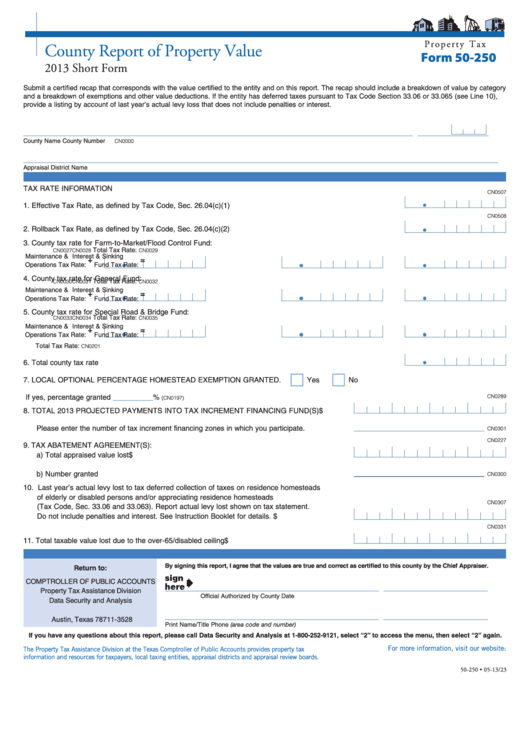

P r o p e r t y T a x

County Report of Property Value

Form 50-250

2013 Short Form

Submit a certified recap that corresponds with the value certified to the entity and on this report. The recap should include a breakdown of value by category

and a breakdown of exemptions and other value deductions. If the entity has deferred taxes pursuant to Tax Code Section 33.06 or 33.065 (see Line 10),

provide a listing by account of last year’s actual levy loss that does not include penalties or interest.

__________________________________________________________________________________

_______________

County Name

County Number

CN0000

____________________________________________________________________________________________________

Appraisal District Name

TAX RATE INFORMATION

CN0507

1. Effective Tax Rate, as defined by Tax Code, Sec. 26.04(c)(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

CN0508

2. Rollback Tax Rate, as defined by Tax Code, Sec. 26.04(c)(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. County tax rate for Farm-to-Market/Flood Control Fund:

Total Tax Rate:

CN0027

CN0028

CN0029

Maintenance &

Interest & Sinking

+

=

Operations Tax Rate:

Fund Tax Rate:

4. County tax rate for General Fund:

Total Tax Rate:

CN0030

CN0031

CN0032

Maintenance &

Interest & Sinking

+

=

Operations Tax Rate:

Fund Tax Rate:

5. County tax rate for Special Road & Bridge Fund:

Total Tax Rate:

CN0033

CN0034

CN0035

Maintenance &

Interest & Sinking

+

=

Operations Tax Rate:

Fund Tax Rate:

Total Tax Rate:

CN0201

6. Total county tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. LOCAL OPTIONAL PERCENTAGE HOMESTEAD EXEMPTION GRANTED. . . . . . . . . . . . . . .

Yes

No

If yes, percentage granted __________%

CN0289

(CN0197)

8. TOTAL 2013 PROJECTED PAYMENTS INTO TAX INCREMENT FINANCING FUND(S) . . . . . $

Please enter the number of tax increment financing zones in which you participate. . . . . . . . . .

CN0301

CN0227

9. TAX ABATEMENT AGREEMENT(S):

a) Total appraised value lost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

b) Number granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

CN0300

10. Last year’s actual levy lost to tax deferred collection of taxes on residence homesteads

of elderly or disabled persons and/or appreciating residence homesteads

CN0307

(Tax Code, Sec. 33.06 and 33.063). Report actual levy lost shown on tax statement.

Do not include penalties and interest. See Instruction Booklet for details. . . . . . . . . . . . . . . . . $

CN0331

11. Total taxable value lost due to the over-65/disabled ceiling . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

By signing this report, I agree that the values are true and correct as certified to this county by the Chief Appraiser.

Return to:

COMPTROLLER OF PUBLIC ACCOUNTS

_____________________________________________

______________________

Property Tax Assistance Division

Official Authorized by County

Date

Data Security and Analysis

P.O. Box 13528

_____________________________________________

______________________

Austin, Texas 78711-3528

Phone (area code and number)

Print Name/Title

If you have any questions about this report, please call Data Security and Analysis at 1-800-252-9121, select “2” to access the menu, then select “2” again.

For more information, visit our website:

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-250 • 05-13/23

1

1 2

2