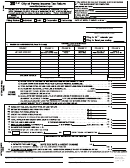

City Of Delaware Income Tax Return - 2012 Page 2

ADVERTISEMENT

15. INCOME

PROFIT

LOSS

16. OTHER TAXABLE INCOME

A. PROFIT FROM ANY BUSINESS OWNED (ATTACH FEDERAL SCHEDULE C) ..........................................................$

A. PROFIT/LOSS FROM ANY BUSINESS OWNED (ATTACH FEDERAL SCHEDULE C) ............................................................

B. RENTAL AND/OR FARM INCOME (ATTACH FEDERAL SCHEDULE E OR F) ............................................................$

B. PROFIT/LOSS FROM ANY RENTAL INCOME AND/OR FARM INCOME (ATTACH FEDERAL SCHEDULE E OR F) .............

C. PARTNERSHIP INCOME (ATTACH FEDERAL SCHEDULE E) ....................................................................................$

C. PROFIT /LOSS FROM NON-DELAWARE PARTNERSHIP (ATTACH FEDERAL SCHEDULE E) .............................................

D. OTHER INCOME (EXPLAIN SOURCE) ....................................................................................................................................

D. OTHER INCOME (ATTACH TAXABLE 1099’S OR EXPLAIN SOURCE) ......................................................................$

REPORT TOTAL PROFITS ONLY HERE AND ON PAGE 1, LINE 2A ........................................................................................

E. TOTAL (SEE INSTRUCTION NO. 8 BELOW) ..................................................................................................................................................................$

IMPORTANT: LOSSES FROM ONE BUSINESS ACTIVITY CANNOT OFFSET PROFIT FROM UNRELATED BUSINESS ACTIVITY. LOSSES MAY BE

16. DEDUCTIONS

CARRIED FORWARD A MAXIMUM OF 3 YEARS TO OFFSET FUTURE PROFIT(S) ON THE SAME BUSINESS ACTIVITY.

A. DEDUCTIBLE EXPENSES (ATTACH FEDERAL FORM 2106 & ITEMIZATION OF ALL EXPENSES REPORTED)....$

17. ALLOWABLE REDUCTIONS OF INCOME

B. INCOME EARNED OUT OF CITY WHILE NOT A RESIDENT (ATTACH CALCULATIONS) ........................................$

A.

ALLOWABLE EXPENSES FROM FEDERAL FORM 2106 (ATTACH FORM 2106 & ITEMIZATION OF ALL EXPENSES REPORTED) .....................__________________

C. TOTAL DEDUCTIONS (LINE 16A + LINE 16B) ..............................................................................................................................................................$

B.

INCOME EARNED OUT OF CITY WHILE NOT A RESIDENT (ATTACH CALCULATIONS) .........................................................................................__________________

REPORT TOTAL REDUCTIONS OF INCOME HERE AND ON PAGE 1, LINE 2B ............................................................................................................__________________

17. NET OTHER TAXABLE INCOME OR DEDUCTIONS (LINE 15E - LINE 16C (INSERT ON LINE 2, PAGE 1) ....................................................................$

18. SCHEDULE 1 - CREDIT FOR TAX PAID OTHER MUNICIPALITIES. PART-YEAR RESIDENTS MUST PRORATE CREDIT ON THE SAME BASIS AS PRORATED INCOME.

ATTACH ALL W2’S AND/OR OTHER CITY RETURN TO SUPPORT TAXABLE INCOME AND TAX PAID. A REFUND OF TAX FROM ANOTHER CITY AND/OR APPLICABLE 2106

EXPENSES MUST REDUCE INCOME IN CALCULATION OF CREDIT.

(A)

(B)

(C)

(D)

(E)

(F)

INCOME TAXED BY

OTHER CITY TAX

LESSER OF

COLUMN (B) X .00775

COLUMN (B) X .00925

MUNICIPALITY

OTHER CITY

COLUMN (B) X .007

WITHHELD OR PAID

COLUMN (D) X .50

(C) OR (E)

TOTAL COLUMN F. ENTER HERE AND CARRY TO LINE 5B ON FRONT ........................................................................................TOTAL

INSTRUCTIONS

12

1.

INFORMATIONAL FILING - complete Informational Filing if the only income received in 20

was non-taxable. If other taxable income was

received in 2008 in addition to non-taxable income, proceed to line 1 of form and complete tax return.

2009

2012

2.

LINE 1 - report total amount of qualifying wages (W-2 box 5 or box 18, whichever is higher). ALL W-2’S MUST BE ATTACHED.

3.

LINE 2A - to be completed if you have income other than W-2 income. Interest and dividend income is not taxable income (ALL FEDERAL

LINE 2 - to be completed if you have income other than W-2 income, or if you have deductions allowable against W-2 income. Interest and

SCHEDULES AND TAXABLE 1099’S MUST BE ATTACHED).

dividend income is not taxable income (ALL FEDERAL SCHEDULES AND TAXABLE 1099’S MUST BE ATTACHED).

.0155

.0185

4.

LINE 4 - Multiply Delaware Taxable income by .014.

.

.

.00775 of

.00925 of

5.

LINE 5B - A partial credit is allowed for taxes due and paid to another city. This credit is lesser of .50 of the tax paid to the other city or .007 of

the income taxed by the other city and Delaware. You must take each W-2 and compute credit individually, then insert the total tax credit on Line

5B. Use above Delaware Schedule 1 to compute credit.

EXAMPLES:

On an income of $10,000.00 earned in a city with a 2.00% earnings tax rate, the employer should withhold $200.00. The maximum allowable

$77.50 (.00775 X $10,000.00) NOT $100.00 (.50 X $200.00).

$92.50 (.00925 X $10,000.00) NOT $100.00 (.50 X $200.00).

credit for Delaware in this case would be $70.00 (.007 X $10,000.00) NOT $100.00 (.50 X $200.00).

On an income of $10,000.00 earned in a city with a 1.00% earnings tax rate, the employer should withhold $100.00. The maximum allowable

$77.50 (.00775 X $10,000.00).

$92.50 (.00925 X $10,000.00).

credit for Delaware in this case would be $50.00 (.50 X $100.00) NOT $70.00 (.007 X $10,000.00).

6.

LINE 5D - enter payments made on your 2008 Declaration of Estimated Tax after pre-printed date on line 5C.

2009

2012

7.

LINE 7 - unless the space is checked as indicating a refund, any overpayment will be applied to your next years estimated tax.

8.

LINE 16 - NOTE: losses from non-related business may not be used to offset either W-2 wages, 1099’s or other non-related business income.

Losses may be carried forward for a maximum period of three years to offset future related business or rental income.

9.

LINE 17A - 2106 employee business expenses are limited to actual expenses incurred in the production or earning of the income. The City

requires you to attach to form 2106, an itemization of all expenses reported. The City does not allow: union dues, non-job related travel, travel

between non-related employers, or any expenses not directly related to income earned from the employer from whom you are reporting the

expenses. THE DEDUCTION WILL BE DISALLOWED IF FORM 2106 AND ITEMIZATION IS NOT ATTACHED.

10.

LINE 17B - If exact non-resident income is not known, taxpayers may report income based on the percentage of time they resided in

Delaware. If income was earned on a different basis, supply employer verification (i.e., payroll check stubs or letter) detailing income earned

and tax withheld/paid during the Delaware residency. Complete Residency and Employment Information on front of tax return.

11.

SIGNATURE: The tax return must be signed and dated. Please provide email address and daytime phone numbers for the taxpayer and tax preparer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2