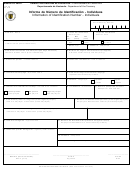

Individual Income Tax Return - Puerto Rico Department Of The Treasury - 2002 Page 18

ADVERTISEMENT

2002

In the space provided,

Ä

of all dependents who are age one or older for

whom you claim an exemption in your return.

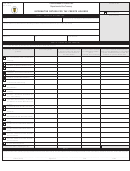

This Schedule must be completed if you received income

for annuities or pensions exceeding $8,000 for individuals

younger than age 60, or $11,000 for individuals age 60

If you do not comply with these requirements, the

or older. Schedule H Individual provides space to report

exemption will be rejected.

the income from only one annuity or pension. Therefore,

in cases of individuals receiving more than one annuity

or pension, a separate schedule should be completed

for each annuity or pension. If the taxpayer receives

more than one annuity or pension, the exclusion will

In the space provided,

apply for each annuity or pension separately.

of

the beneficiaries for whom you made contributions to an

If you receive income from social security pension, do

Educational Contribution Account.

not complete this Schedule because the same is not

.

taxable in Puerto Rico. Otherwise, if you bought an

annuity through a financial or insurance institution, do

not complete this Schedule. Any income received from

such annuity must be informed on Schedule F

.

Individual, after considering the annuity's cost to be

recovered.

Enter the cost of the annuity or pension. The

cost of the annuity is the amount that the taxpayer paid

in order to be entitled to receive the annuity or pension.

Said cost appears in Form 499R-2/W-2PR, Part 7.

Enter the total amount received from annuities

or pensions during the year. This information appears

in Form 499R-2/W-2PR, Part 12.

Enter $8,000 if you are younger than age 60,

or enter $11,000 if you are age 60 or older.

If the total amount received during the year exceeds

$8,000 or $11,000, as applicable, only the excess over

such amount will be subject to tax. While you are

recovering the cost of the annuity or pension, you will

be taxed up to 3% of such cost.

Ä

Enter the amount of line 11 or 3% of the

cost of the annuity, whichever is larger, until you have

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22