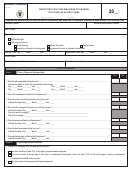

Schedule F Corporation - Deduction For Contributions To Pension Or Other Qualified Plans - 2012 Page 2

ADVERTISEMENT

Rev. 03.12

Schedule F Corporation - Page 2

Part III

Discrimination

I

Yes

No

1. In the case of a plan that includes an agreement of cash or deferred contributions under Section 1081.01(d) of the Code, indicate the

non-discriminatory test met by the plan:

The deferred real percentage to highly compensated employees does not exceed the deferred real percentage of all other eligible

employees multiplied by 1.25.

The excess of the deferred real percentage of the group of highly compensated employees over the percentage of all other eligible

employees does not exceed 2 percentage points and the deferred real percentage for the group of highly compensated employees

does not exceed the deferred real percentage of all other eligible employees multiplied by 2.

2. If any of the tests were not met, were the corrective measures provided by Section 1081.01(d)(6) of the Code taken? ...............................

(2)

P a r t e

Part IV

I

Employer Contributions

IV

Yes

No

1. Indicate the total compensation paid or accrued during the year to all employees participating in the plan:

$_____________________________

2. In the case of a defined benefits pension plan, indicate if the contributions exceed the limits provided by Section 1033.09(a)(1)(A)(i)

of the Code .............................................................................................................................................................................................

(2)

3. In the case of a defined contributions pension plan, indicate if the contributions exceed the limits provided by Section 1033.09(a)(1)(A)(ii) of

the Code.........................................................................................................................................................................................................

(3)

4. In the case of purchase of retirement annuities, indicate if the contributions exceed the limits provided by Section 1033.09(a)(1)(B) of theCode .....

(4)

5. In the case of a stock bonus or profit sharing plan, indicate if the contributions exceed the limits provided by Section 1033.09(a)(1)(C) of the

Code ........................................................................................................................................................................................................

(5)

6. Indicate if it was necessary to apply the limitation provided by Section 1033.09(a)(1)(F) of the Code ........................................................

(6)

Participant’s Contributions

Part V

Parte V

Yes

No

1. In the case of a plan that includes an agreement of cash or deferred contributions under Section 1081.01(d) of the Code, indicate if the

participant’s contributions exceeded $10,000 (See instructions) ...............................................................................................................

(1)

2. Indicate if the participants of age 50 or older made additional contributions according to Section 1081.01(d)(7)(C) of the Code ................

(2)

3. Indicate if any contribution in excess of the limits provided by Section 1081.01(d)(6)(A) or 1081.01(d)(7)(A) of the Code was included as

gross income of the participant ...............................................................................................................................................................

(3)

Part VI

IEmployees’ Information

1. Total number of employees: __________

2. Number of non-eligible employees: __________

3. Number of participants at the beginning of the year: __________

4. Number of participants at the end of the year: __________

(a) Active: __________

(b) Retired or receiving benefits: __________

(c) Retired or separated from service entitled to receive future benefits: __________

(d) Deceased whose beneficiaries are receiving or are entitled to receive benefits: ___________

5. Number of participants separated from service without having acquired rights over employer contributions: __________

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2