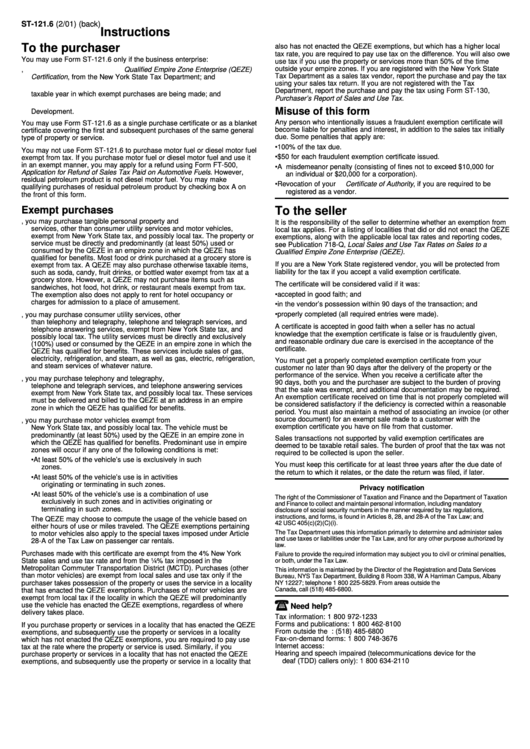

Form St-121.6 Instructions - Qualified Empire Zone Enterprise (Qeze) Exempt Purchase Certificate

ADVERTISEMENT

ST-121.6 (2/01) (back)

Instructions

To the purchaser

also has not enacted the QEZE exemptions, but which has a higher local

tax rate, you are required to pay use tax on the difference. You will also owe

You may use Form ST-121.6 only if the business enterprise:

use tax if you use the property or services more than 50% of the time

outside your empire zones. If you are registered with the New York State

1. has received a Form DTF-81, Qualified Empire Zone Enterprise (QEZE)

Tax Department as a sales tax vendor, report the purchase and pay the tax

Certification , from the New York State Tax Department; and

using your sales tax return. If you are not registered with the Tax

2. has met the required employment test in the taxable year prior to the

Department, report the purchase and pay the tax using Form ST-130,

taxable year in which exempt purchases are being made; and

Purchaser’s Report of Sales and Use Tax.

3. has not been decertified by the Commissioner of Economic

Misuse of this form

Development.

Any person who intentionally issues a fraudulent exemption certificate will

You may use Form ST-121.6 as a single purchase certificate or as a blanket

become liable for penalties and interest, in addition to the sales tax initially

certificate covering the first and subsequent purchases of the same general

due. Some penalties that apply are:

type of property or service.

•

100% of the tax due.

You may not use Form ST-121.6 to purchase motor fuel or diesel motor fuel

•

$50 for each fraudulent exemption certificate issued.

exempt from tax. If you purchase motor fuel or diesel motor fuel and use it

in an exempt manner, you may apply for a refund using Form FT-500,

•

A misdemeanor penalty (consisting of fines not to exceed $10,000 for

Application for Refund of Sales Tax Paid on Automotive Fuels . However,

an individual or $20,000 for a corporation).

residual petroleum product is not diesel motor fuel. You may make

•

Revocation of your Certificate of Authority , if you are required to be

qualifying purchases of residual petroleum product by checking box A on

registered as a vendor.

the front of this form.

Exempt purchases

To the seller

A. By checking Box A, you may purchase tangible personal property and

It is the responsibility of the seller to determine whether an exemption from

services, other than consumer utility services and motor vehicles,

local tax applies. For a listing of localities that did or did not enact the QEZE

exempt from New York State tax, and possibly local tax. The property or

exemptions, along with the applicable local tax rates and reporting codes,

service must be directly and predominantly (at least 50%) used or

see Publication 718-Q, Local Sales and Use Tax Rates on Sales to a

consumed by the QEZE in an empire zone in which the QEZE has

Qualified Empire Zone Enterprise (QEZE).

qualified for benefits. Most food or drink purchased at a grocery store is

If you are a New York State registered vendor, you will be protected from

exempt from tax. A QEZE may also purchase otherwise taxable items,

liability for the tax if you accept a valid exemption certificate.

such as soda, candy, fruit drinks, or bottled water exempt from tax at a

grocery store. However, a QEZE may not purchase items such as

The certificate will be considered valid if it was:

sandwiches, hot food, hot drink, or restaurant meals exempt from tax.

•

accepted in good faith; and

The exemption also does not apply to rent for hotel occupancy or

charges for admission to a place of amusement.

