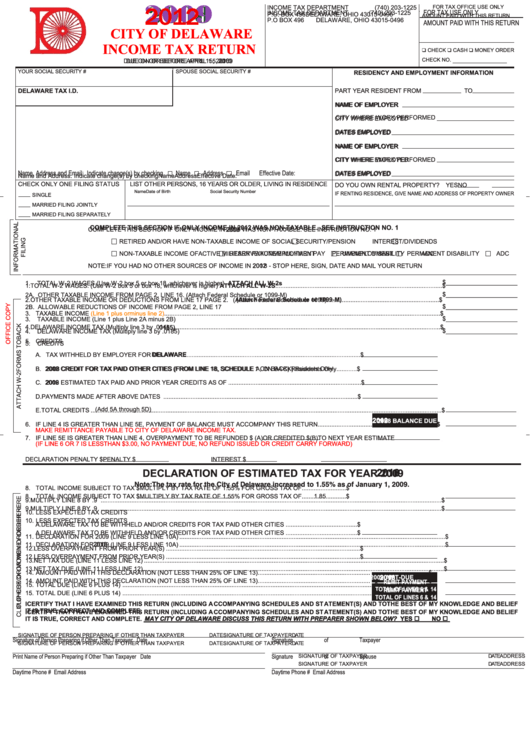

City Of Delaware Income Tax Return - 2012

ADVERTISEMENT

2009

2012

,1&20( 7$; '(3$570(17

)25 7$; 2)),&( 86( 21/<

FOR TAX USE ONLY

INCOME TAX DEPARTMENT

(740) 203-1225

32 %2;

'(/$:$5( 2+,2

$02817 3$,' :,7+ 7+,6 5(7851

P.O BOX 496

DELAWARE, OHIO 43015-0496

AMOUNT PAID WITH THIS RETURN

&,7< 2) '(/$:$5(

,1&20( 7$; 5(7851

K &+(&. K &$6+ K 021(< 25'(5

DUE ON OR BEFORE APRIL 15, 2013

2010

&+(&. 12

'8( 21 25 %()25( $35,/ 5

<285 62&,$/ 6(&85,7<

63286( 62&,$/ 6(&85,7<

5(6,'(1&< $1' (03/2<0(17 ,1)250$7,21

'(/$:$5( 7$; ,'

3$57 <($5 5(6,'(17 )520

72

NAME OF EMPLOYER

1$0( 2) (03/2<(5

CITY WHERE WORK PERFORMED

&,7< :+(5( (03/2<('

DATES EMPLOYED

'$7(6 (03/2<('

NAME OF EMPLOYER

1$0( 2) (03/2<(5

CITY WHERE WORK PERFORMED

&,7< :+(5( (03/2<('

Name, Address and Email: Indicate change(s) by checking

Name

Address

Email

Effective Date:

DATES EMPLOYED

'$7(6 (03/2<('

1DPH DQG $GGUHVV

,QGLFDWH FKDQJH

V

E\ FKHFNLQJ

1DPH

$GGUHVV (IIHFWLYH 'DWH

&+(&. 21/< 21( ),/,1* 67$786

/,67 27+(5 3(56216 <($56 25 2/'(5 /,9,1* ,1 5(6,'(1&(

'2 <28 2:1 5(17$/ 3523(57<" <(6

12

1DPH

'DWH RI %LUWK

6RFLDO 6HFXULW\ 1XPEHU

,) 5(17,1* 5(6,'(1&( *,9( 1$0( $1' $''5(66 2) 35 23(57< 2:1(5

6,1*/(

0$55,(' ),/,1* -2,17/<

0$55,(' ),/,1* 6(3$5$7(/<

COMPLETE THIS SECTION IF ONLY INCOME IN 2012 WAS NON-TAXABLE. SEE INSTRUCTION NO. 1

2009

&203/(7( 7+,6 6(&7,21 ,) 21/< ,1&20( ,1 :$6 1217$;$%/( 6(( ,16758&7,21 12

&

5(7,5(' $1'25 +$9( 1217$;$%/( ,1&20( 2)

62&,$/ 6(&85,7<3(16,21

,17(5(67',9,'(1'6

RESERVE/ACTIVE MILITARY PAY

UNEMPLOYMENT

PERMANENT DISABILITY

ADC

1217$;$%/( ,1&20( 2)

$&7,9( 0,/,7$5< 3$<

81(03/2<0(17

3(50$1(17 ',6$%,/,7<

$'&

2012

127(

,) <28 +$' 12 27+(5 6285&(6 2) ,1&20( ,1 6723 +(5( 6,*1 '$7( $1' 0$,/ <285 5(7851

$_____________________

1.

TOTAL W-2 WAGES (Use W-2 box 5 or box 18, whichever is higher) ATTACH ALL W-2s ...................................................................................................

727$/ : :$*(6

8VH : ER[ RU ER[ ZKLFKHYHU LV KLJKHU

$77$&+ $// :6

$_____________________

2A. OTHER TAXABLE INCOME FROM PAGE 2, LINE 16. (Attach Federal Schedule or 1099-M) ...............................................................................................

(Attach Federal Schedule or 1099-M)

27+(5 7$;$%/( ,1&20( 25 '('8&7,216 )520 /,1( 3$*(

$WWDFK )HGHUDO 6FKHGXOH RU

$_____________________

2B. ALLOWABLE REDUCTIONS OF INCOME FROM PAGE 2, LINE 17 ......................................................................................................................................

7$;$%/( ,1&20(

/LQH SOXV RU PLQXV OLQH

$_____________________

3.

