Form 50-109 - City Report Of Property Value - 2000

ADVERTISEMENT

Comptroller

T

E

50-109

of Public

S

X

Accounts

(Rev. 4-00/10)

A

FORM

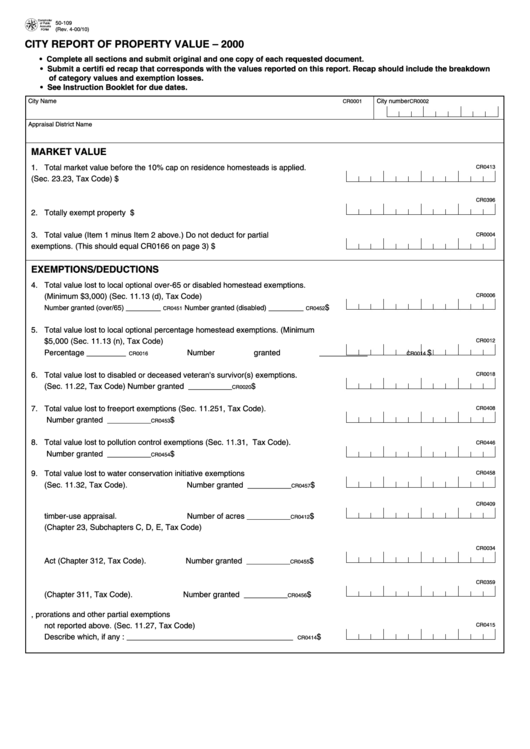

CITY REPORT OF PROPERTY VALUE – 2000

• Complete all sections and submit original and one copy of each requested document.

• Submit a certifi ed recap that corresponds with the values reported on this report. Recap should include the breakdown

of category values and exemption losses.

• See Instruction Booklet for due dates.

City Name

City number

CR0002

CR0001

Appraisal District Name

MARKET VALUE

1. Total market value before the 10% cap on residence homesteads is applied.

CR0413

(Sec. 23.23, Tax Code) ................................................................................................. $

CR0396

2. Totally exempt property value. ...................................................................................... $

3. Total value (Item 1 minus Item 2 above.) Do not deduct for partial

CR0004

exemptions. (This should equal CR0166 on page 3). ................................................... $

EXEMPTIONS/DEDUCTIONS

4. Total value lost to local optional over-65 or disabled homestead exemptions.

(Minimum $3,000) (Sec. 11.13 (d), Tax Code)

CR0006

________

________

.... $

Number granted (over/65)

Number granted (disabled)

CR0451

CR0452

5. Total value lost to local optional percentage homestead exemptions. (Minimum

$5,000 (Sec. 11.13 (n), Tax Code)

CR0012

Percentage _________

Number granted ___________

........ $

CR0016

CR0014

6. Total value lost to disabled or deceased veteran's survivor(s) exemptions.

CR0018

(Sec. 11.22, Tax Code)

Number granted __________

......... $

CR0020

7. Total value lost to freeport exemptions (Sec. 11.251, Tax Code).

CR0408

Number granted __________

......... $

CR0453

8. Total value lost to pollution control exemptions (Sec. 11.31, Tax Code).

CR0446

Number granted __________

......... $

CR0454

9. Total value lost to water conservation initiative exemptions

CR0458

(Sec. 11.32, Tax Code).

Number granted __________

......... $

CR0457

10. Total productivity value loss under 1-d and 1-d-1 agricultural appraisal and

CR0409

timber-use appraisal.

Number of acres __________

......... $

CR0412

(Chapter 23, Subchapters C, D, E, Tax Code)

CR0034

11. Total appraised value lost under the Property Redevelopment and Tax Abatement

Act (Chapter 312, Tax Code).

Number granted __________

......... $

CR0455

12. Captured appraised value lost under the Tax Increment Financing Act

CR0359

(Chapter 311, Tax Code).

Number granted __________

......... $

CR0456

13. Total value lost to solar and wind-powered, prorations and other partial exemptions

not reported above. (Sec. 11.27, Tax Code)

CR0415

Describe which, if any : ______________________________________

........ $

CR0414

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4