Attach 1998 Form CT-1120K, Business Tax Credit Summary , for each affiliate claiming a business tax credit and enter the combined

credit totals on Schedule KC.

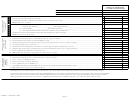

PART I - TAX CREDITS FROM 1998 INCOME YEAR

A

B

Combined Amount

Name of Affiliate

PART I-A Financial Institutions Tax Credit

Applied

Computing Credit

1

Financial Institutions

A

C

B

Combined Amount

Name of Affiliate

Carryback

PART I-B Tax Credits With Carryback Provisions

Applied

Computing Credit

A m o u n t

2

Neighborhood Assistance Act

3

Housing Program Contribution (See instructions)

4

Employer-Assisted Housing (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

5

TOTAL PART I-B (Add Lines 2 through 4)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

A

B

PART I-C Tax Credits Without Carryback or

Combined Amount

Name of Affiliate

Carryforward Provisions

Applied

Computing Credit

6

Apprenticeship Training

7

25% Manufacturing Facility - Targeted Investment Community

8

50% Manufacturing Facility - Enterprise Zone or Entertainment District

9

Research and Experimental Expenditures (other than biotechnology

companies)

1 0 Research and Development Grants to Institutions of Higher Education

1 1 Machinery and Equipment Expenditure

1 2 Traffic Reduction Programs

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

1 3 TOTAL PART I-C (Add Lines 6 through 12 )

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

C

A

B

Name of Affiliate

Combined Amount

Carryforward

PART I-D Tax Credits With Carryforward Provisions

Computing Credit

Applied

Amount to 1999

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 4 Housing Program Contribution (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 5 Employer-Assisted Housing (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 6 Opportunity Certificate

1 7 Clean Alternative Fuel

1 8 Research and Experimental Expenditures (biotechnology companies only)

1 9 Research and Development

2 0 Fixed Capital Investment

2 1 Human Capital Investment

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

2 2 TOTAL PART I-D (Add Lines 14 through 21 )

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

A

C

B

PART I-E Electronic Data Processing Equipment

Combined Amount

Name of Affiliate

Carryforward

Property Tax Credit

Applied

Computing Credit

Amount to 1999

2 3 Electronic Data Processing Equipment Property Tax Credit

A

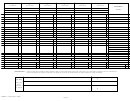

B

Combined Amount

Name of Affiliate

PART II - CARRYFORWARD CREDITS FROM 1997 INCOME YEAR

Applied

Computing Credit

1

Air Pollution

2 Industrial Waste

3 Neighborhood Assistance Act

4 Child Day Care

5 Housing Program Contribution

6 Clean Alternative Fuel

7 Employer-Assisted Housing

8 Electronic Data Processing Equipment Property Tax

9 Research and Development

10 Research and Experimental Expenditures (biotechnology companies only)

11 Opportunity Certificate

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

12 TOTAL PART II (Add Lines 1 through 11)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

A

B

Combined Amount

Name of Affiliate

PART III - TOTAL TAX CREDITS

Applied

Computing Credit

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

13 TOTAL TAX CREDITS (Add Part I, Lines 1, 5, 13, 22, 23 and Part II, Line 12)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

(Enter here and on 1998 Form CT-1120CR, Part IV, Line 5)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4

Form CT-1120CR (Rev. 12/98)

Page 4

1

1 2

2 3

3 4

4