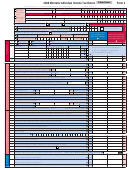

Column A (for single

Column B (for spouse

Form 2 Page 2 - 2003

Social Security Number

/

/

joint, separate, or head

only when filing

separate, and box 3 is

of household)

checked

38. Montana adjusted gross income (From line 37) ..........................................................

38.

38.

Deductions

Check only one

}

39. (A) Standard deduction:

(A)

(B)

Itemized deductions:

(B)

39.

39.

40.

Subtract

line 39 from 38 and enter balance.................................................................

=>

40.

40.

Exemptions (All filers are entitled to at least one exemption)

41. Multiply $1,780 times the number of exemptions on line 5 ...............................................

41.

41.

42. Taxable income. Subtract line 41 from line 40 ........................................................

=>

42.

42.

Nonresidents and Part-Year Residents complete and attach Schedules III and IV Form 2A, before proceeding

43.

Tax from table below. Non/part year residents enter the amount from line 131, Form

43.

43.

2A, Schedule IV. If line 42 is less than zero, enter zero here.

44.

44.

44. Tax on lump sum distributions (see instructions for this line). Attach Federal Form 4972

=>

45.

45.

45.

Subtotal—Add lines 43 and 44..........................................................................Subtotal

46.

46.

46. Credits from Form 2A, line 113, Schedule II ....................................................................

=>

47.

47.

47. Balance—Subtract line 46 from 45 and enter difference

(but not less than zero)

.

48.

48.

48. Recapture investment credit ........................................................... Attach Form RIC

.

49.

49. Recapture tax and withdrawal penalties (specify)_________________________

49.

50. For each of the programs below enter any amount you and your spouse want to contribute.

Enter totals in boxes (see instructions for details).

Nongame Wildlife

Child Abuse

Agriculture in

Program

Prevention

Schools

Enter total amount

in boxes........

51.

53.

50.

50.

52.

=>

54. Total Tax —Add lines 47, 48, 49 and 50.................................................................Total

54.

54.

55. Combine amounts shown on line 54 columns A and B.....................................................

=>

55.

55.

Montana tax withheld.................................................Attach withholding statements

56.

56.

56.

57. Payments of 2003 estimated tax and amounts credited from previous year ........

57.

57.

58. Payment made with extension ..........................................................................

58.

58.

59. Elderly Homeowner/ Renter Credit .......................................... Attach Form 2EC

59.

59.

60. Total of lines 56 thru 59.....................................................................................Total

60.

60.

61. Combine amounts shown on line 60 columns A and B ...................................................

=>

61.

61.

62.

If line 61 is larger than line 55 enter the difference. This is your overpayment..........................................

62.

62.

63. Amount on line 62 to be applied to 2004 estimate 63.

64. Enter the amount from line 62 you want refunded to you

(refunds more than $1.00 will be issued)

Refund.........

64.

64.

Refund Returns: Mail to Dept. of Revenue, PO Box 6577, Helena, MT 59604-6577

If you wish to use direct deposit enter your RTN# and ACCT# below. See instructions on page 6.

Checking

RTN#

ACCT#

Savings

65

. If line 55 is larger than line 61 enter tax due (If you owe see instructions for this line) ...........................................

Tax Due

65.

65.

,Send your check or money order with payment coupon to: Dept. of Revenue, PO Box 6308, Helena, MT 59604-6308.

If you choose to pay your tax due by credit card visit our website at and enter your confirmation

•

number here.______________________________ See instructions on page 6.

Underpayment penalty

66.

See Worksheet VII, Schedule W...

66.

•

Check this box if at least 2/3 of your gross income is from farming.

Late filing penalty-See page 2.......

(attach breakdown of computations)

67.

67.

•

Check here if estimated payments were made using the

68.

68.

Late payment penalty-See page 2.

annualization method. (Attach Montana Form EST-P)

69.

69.

Interest 1% (.01) per month..........

•

Check here if you do not need state income tax forms and instructions

70.

70 .

Total of lines 65 through 69...........

mailed to you next year. Tax forms are also available on the internet.

Extension - Check this box and attach copies of federal

extension(s) to receive a valid Montana extension.

See Page 2 of instructions for details.

Name, address and telephone number of preparer

May the DOR discuss this return with the preparer shown above? yes

no

Questions? Please call (406) 444-6900 or TDD (406) 444-2830 for hearing impaired

.

X

X

Your signature is required

Date

Daytime telephone number

Spouse signature

Date

I declare under penalty of false swearing that the information in this return and attachments is true, correct and complete.

If you electronically file, keep this form for your records (do not send to the Department of Revenue).

Tax Table

If Taxable Income is:

If Taxable Income is:

Over

But not over

Multiply by and Subtract =Tax

Over

But not over Multiply by and Subtract = Tax

$

0 ...... $ 2,200............ X ... 2 %..................$ 0

$17,800 ...... $22,200 ...........X ... 7 % ............$ 466

$ 2,200 ...... $ 4,400............ X ... 3 %................. $ 22

$22,200 ...... $31,100 ...........X ... 8 % ............$ 688

$ 4,400 ...... $ 8,900............ X ... 4 %..................$ 66

$31,100 ...... $44,500 ...........X ... 9 % ............$ 999

$ 8,900 ...... $13,300............ X ... 5 % .................$155

$44,500 ...... $77,800 ...........X ... 10 % ............$1,444

$13,300 ...... $17,800............ X ... 6 %..................$288

$77,800 ................................X ... 11 % ............$2,222

Example = taxable income $2,400 x 3% (.03) = $72 subtract $22 = $50 tax

1

1 2

2