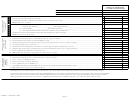

1.

PARENT OR DESIGNATED

CT PARENT CORPORATION

ENTER CORPORATION NAMES

ENTER CONNECTICUT TAX REGISTRATION NUMBERS

- 000

ENTER FEDERAL EMPLOYER ID NUMBERS

1. Form CT-1120, Computation of Net Income, Line 1, (federal taxable income (loss) before net operating loss and special deductions) ......................... 1

PART

II

A

2. Interest income wholly exempt from federal tax ......................................................................................................................................................... 2

D

3. Unallowable deduction for corporation tax (from Form CT-1120, Schedule F, Line 8) .................................................................................................. 3

D

4. TOTAL (Add Lines 1, 2 and 3) .................................................................................................................................................................................. 4

D

5. Dividends (a) Dividends from domestic companies less than 20% owned

E

Limited to 70% deduction ____________________ (less related expenses) __________________ ................................................. 5a

D

(b) Other dividends ____________________ (less related expenses) ____________________ ........................................................... 5b

U

(c) Intercorporate dividends from corporations included in this combined return ..................................................................................... 5c

C

6. Capital loss carryover if not deducted in computing federal capital gain ( Attach schedule ) ......................................................................................... 6

T

7. TOTAL (Add Lines 5a, 5b, 5c and 6) ......................................................................................................................................................................... 7

8. NET INCOME (Loss) Subtract Line 7 from Line 4. If 100% Connecticut, enter also on Line 10 ..................................................................................... 8

9. Apportionment fraction (Form CT-1120A, Schedule Q or R. Carry to six places. ) ...................................................................................................... 9

0.

10. Connecticut net income (Line 8, or Line 8 multiplied by Line 9) .................................................................................................................................... 10

11. Operating loss carryover from separate return year (Cannot exceed amount on Line 10. Attach schedule ) .............................................................. 11

12. Net income (Subtract Line 11 from Line 10) ................................................................................................................................................................ 12

13. Combined net income (Add all amounts on Line 12. Enter on Page 3, Combined Total Column, Line 13.) ...................................................................... 13

14. Operating loss carryover from combined return year (Cannot exceed amount on Line 13. Attach schedule ) ............................................................. 14

15. Income subject to tax (Subtract Line 14 from Line 13) ................................................................................................................................................ 15

16. TAX: Multiply Line 15 by 9.50% (.095) (Enter here and on Part IV, Line 2a) ................................................................................................................. 16

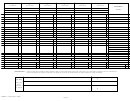

1. Form CT-1120, Sch. D, Column C, Line 6 (Banks, Form CT-1120/CT-1120S ATT, Sch. J, Column D, Line 5. If 100% CT, enter also on Line 3) .............. 1

PART

III

2. Apportionment fraction (Form CT-1120A, Schedule S. Carry to six places ) ............................................................................................................... 2

0.

3. Line 1, or Line 1 multiplied by Line 2 ....................................................................................................................................................................... 3

4. Number of months covered by this return ................................................................................................................................................................ 4

5. Line 3 multiplied by Line 4, divided by 12 ................................................................................................................................................................ 5

*

6.

Combined minimum tax base (Add all amounts on Line 5. Enter on Page 3, Combined Total Column, Line 6) .............................................................. 6

7. TAX: Multiply Line 6 by .0031 (3 1/10 mills per dollar) ................................................................................................................................................ 7

*

If a banking corporation is not included in the combined group, enter the total of all included corporations on Page 3, Combined Total Column, Line 6.

Calculate the tax on the combined total of Line 6 at the rate of 3 1/10 mills per dollar (.0031) and enter this amount on Page 3, Combined Total Column, Line 7.

If the combined group includes a banking corporation, do not enter any amount on Page 3, Combined Total Column, Line 6. Instead, enter on Page 3, Combined Total

Column, Line 7, the sum of the tax due for each individual corporation based on the amount entered on Line 5, using the applicable tax rate for each corporation.

(Banks are taxable at the rate of 4% (.04) of Line 3.) (Corporations other than banks are taxable at the rate of 3 1/10 mills per dollar (.0031) of Line 5.)

FORM CT-1120CR (Rev. 12/98)

Page 2

1

1 2

2 3

3 4

4