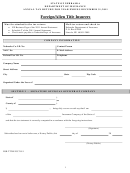

Form 1076 - Annual Municipal Premium & Tax Report - Louisiana Department Of Insurance - 2011 Page 5

ADVERTISEMENT

NAIC NUMBER:

COMPANY NAME:

Reconciliation Table

$

A. Total Premium Reported on 2011 Form 1061, Item A1 + B1

B. Less Exempt Premium (Check Reason for Exempting Premium Below)

$

Flood premiums written through the federal WYO

Life Premium written on U.S. Military personnel stationed

Exemptions:

program

outside the State of Louisiana.

C. Total Premium Allocated on Form 1076 (Line A – Line B)

$

Filing Instructions

Who Must File This Form?

Except for HMOs, all insurance companies that file Form 1061.

March 1, 2012

Due Date:

This form is required under provisions of L.R.S. 22§792. L.R.S. 22§833 outlines the penalties for

Penalty for Failure to File This

failing to file this form.

Form:

Filing Address:

Form 1076 should be filed along with Form 1061 to the address listed on Page 1 of this form. Do

Not include this form with your Annual Statement filing.

The premiums and taxes reported on this form to the Department of Insurance should be reported

Tax Payment:

and paid directly to each municipality, parish or representative thereof. Do not pay the municipal

tax to the Department of Insurance. For a list of addresses, go to , then click on

Insurers, and then click on Taxes. The Louisiana Municipality/Parish address list is on the menu.

For purposes of completing this form, refer to L.R.S. 22§833. You may contact each municipality,

Tax Liability Calculation:

parish or representative thereof, to determine if the actual tax liability is the same as the maximum

provided in L.R.S. 22§833 (see below).

The total premium reported on Form 1061, Item A1 + Item B1 must be allocated to a municipality or

Premium Allocation:

parish listed on this form. See note on Page 3 below the total line.

You may call us at (225) 342-1012 or fax your request to (225) 342-9708. Also, visit our web site at

How to contact us:

Form 1076 no longer must be signed or notarized.

Affidavit:

L.R.S. 22§843 Tax base; computation in case of new business

The annual premiums referred to in this Part shall be the gross amount of direct premiums, excluding premiums on annuity contracts, for

the preceding year less return premiums without any deductions for dividends paid or otherwise credited to policyholders, and without

consideration for reinsurance.

L.R.S. 22§833 Authorization of local license taxes; penalties for nonpayment

A.

Any municipal or parochial corporation in the state shall have the right to impose a license tax on any insurer engaged in the

business of issuing any form of insurance policy or contract, which may now or hereafter be subject to the payment of any license

tax for state purposes, as provided in this Part, as follows:

1)

On any insurer engaged in the business of issuing life or accident or health insurance policies, other than programs of

benefits authorized or provided pursuant to the provisions of Parts I and II of Chapter 12 of Title 42 of the Louisiana

Revised Statutes of 1950, or other forms of contracts or obligations covering such risks, or issuing endowment or

annuity policies, or contracts, or other similar forms of contract obligations in consideration of the payment of a premium

or other consideration for the issuance of such policies, contracts, or obligations, whether such insurer is operating in

this state through an agent or other representative or otherwise, not more than ten dollars on gross annual premiums up

to two thousand dollars, and the additional license thereafter shall not be more than seventy dollars on each ten

thousand dollars, or fraction thereof, of gross annual premiums in excess of two thousand dollars. Provided that the

maximum license on such businesses, payable to such municipal or parochial corporation by any one insurer, shall not

exceed twenty-one thousand dollars.

(2)

On any insurer, engaged in the business of issuing policies, contracts, or other forms of obligations covering the risk of

fire, marine, transportation, surety, fidelity, indemnity, guaranty, worker's compensation, employers' liability, property

damage, live stock, vehicle, automatic sprinkler, burglary, or insurance business of any other kind whatsoever in this

state, whether such insurer is operating in this state through agents or other representatives or otherwise, not more than

the following:

(a) 1st Class:

When the gross receipts are not more than two thousand dollars, the license shall not exceed

forty dollars;

(b) 2nd Class:

When the gross receipts are more than two thousand dollars, and not more than four thousand

dollars, the license shall not exceed sixty dollars;

Form 1076 (Revised 01/12)

THIS DOCUMENT IS EXEMPT FROM PUBLIC RECORDS LAW UNDER R.S. 44§4

Page 5 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6