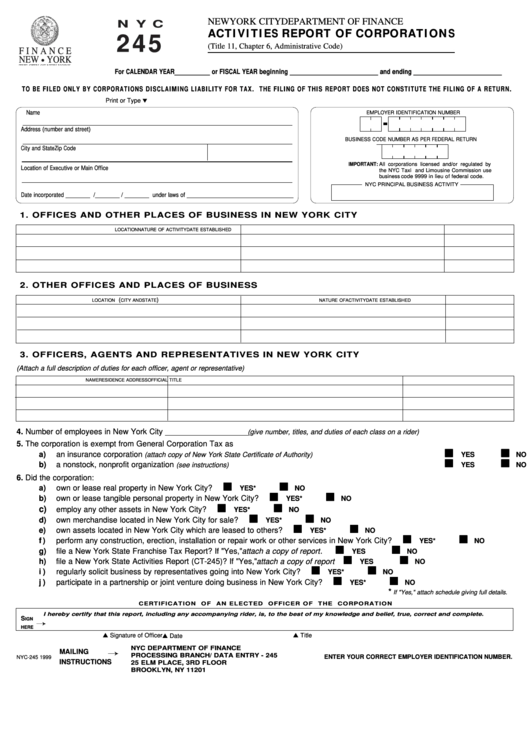

Form Nyc 245 - Activities Report Of Corporations - 1999

ADVERTISEMENT

NEW YORK CITY DEPARTMENT OF FINANCE

N Y C

ACTIVITIES REPORT OF CORPORATIONS

245

(Title 11, Chapter 6, Administrative Code)

F I N A N C E

NEW YORK

THE CITY OF NEW YORK

For CALENDAR YEAR __________ or FISCAL YEAR beginning _________________________ and ending _________________________

TO BE FILED ONLY BY CORPORATIONS DISCLAIMING LIABILITY FOR TAX. THE FILING OF THIS REPORT DOES NOT CONSTITUTE THE FILING OF A RETURN.

Print or Type

Name

EMPLOYER IDENTIFICATION NUMBER

Address (number and street)

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

City and State

Zip Code

IMPORTANT: All corporations licensed and/or regulated by

Location of Executive or Main Office

the NYC Taxi and Limousine Commission use

business code 9999 in lieu of federal code.

NYC PRINCIPAL BUSINESS ACTIVITY

Date incorporated ________ /________ / ________ under laws of ___________________________________

1. OFFICES AND OTHER PLACES OF BUSINESS IN NEW YORK CITY

LOCATION

NATURE OF ACTIVITY

DATE ESTABLISHED

2. OTHER OFFICES AND PLACES OF BUSINESS

(

)

LOCATION

CITY AND STATE

NATURE OF ACTIVITY

DATE ESTABLISHED

3. OFFICERS, AGENTS AND REPRESENTATIVES IN NEW YORK CITY

(Attach a full description of duties for each officer, agent or representative)

NAME

RESIDENCE ADDRESS

OFFICIAL TITLE

4. Number of employees in New York City ___________________

(give number, titles, and duties of each class on a rider)

5. The corporation is exempt from General Corporation Tax as

a)

an insurance corporation

(attach copy of New York State Certificate of Authority)............................................................

YES

NO

b)

a nonstock, nonprofit organization

(see instructions) .......................................................................................................

YES

NO

6. Did the corporation:

a)

own or lease real property in New York City? ....................................................................................................

YES*

NO

b)

own or lease tangible personal property in New York City? ..............................................................................

YES*

NO

c)

employ any other assets in New York City?.......................................................................................................

YES*

NO

d)

own merchandise located in New York City for sale? ........................................................................................

YES*

NO

e)

own assets located in New York City which are leased to others?....................................................................

YES*

NO

f )

perform any construction, erection, installation or repair work or other services in New York City? .................

YES*

NO

g)

file a New York State Franchise Tax Report? If "Yes," attach a copy of report . ................................................

YES

NO

h)

file a New York State Activities Report (CT-245)? If "Yes," attach a copy of report ...........................................

YES

NO

i )

regularly solicit business by representatives going into New York City? ...........................................................

YES*

NO

j )

participate in a partnership or joint venture doing business in New York City? .................................................

YES*

NO

*

If "Yes," attach schedule giving full details.

C E R T I F I C AT I O N

O F A N E L E C T E D

O F F I C E R O F

T H E

C O R P O R AT I O N

I hereby certify that this report, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

S

IGN

HERE

Signature of Officer

Title

Date

NYC DEPARTMENT OF FINANCE

MAILING

PROCESSING BRANCH/ DATA ENTRY - 245

ENTER YOUR CORRECT EMPLOYER IDENTIFICATION NUMBER.

NYC-245 1999

INSTRUCTIONS

25 ELM PLACE, 3RD FLOOR

BROOKLYN, NY 11201

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1