Form Tc214 - Income And Expense Schedule For Department Stores, Theaters, And Parking Sites - 2016

ADVERTISEMENT

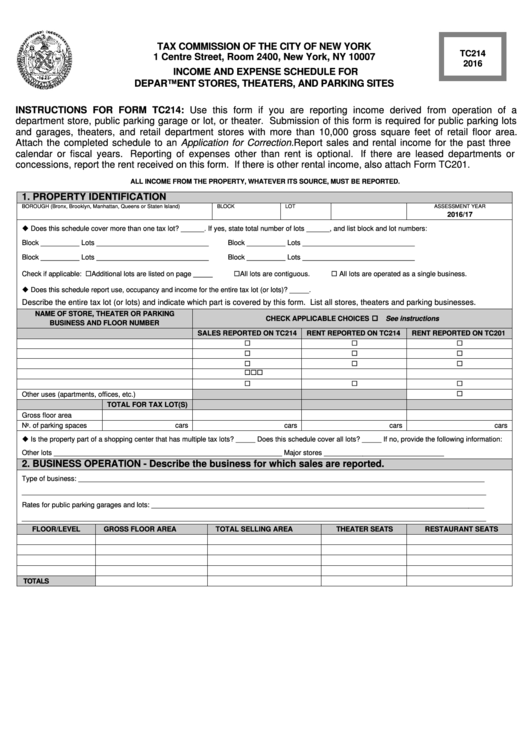

TAX COMMISSION OF THE CITY OF NEW YORK

TC214

1 Centre Street, Room 2400, New York, NY 10007

2016

INCOME AND EXPENSE SCHEDULE FOR

DEPARTMENT STORES, THEATERS, AND PARKING SITES

INSTRUCTIONS FOR FORM TC214: Use this form if you are reporting income derived from operation of a

department store, public parking garage or lot, or theater. Submission of this form is required for public parking lots

and garages, theaters, and retail department stores with more than 10,000 gross square feet of retail floor area.

Attach the completed schedule to an Application for Correction. Report sales and rental income for the past three

calendar or fiscal years. Reporting of expenses other than rent is optional. If there are leased departments or

concessions, report the rent received on this form. If there is other rental income, also attach Form TC201.

ALL INCOME FROM THE PROPERTY, WHATEVER ITS SOURCE, MUST BE REPORTED.

1. PROPERTY IDENTIFICATION

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island)

BLOCK

LOT

REP. TC GROUP NUMBER

ASSESSMENT YEAR

2016/17

Does this schedule cover more than one tax lot? ______. If yes, state total number of lots ______, and list block and lot numbers:

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Check if applicable: Additional lots are listed on page _____

All lots are contiguous.

All lots are operated as a single business.

Does this schedule report use, occupancy and income for the entire tax lot (or lots)? _____.

Describe the entire tax lot (or lots) and indicate which part is covered by this form. List all stores, theaters and parking businesses.

NAME OF STORE, THEATER OR PARKING

CHECK APPLICABLE CHOICES

See instructions

BUSINESS AND FLOOR NUMBER

SALES REPORTED ON TC214

RENT REPORTED ON TC214

RENT REPORTED ON TC201

Other uses (apartments, offices, etc.)

TOTAL FOR TAX LOT(S)

Gross floor area

sq.ft.

sq.ft.

sq.ft.

sq.ft.

No. of parking spaces

cars

cars

cars

cars

Is the property part of a shopping center that has multiple tax lots? _____ Does this schedule cover all lots? _____ If no, provide the following information:

Other lots ___________________________________________________________ Major stores _______________________________

2. BUSINESS OPERATION - Describe the business for which sales are reported.

Type of business: _________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

Rates for public parking garages and lots: ______________________________________________________________________________________

________________________________________________________________________________________________________________________

FLOOR/LEVEL

GROSS FLOOR AREA SQ.FT.

TOTAL SELLING AREA SQ.FT.

THEATER SEATS

RESTAURANT SEATS

TOTALS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2