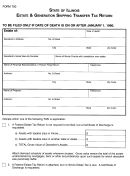

Form 700 - Estate & Generation Skipping Transfer Tax Return For Decedents Dying On Or After January 1, 2003 Page 2

ADVERTISEMENT

G 3. A Federal Estate Tax Return is attached, and an Illinois Estate Tax is due.

A Certificate of Discharge is requested.

(Complete Recapitulation and Schedule A or B, whichever is applicable.)

G 4. This is an Amended or Supplemental Return.

(Complete Recapitulation and Schedule A or B, whichever is applicable, and attach copy of amended

Federal Estate Tax Return or other applicable documents.)

G 5. This is a Generation Skipping Transfer Tax Return.

(Attach copy of Federal Return and Supporting Documents.)

Decedent was:

G a) a resident of Illinois, Year domicile established . . . . . . . . . . . .

a)

G b) a non-resident of Illinois, Year domicile established . . . . . . . .

b)

G c) an alien, State of residence . . . . . . . . . . . . . . . . . . . . . . . . . . .

c)

Due date of this Return:

.

G 6. If due date determined by extension of time to file Federal Estate Tax Return, check box and attach a

copy of the extension request. File a copy of approved extension request when available. This return

and extension request should be filed within 9 months.

The undersigned declare, under penalties of perjury, that they have examined this return, including any and all

accompanying schedules or attachments, and that they believe the same to be true and correct as to every

material matter and further verify that any attached Federal Estate Tax Return and any other applicable

Federal tax documents are true and corrected copies of the originals filed with the Internal Revenue Service.

The undersigned further certify that the attached Will (if decedent died testate) is a true and correct copy of

the Will of the decedent.

Signature of decedent’s personal representative

Title

Date

Signature of preparer

Title

Date

Note:

All attac hm ents m ust be filed with the Attorney G eneral’s c opy of the return. If a Ce rtificate of D ischarge is

requested, a co py of the Form 700 m ust be filed with the appropriate Co unty Treas urer.

SCHEDULE A - R

D

’

E

- (S

)

ESIDENT

ECEDENT

S

STATE

EE INSTRUCTIONS BELOW

I.

Illinois Estate Tax Computation

1. Total amount calculable from State Death Tax Credit Table

(see instructions on page 4) . . . . . . . . . . . . . . . . . . . . .

1. $

2. Taxes paid to other states qualifying for the state death tax credit

(attach evidence and computation) . . . . . . . . . . . . . . .

2. $

3. Net tax remaining

(line 1 less line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. $

STATE OF ILLINOIS ESTATE & GENERATION SKIPPING TRANSFER TAX RETURN - PAGE 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4