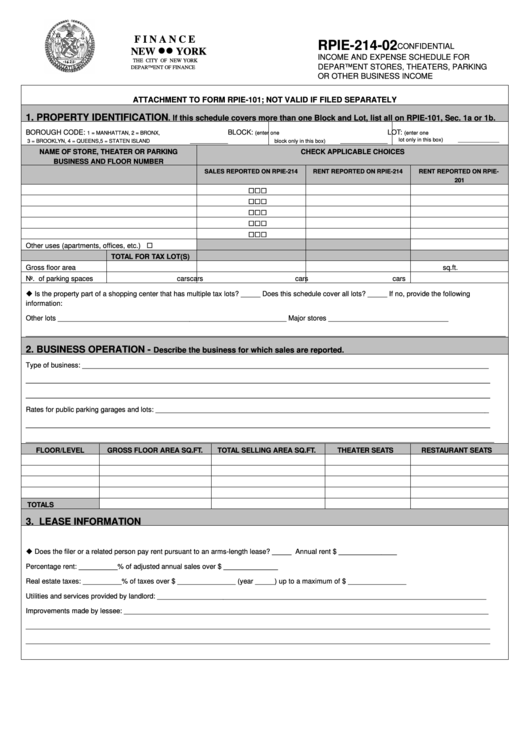

Form Rpie-214-02 - Income And Expense Schedule For Department Stores, Theaters, Parking Or Other Business Income

ADVERTISEMENT

F I N A N C E

RPIE-214-02

CONFIDENTIAL

NEW l l YORK

INCOME AND EXPENSE SCHEDULE FOR

THE CITY OF NEW YORK

DEPARTMENT STORES, THEATERS, PARKING

DEPARTMENT OF FINANCE

OR OTHER BUSINESS INCOME

ATTACHMENT TO FORM RPIE-101; NOT VALID IF FILED SEPARATELY

1. PROPERTY IDENTIFICATION

. If this schedule covers more than one Block and Lot, list all on RPIE-101, Sec. 1a or 1b.

BOROUGH CODE:

BLOCK:

LOT:

1 = MANHATTAN, 2 = BRONX,

(enter one

(enter one

3 = BROOKLYN, 4 = QUEENS, 5 = STATEN ISLAND

_____________

block only in this box)

________________

lot only in this box)

______________

NAME OF STORE, THEATER OR PARKING

CHECK APPLICABLE CHOICES

BUSINESS AND FLOOR NUMBER

SALES REPORTED ON RPIE-214

RENT REPORTED ON RPIE-214

RENT REPORTED ON RPIE-

201

¨

¨

¨

¨

¨

¨

¨

¨

¨

¨

¨

¨

¨

¨

¨

¨

Other uses (apartments, offices, etc.)

TOTAL FOR TAX LOT(S)

Gross floor area

sq.ft.

sq.ft.

sq.ft.

sq.ft.

No. of parking spaces

cars

cars

cars

cars

u Is the property part of a shopping center that has multiple tax lots? _____ Does this schedule cover all lots? _____ If no, provide the following

information:

Other lots ___________________________________________________________ Major stores _______________________________

____________________________________________________________________________________________________________________________

2. BUSINESS OPERATION -

Describe the business for which sales are reported.

Type of business: _________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

Rates for public parking garages and lots: ______________________________________________________________________________________

________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

FLOOR/LEVEL

GROSS FLOOR AREA SQ.FT.

TOTAL SELLING AREA SQ.FT.

THEATER SEATS

RESTAURANT SEATS

TOTALS

3. LEASE INFORMATION

u Does the filer or a related person pay rent pursuant to an arms-length lease? _____ Annual rent $ _______________

Percentage rent: __________% of adjusted annual sales over $ ______________

Real estate taxes: __________% of taxes over $ _______________ (year _____) up to a maximum of $ _______________

Utilities and services provided by landlord: _____________________________________________________________________________________

Improvements made by lessee: ______________________________________________________________________________________________

________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2