )

0

0

0

0

Rents

16

0

0

Taxes,

use Schedule D format from Form D-20

17

( )

0

0

Interest payments,

net of nondeductible payments to related entities

18

0

0

0

0

0

0

0

0

0

Contributions and/or Gifts,

Attach Statement

19

0

0

0

0

0

0

0

0

0

Amortization,

Attach copy of your federal Form 4562

Depreciation,

Attach copy of federal Form 4562, excluding federal

20

0

0

0

bonus depreciation and IRC Sec. 179 expense deductions

21

Depletion,

0

0

0

0

0

0

0

0

0

Attach Statement

22

0

0

0

0

0

0

0

0

0

Royalty payments,

net of non-deductible payments to related entities

23

Pension, profit-sharing plans

0

0

0

24

( )

0

0

Other deductions,

including Advertising and Line 49, Attach Statement

25

Total Deductions,

( )

0

0

Add Lines 11 through 24

26

Net Income,

( )

( )

0

0

Line 10 minus Line 25

27

Net operating loss deduction

0

0

0

0

0

0

0

0

0

(For years before 2000)

28

Net income after net operating loss deduction,

( )

( )

0

0

Line 26 minus Line 27

0

0

0

0

0

0

0

0

0

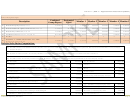

29

(a) Non-business income,

Attach Statement

(b) Expense Related to Non-business Income,

0

0

0

0

0

0

0

0

0

Attach Statement

0

0

0

0

0

0

0

0

0

(c) 29(a) minus 29(b)

30

Net income subject to apportionment,

( )

( )

0

0

Line 28 minus Line 29( c )

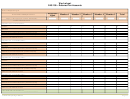

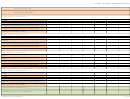

Combined Reporting Schedules

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37