Form 700 - Estate & Generation Skipping Transfer Tax Return For Decedents Dying On Or After January 1, 2003 Page 4

ADVERTISEMENT

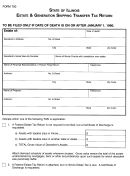

RECAPITULATION

1. Amount of tax payable to Illinois

(Schedule A line 5 or Schedule B, line 5 and/or Schedule C, line 3) . . . . .

1. $

2. Late filing penalty

(5% of tax for each month or portion thereof - maximum penalty 25%) . . .

2. $

3. Late payment penalty (½ of 1% of tax for each month

or portion thereof - maximum penalty 25%). . . . . . . . . . . . . . . . . . . . . . . .

3. $

4. Interest at 10% per annum from 9 months

after death until date of payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. $

5. Total Tax, penalties and interest payable

(Total of lines 1, 2, 3 and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. $

6. Prior Payment

(attach explanation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. $

7. Balance due

(line 5 minus line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. $

The estate elects to pay $

of line 1 in installments under 35 ILCS 405/6

(supply proof of acceptance by Internal Revenue Service when available of Sec. 6166 election and file

IL-4350a).

FILING AND PAYMENT INSTRUCTIONS

For decedents dying on or after January 1, 2003, the Illinois Estate Tax is the full amount calculable from

the State Death Tax Credit Table as it existed in § 2011 of the Internal Revenue Code on December 31,

2001. The Illinois Estate Tax is computed without recognizing the reductions or termination of the State

Death Tax Credit under Internal Revenue Code §§ 2011(b)(2) and 2011(f) (as amended in 2001). However,

the amount cannot be greater than an amount to reduce the Federal Estate Tax to $0.

This return must be filed within nine (9) months of the date of death.

For Cook, DuPage, Lake and McHenry Counties, file original of the return with the Office of the Attorney

th

General, Revenue Litigation Bureau, 100 West Randolph Street, 13

Floor, Chicago, Illinois 60601. For all

other counties, file original of the return with the Office of the Attorney General, Revenue Litigation Bureau,

500 South Second Street, Springfield, Illinois, 62706. An additional copy of the return, without

attachments, must also be filed with the County Treasurer of the County having jurisdiction over the estate.

ALL PAYMENTS OF ILLINOIS ESTATE TAXES, PENALTY AND INTEREST MUST BE MADE PAYABLE

TO THE COUNTY TREASURER OF THE COUNTY HAVING JURISDICTION OVER THE ESTATE. IF

THE DECEDENT IS A NON-RESIDENT AND HAS PROPERTY IN MORE THAN ONE COUNTY,

PAYMENT OF ALL TAX SHOULD BE MADE TO THE COUNTY HAVING THE GREATEST VALUE OF

PROPERTY.

ALL PAYMENTS MUST BE MAILED TO OR DEPOSITED WITH THE COUNTY TREASURER IN ORDER

TO BE CREDITED WITH TIMELY PAYMENT. Please Send a Copy of the County Treasurer’s Receipt to:

th

Office of the Attorney General, Revenue Litigation Bureau, 100 West Randolph Street, 13

Floor, Chicago,

Illinois 60601, or the Office of the Attorney General, Revenue Litigation Bureau, 500 South Second Street,

Springfield, Illinois, 62706, as appropriate.

STATE OF ILLINOIS ESTATE & GENERATION SKIPPING TRANSFER TAX RETURN - PAGE 4

(Revised 8/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4