TAXABLE INCOME (Line 1 plus Line 2A minus 2B) ...............................................................................................................................................................

.0155)

.0185)

'(/$:$5( ,1&20( 7$;

0XOWLSO\ OLQH E\

$_____________________

4.

DELAWARE INCOME TAX (Multiply line 3 by .0185) .......................................................................................................................................................................

&5(',76

5.

CREDITS

DELAWARE

$ 7$; :,7++(/' %< (03/2<(5 )25 '(/$:$5(

2009

2012 CREDIT FOR TAX PAID OTHER CITIES (FROM LINE 18, SCHEDULE 1 ON BACK) Residents Only

% &5(',7 )25 7$; 3$,' 27+(5 &,7,(6

)520 /,1( 6&+('8/( $ 21 %$ &.

5HVLGHQWV 2QO\

2009

2012

& (67,0$7(' 7$; 3$,' $1' 35,25 <($5 &5(',76 $6 2)

' 3$<0(176 0$'( $)7(5 $%29( '$7(6

(Add 5A through 5D)

( 727$/ &5(',76

2009

2012

%$/$1&( '8(

,) /,1( ,6 *5($7(5 7+$1 /,1( ( 3$<0(17 2) %$/$1&( 0867 $&&203$1< 7+,6 5(7851

0$.( 5(0,77$1&( 3$<$%/( 72 &,7< 2) '(/$:$5( ,1&20( 7$;

,) /,1( ( ,6 *5($7(5 7+$1 /,1( 29(53$<0(17 72 %( 5()81'('

$

25 &5(',7('

%

72 1(;7 <($5 (67,0$7(

,) /,1( 25 ,6 /(66 7+$1 12 3$<0(17 '8( 12 5()81' ,668(' 25 &5(',7 &$55 < )25:$5'

'(&/$5$7,21 3(1$/7<

3(1$/7<

,17(5(67

2010

2013

'(&/$5$7,21 2) (67,0$7(' 7$; )25 <($5

'

Note: The tax rate for the City of Delaware increased to 1.55% as of January 1, 2009.

727$/ ,1&20( 68%-(&7 72 7$;

08/7,3/< %< 7$; 5$7( 2)

)25 *5266 7$; 2)

1.85

727$/ ,1&20( 68%-(&7 72 7$;

08/7,3/< %< 7$; 5$7( 2)

)25 *5266 7$; 2)

08/7,3/< /,1( %<

08/7,3/< /,1( %<

/(66 (;3(&7(' 7$; &5(',76

/(66 (;3(&7(' 7$; &5(',76

$ '(/$:$5( 7$; 72 %( :,7++(/' $1'25 &5(',76 )25 7$; 3$,' 27+(5 &,7,(6

$ '(/$:$5( 7$; 72 %( :,7++(/' $1'25 &5(',76 )25 7$; 3$,' 27+(5 &,7,(6

'(&/$5$7,21 )25

/,1(

/(66 /,1( $

2010

2013

'(&/$5$7,21 )25

/,1(

/(66 /,1( $

/(66 29(53$<0(17 )520 35,25 <($5

6

/(66 29(53$<0(17 )520 35,25 <($5

6

1(7 7$; '8(

/,1( /(66 /,1(

1(7 7$; '8(

/,1( /(66 /,1(

$07'8(

$02817 3$,' :,7+ 7+,6 '(&/$5$7,21

127 /(66 7+$1

2) /,1(

2013

2010

$07'8(

$02817 3$,' :,7+ 7+,6 '(&/$5$7,21

127 /(66 7+$1

2) /,1(

5(0,7 3$<0(17

727$/ '8(

/,1( 3/86

727$/ 2) /,1(6

5(0,7 3$<0(17

727$/ '8(

/,1( 3/86

727$/ 2) /,1(6

, &(57,)< 7+$7 , +$9( (;$0,1(' 7+,6 5(7851

,1&/8',1* $ &&203$1<,1* 6&+('8/(6 $1' 67$7(0(17

6

$1' 72 7+( %(67 2) 0< .12 :/('*( $1' %(/,()

,7 ,6 758( &255(&7 $1' &203/(7(

, &(57,)< 7+$7 , +$9( (;$0,1(' 7+,6 5(7851

,1&/8',1* $ &&203$1<,1* 6&+('8/(6 $1' 67$7(0(17

6

$1' 72 7+( %(67 2) 0< .12 :/('*( $1' %(/,()

MAY CITY OF DELAWARE DISCUSS THIS RETURN WITH PREPARER SHOWN BELOW? YES o

MAY CITY OF DELAWARE DISCUSS THIS RETURN WITH PREPARER SHOWN BELOW? YES o

NO o

NO o

,7 ,6 758( &255(&7 $1' &203/(7(

6,*1$785( 2) 3(5621 35(3$5,1* ,) 27+(5 7+$1 7$;3$<(5

'$7(

6,*1$785( 2) 7$;3$<(5

'$7(

Signature of Person Preparing if Other Than Taxpayer

Date

Signature of Taxpayer

Date

6,*1$785( 2) 3(5621 35(3$5,1* ,) 27+(5 7+$1 7$;3$<(5

'$7(

6,*1$785( 2) 7$;3$<(5

'$7(

Print Name of Person Preparing if Other Than Taxpayer

Date

Signature of Spouse

Date

$''5(66

7(/(3+21( 180%(5

6,*1$785( 2) 7$;3$<(5

'$7(

$''5(66

7(/(3+21( 180%(5

6,*1$785( 2) 7$;3$<(5

'$7(

Daytime Phone #

Email Address

Daytime Phone #

Email Address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2