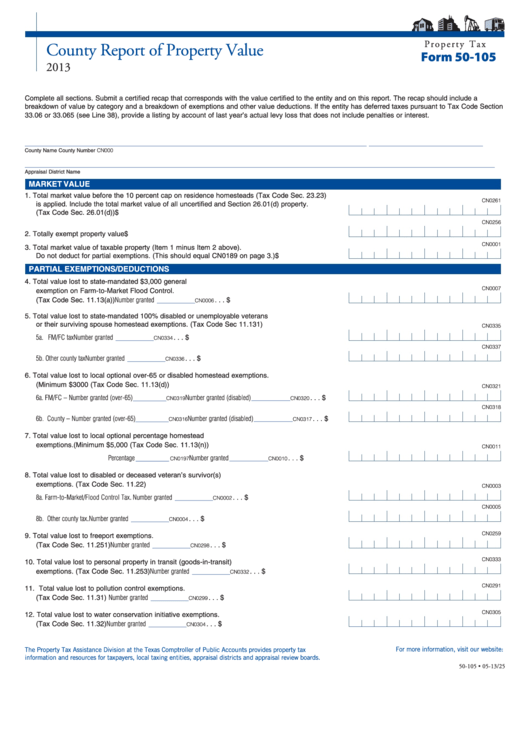

P r o p e r t y T a x

County Report of Property Value

Form 50-105

2013

Complete all sections. Submit a certified recap that corresponds with the value certified to the entity and on this report. The recap should include a

breakdown of value by category and a breakdown of exemptions and other value deductions. If the entity has deferred taxes pursuant to Tax Code Section

33.06 or 33.065 (see Line 38), provide a listing by account of last year’s actual levy loss that does not include penalties or interest.

________________________________________________________________________

________________________

County Name

County Number

CN000

___________________________________________________________________________________________________

Appraisal District Name

MARKET VALUE

1. Total market value before the 10 percent cap on residence homesteads (Tax Code Sec. 23.23)

CN0261

is applied. Include the total market value of all uncertified and Section 26.01(d) property.

(Tax Code Sec. 26.01(d)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

CN0256

2. Totally exempt property value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

CN0001

3. Total market value of taxable property (Item 1 minus Item 2 above).

Do not deduct for partial exemptions. (This should equal CN0189 on page 3.). . . . . . . . . . . . . . . . . $

PARTIAL EXEMPTIONS/DEDUCTIONS

4. Total value lost to state-mandated $3,000 general

CN0007

exemption on Farm-to-Market Flood Control.

________

(Tax Code Sec. 11.13(a)). . . . . . . . . . . . . . . . . . . . . . . . . . . . . Number granted

. . . $

CN0006

5. Total value lost to state-mandated 100% disabled or unemployable veterans

or their surviving spouse homestead exemptions. (Tax Code Sec 11.131)

CN0335

________

5a. FM/FC tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Number granted

. . . $

CN0334

CN0337

________

5b. Other county tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Number granted

. . . $

CN0336

6. Total value lost to local optional over-65 or disabled homestead exemptions.

(Minimum $3000 (Tax Code Sec. 11.13(d))

CN0321

_______

6a. FM/FC – Number granted (over-65)

Number granted (disabled)

__________

. . . $

CN0319

CN0320

CN0318

_______

6b. County – Number granted (over-65)

Number granted (disabled)

__________

. . . $

CN0316

CN0317

7. Total value lost to local optional percentage homestead

exemptions.(Minimum $5,000 (Tax Code Sec. 11.13(n))

CN0011

_______

Percentage

. . . . . . . . Number granted

__________

. . . $

CN0197

CN0010

8. Total value lost to disabled or deceased veteran’s survivor(s)

exemptions. (Tax Code Sec. 11.22)

CN0003

________

8a. Farm-to-Market/Flood Control Tax. . . . . . . . . . . . . . . . . . . . . . . . Number granted

. . . $

CN0002

CN0005

________

8b. Other county tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Number granted

. . . $

CN0004

CN0259

9. Total value lost to freeport exemptions.

________

(Tax Code Sec. 11.251). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Number granted

. . . $

CN0298

CN0333

10. Total value lost to personal property in transit (goods-in-transit)

________

exemptions. (Tax Code Sec. 11.253). . . . . . . . . . . . . . . . . . . . Number granted

. . . $

CN0332

CN0291

11. Total value lost to pollution control exemptions.

________

(Tax Code Sec. 11.31) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Number granted

. . . $

CN0299

CN0305

12. Total value lost to water conservation initiative exemptions.

________

(Tax Code Sec. 11.32). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Number granted

. . . $

CN0304

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-105 • 05-13/25

1

1 2

2 3

3 4

4 5

5