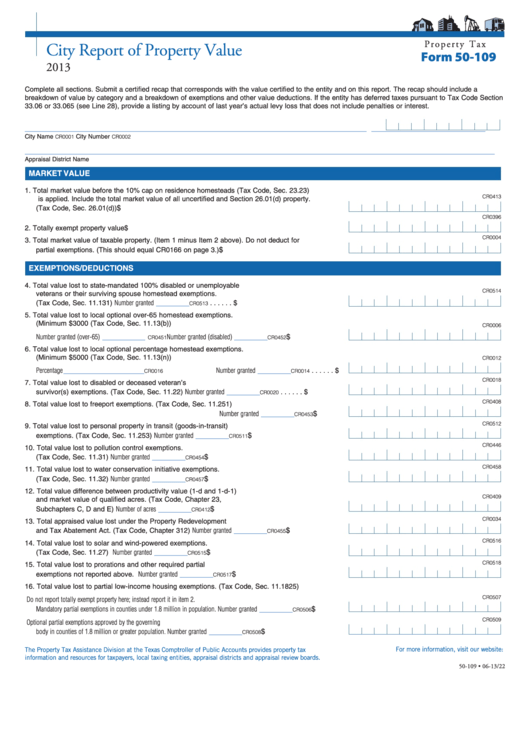

P r o p e r t y T a x

City Report of Property Value

Form 50-109

2013

Complete all sections. Submit a certified recap that corresponds with the value certified to the entity and on this report. The recap should include a

breakdown of value by category and a breakdown of exemptions and other value deductions. If the entity has deferred taxes pursuant to Tax Code Section

33.06 or 33.065 (see Line 28), provide a listing by account of last year’s actual levy loss that does not include penalties or interest.

________________________________________________________________________

________________________

City Name

City Number

CR0001

CR0002

___________________________________________________________________________________________________

Appraisal District Name

MARKET VALUE

1. Total market value before the 10% cap on residence homesteads (Tax Code, Sec. 23.23)

CR0413

is applied. Include the total market value of all uncertified and Section 26.01(d) property.

(Tax Code, Sec. 26.01(d))

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

CR0396

2. Totally exempt property value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

CR0004

3. Total market value of taxable property. (Item 1 minus Item 2 above). Do not deduct for

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

partial exemptions. (This should equal CR0166 on page 3.)

EXEMPTIONS/DEDUCTIONS

4. Total value lost to state-mandated 100% disabled or unemployable

CR0514

veterans or their surviving spouse homestead exemptions.

_______

Number granted

(Tax Code, Sec. 11.131)

. . . . . . $

CR0513

5. Total value lost to local optional over-65 homestead exemptions.

(Minimum $3000 (Tax Code, Sec. 11.13(b))

CR0006

_________

_______

Number granted (over-65)

Number granted (disabled)

. . . . . $

CR0451

CR0452

6. Total value lost to local optional percentage homestead exemptions.

(Minimum $5000 (Tax Code, Sec. 11.13(n))

CR0012

_________________

_______

Percentage

Number granted

. . . . . . $

CR0016

CR0014

CR0018

7. Total value lost to disabled or deceased veteran’s

_______

survivor(s) exemptions. (Tax Code, Sec. 11.22)

Number granted

. . . . . . $

CR0020

CR0408

8. Total value lost to freeport exemptions. (Tax Code, Sec. 11.251)

_______

Number granted

. . . . . $

CR0453

CR0512

9. Total value lost to personal property in transit (goods-in-transit)

_______

Number granted

. . . . . $

exemptions. (Tax Code, Sec. 11.253)

CR0511

CR0446

10. Total value lost to pollution control exemptions.

_______

Number granted

. . . . . $

(Tax Code, Sec. 11.31)

CR0454

CR0458

11. Total value lost to water conservation initiative exemptions.

_______

Number granted

. . . . . $

(Tax Code, Sec. 11.32)

CR0457

12. Total value difference between productivity value (1-d and 1-d-1)

CR0409

and market value of qualified acres. (Tax Code, Chapter 23,

_______

Number of acres

. . . . . $

Subchapters C, D and E)

CR0412

CR0034

13. Total appraised value lost under the Property Redevelopment

_______

Number granted

. . . . . $

and Tax Abatement Act. (Tax Code, Chapter 312)

CR0455

CR0516

14. Total value lost to solar and wind-powered exemptions.

_______

(Tax Code, Sec. 11.27)

Number granted

. . . . . $

CR0515

CR0518

15. Total value lost to prorations and other required partial

_______

Number granted

. . . . . $

exemptions not reported above.

CR0517

16. Total value lost to partial low-income housing exemptions. (Tax Code, Sec. 11.1825)

CR0507

Do not report totally exempt property here; instead report it in item 2.

_______

. . . . . $

Mandatory partial exemptions in counties under 1.8 million in population. Number granted

CR0506

CR0509

Optional partial exemptions approved by the governing

_______

body in counties of 1.8 million or greater population.

Number granted

. . . . . $

CR0508

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-109 • 06-13/22

1

1 2

2 3

3 4

4 5

5