•

in the vendor’s possession within 90 days of the transaction; and

•

properly completed (all required entries were made).

B. By checking Box B, you may purchase consumer utility services, other

than telephony and telegraphy, telephone and telegraph services, and

A certificate is accepted in good faith when a seller has no actual

telephone answering services, exempt from New York State tax, and

knowledge that the exemption certificate is false or is fraudulently given,

possibly local tax. The utility services must be directly and exclusively

and reasonable ordinary due care is exercised in the acceptance of the

(100%) used or consumed by the QEZE in an empire zone in which the

certificate.

QEZE has qualified for benefits. These services include sales of gas,

electricity, refrigeration, and steam, as well as gas, electric, refrigeration,

You must get a properly completed exemption certificate from your

and steam services of whatever nature.

customer no later than 90 days after the delivery of the property or the

performance of the service. When you receive a certificate after the

C. By checking Box C, you may purchase telephony and telegraphy,

90 days, both you and the purchaser are subject to the burden of proving

telephone and telegraph services, and telephone answering services

that the sale was exempt, and additional documentation may be required.

exempt from New York State tax, and possibly local tax. These services

An exemption certificate received on time that is not properly completed will

must be delivered and billed to the QEZE at an address in an empire

be considered satisfactory if the deficiency is corrected within a reasonable

zone in which the QEZE has qualified for benefits.

period. You must also maintain a method of associating an invoice (or other

source document) for an exempt sale made to a customer with the

D. By checking Box D, you may purchase motor vehicles exempt from

exemption certificate you have on file from that customer.

New York State tax, and possibly local tax. The vehicle must be

predominantly (at least 50%) used by the QEZE in an empire zone in

Sales transactions not supported by valid exemption certificates are

which the QEZE has qualified for benefits. Predominant use in empire

deemed to be taxable retail sales. The burden of proof that the tax was not

zones will occur if any one of the following conditions is met:

required to be collected is upon the seller.

•

At least 50% of the vehicle’s use is exclusively in such

You must keep this certificate for at least three years after the due date of

zones.

the return to which it relates, or the date the return was filed, if later.

•

At least 50% of the vehicle’s use is in activities

originating or terminating in such zones.

Privacy notification

•

At least 50% of the vehicle’s use is a combination of use

The right of the Commissioner of Taxation and Finance and the Department of Taxation

exclusively in such zones and in activities originating or

and Finance to collect and maintain personal information, including mandatory

terminating in such zones.

disclosure of social security numbers in the manner required by tax regulations,

instructions, and forms, is found in Articles 8, 28, and 28-A of the Tax Law; and

The QEZE may choose to compute the usage of the vehicle based on

42 USC 405(c)(2)(C)(i).

either hours of use or miles traveled. The QEZE exemptions pertaining

The Tax Department uses this information primarily to determine and administer sales

to motor vehicles also apply to the special taxes imposed under Article

and use taxes or liabilities under the Tax Law, and for any other purpose authorized by

28-A of the Tax Law on passenger car rentals.

law.

Purchases made with this certificate are exempt from the 4% New York

Failure to provide the required information may subject you to civil or criminal penalties,

State sales and use tax rate and from the ¼% tax imposed in the

or both, under the Tax Law.

Metropolitan Commuter Transportation District (MCTD). Purchases (other

This information is maintained by the Director of the Registration and Data Services

than motor vehicles) are exempt from local sales and use tax only if the

Bureau, NYS Tax Department, Building 8 Room 338, W A Harriman Campus, Albany

purchaser takes possession of the property or uses the service in a locality

NY 12227; telephone 1 800 225-5829. From areas outside the U.S. and outside

Canada, call (518) 485-6800.

that has enacted the QEZE exemptions. Purchases of motor vehicles are

exempt from local tax if the locality in which the QEZE will predominantly

use the vehicle has enacted the QEZE exemptions, regardless of where

Need help?

delivery takes place.

Tax information: 1 800 972-1233

Forms and publications: 1 800 462-8100

If you purchase property or services in a locality that has enacted the QEZE

From outside the U.S. and outside Canada: (518) 485-6800

exemptions, and subsequently use the property or services in a locality

Fax-on-demand forms: 1 800 748-3676

which has not enacted the QEZE exemptions, you are required to pay use

Internet access:

tax at the rate where the property or service is used. Similarly, if you

Hearing and speech impaired (telecommunications device for the

purchase property or services in a locality that has not enacted the QEZE

deaf (TDD) callers only): 1 800 634-2110

exemptions, and subsequently use the property or service in a locality that

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1