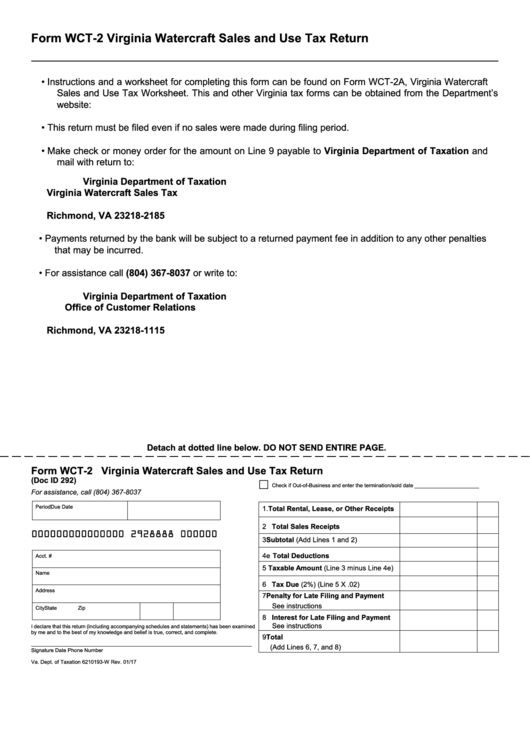

Form WCT-2

Virginia Watercraft Sales and Use Tax Return

•

Instructions and a worksheet for completing this form can be found on Form WCT-2A, Virginia Watercraft

Sales and Use Tax Worksheet. This and other Virginia tax forms can be obtained from the Department’s

website:

•

This return must be filed even if no sales were made during filing period.

•

Make check or money order for the amount on Line 9 payable to Virginia Department of Taxation and

mail with return to:

Virginia Department of Taxation

Virginia Watercraft Sales Tax

P.O. Box 2185

Richmond, VA 23218-2185

•

Payments returned by the bank will be subject to a returned payment fee in addition to any other penalties

that may be incurred.

For assistance call (804) 367-8037 or write to:

•

Virginia Department of Taxation

Office of Customer Relations

P.O. Box 1115

Richmond, VA 23218-1115

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

Form WCT-2 Virginia Watercraft Sales and Use Tax Return

(Doc ID 292)

c

Check if Out-of-Business and enter the termination/sold date ______________________

For assistance, call (804) 367-8037

Period

Due Date

1. Total Rental, Lease, or Other Receipts

2 Total Sales Receipts

000000000000000 2928888 000000

3 Subtotal (Add Lines 1 and 2)

4e Total Deductions

Acct. #

5 Taxable Amount (Line 3 minus Line 4e)

Name

6 Tax Due (2%) (Line 5 X .02)

Address

7 Penalty for Late Filing and Payment

See instructions

City

State

Zip

8 Interest for Late Filing and Payment

See instructions

I declare that this return (including accompanying schedules and statements) has been examined

by me and to the best of my knowledge and belief is true, correct, and complete.

9 Total

(Add Lines 6, 7, and 8)

Signature

Date

Phone Number

Va. Dept. of Taxation 6210193-W Rev. 01/17

1

1 2

2 3

3