PRINT

CLEAR

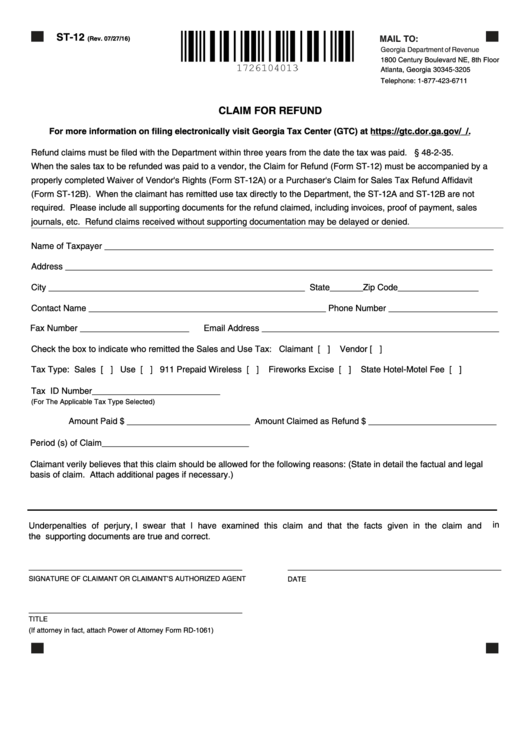

ST-12

MAIL TO:

(Rev. 07/27/16)

Georgia Department of Revenue

1800 Century Boulevard NE, 8th Floor

Atlanta, Georgia 30345-3205

Telephone: 1-877-423-6711

CLAIM FOR REFUND

For more information on filing electronically visit Georgia Tax Center (GTC) at https://gtc.dor.ga.gov/_/.

Refund claims must be filed with the Department within three years from the date the tax was paid. O.C.G.A. § 48-2-35.

When the sales tax to be refunded was paid to a vendor, the Claim for Refund (Form ST-12) must be accompanied by a

properly completed Waiver of Vendor's Rights (Form ST-12A) or a Purchaser's Claim for Sales Tax Refund Affidavit

(Form ST-12B). When the claimant has remitted use tax directly to the Department, the ST-12A and ST-12B are not

required. Please include all supporting documents for the refund claimed, including invoices, proof of payment, sales

journals, etc. Refund claims received without supporting documentation may be delayed or denied.

__________________________________________________________________________________________________________________________________________________________________________________________________

Name of Taxpayer __________________________________________________________________________________

Address __________________________________________________________________________________________

City ______________________________________________________ State_______

Zip Code_________________

Contact Name __________________________________________________ Phone Number _______________________

Fax Number _______________________

Email Address __________________________________________________

Check the box to indicate who remitted the Sales and Use Tax: Claimant [ ]

Vendor [ ]

Tax Type: Sales [ ] Use [ ] 911 Prepaid Wireless [ ]

Fireworks Excise [ ]

State Hotel-Motel Fee [ ]

Tax ID Number___________________________

(For The Applicable Tax Type Selected)

Amount Paid $ __________________________ Amount Claimed as Refund $ ___________________________

Period (s) of Claim_______________________________

Claimant verily believes that this claim should be allowed for the following reasons: (State in detail the factual and legal

basis of claim. Attach additional pages if necessary.)

Under penalties of perjury, I swear that I have examined this claim and that the facts given in the claim and in

the supporting documents are true and correct.

_____________________________________________

_____________________________________________

SIGNATURE OF CLAIMANT OR CLAIMANT’S AUTHORIZED AGENT

DATE

_____________________________________________

TITLE

(If attorney in fact, attach Power of Attorney Form RD-1061)

1

1 2

2