2011 Instructions To Complete The Dc Combined Report Page 4

ADVERTISEMENT

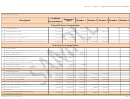

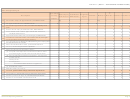

Complete Schedule 4 formats for Capital and Section 123 gains and losses and casualty

and theft gain and losses.

Complete Schedules 5 through 9 as applicable.

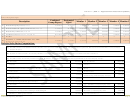

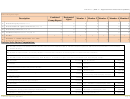

You may provide the copies of the federal schedules for each member in the group

including the designated agent for balance sheet items or provide schedules in format

of schedule G Balance Sheet given in the District Form D-20 on a CD in PDF format.

Prepare the worksheet for FAS 109- Deferred Tax Accounts.

Bring the totals to the form D-20 or D-30 as appropriate from the column marked

‘Combined Group Report’.

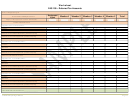

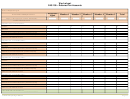

The designated agent must sign the returns and provide all the pertinent data and or

information requested.

File all the combined report schedules, worksheets, net operating loss carry over

schedules, unitary group member schedules, worldwide DC combined reporting filing

election if made, all applicable statements etc., with the D-20 or D-30 on a CD in PDF

format.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37