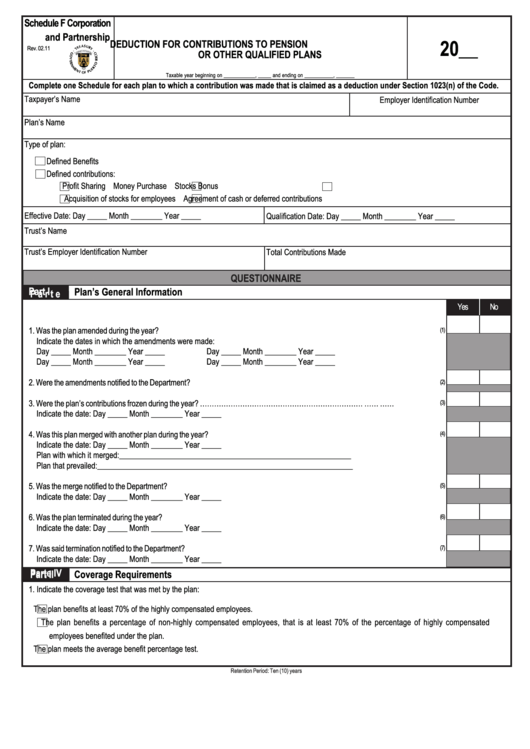

Schedule F Corporation And Partnership - Deduction For Contributions To Pension Or Other Qualified Plans - 2011

ADVERTISEMENT

Schedule F Corporation

and Partnership

20__

DEDUCTION FOR CONTRIBUTIONS TO PENSION

Rev. 02.11

OR OTHER QUALIFIED PLANS

Taxable year beginning on ____________, _____ and ending on ___________, _______

Complete one Schedule for each plan to which a contribution was made that is claimed as a deduction under Section 1023(n) of the Code.

Taxpayer’s Name

Employer Identification Number

Plan’s Name

Type of plan:

Defined Benefits

Defined contributions:

Profit Sharing

Money Purchase

Stocks Bonus

Acquisition of stocks for employees

Agreement of cash or deferred contributions

Effective Date: Day _____ Month ________ Year _____

Qualification Date: Day _____ Month ________ Year _____

Trust’s Name

Trust’s Employer Identification Number

Total Contributions Made

QUESTIONNAIRE

Part I

Plan’s General Information

P a r t e

IV

Yes

No

1. Was the plan amended during the year?..........................................................................................................................................

(1)

Indicate the dates in which the amendments were made:

Day _____ Month ________ Year _____

Day _____ Month ________ Year _____

Day _____ Month ________ Year _____

Day _____ Month ________ Year _____

Parte I

2. Were the amendments notified to the Department? ...........................................................................................................................

(2)

3. Were the plan’s contributions frozen during the year? ……………………………………………………………................…….....……

(3)

Indicate the date: Day _____ Month ________ Year _____

4. Was this plan merged with another plan during the year?.................................................................................................................

(4)

Indicate the date: Day _____ Month ________ Year _____

Plan with which it merged:___________________________________________________________

Plan that prevailed:_________________________________________________________________

5. Was the merge notified to the Department?.......................................................................................................................................

(5)

Indicate the date: Day _____ Month ________ Year _____

6. Was the plan terminated during the year?.........................................................................................................................................

(6)

Indicate the date: Day _____ Month ________ Year _____

7. Was said termination notified to the Department? ..............................................................................................................................

(7)

Indicate the date: Day _____ Month ________ Year _____

Parte IV

Part II

Coverage Requirements

1. Indicate the coverage test that was met by the plan:

The plan benefits at least 70% of the highly compensated employees.

The plan benefits a percentage of non-highly compensated employees, that is at least 70% of the percentage of highly compensated

employees benefited under the plan.

The plan meets the average benefit percentage test.

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2