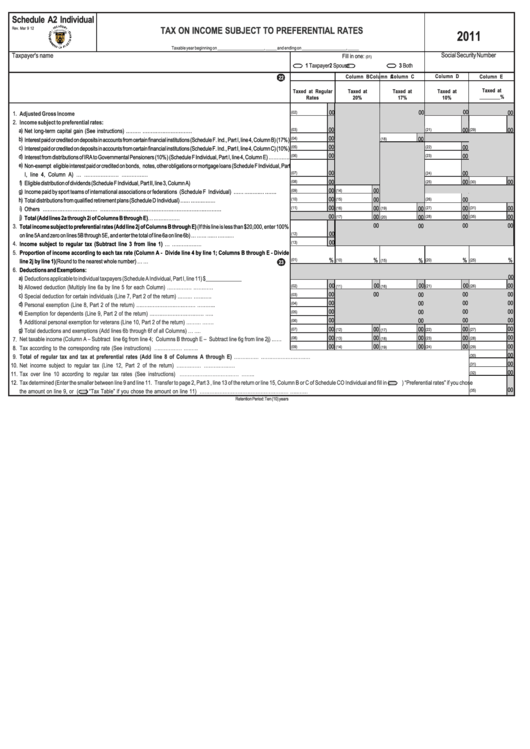

Schedule A2 Individual

TAX ON INCOME SUBJECT TO PREFERENTIAL RATES

Rev. Mar 9 12

2011

Taxable year beginning on _____________________, _____ and ending on ____________________, _____

Social Security Number

Taxpayer's name

Fill in one:

(01)

1 Taxpayer

3 Both

2 Spouse

Column A

Column B

Column C

Column D

Column E

22

Taxed at

Taxed at Regular

Taxed at

Taxed at

Taxed at

________%

Rates

20%

17%

10%

00

00

00

00

1.

Adjusted Gross Income

(02)

2.

Income subject to preferential rates:

00

00

00

a)

Net long-term capital gain (See instructions) ……….....................................................................…………………………

(03)

(21)

(29)

00

b)

00

Interest paid or credited on deposits in accounts from certain financial institutions (Schedule F. Ind., Part I, line 4, Column B) (17%)

(04)

(18)

00

00

c)

Interest paid or credited on deposits in accounts from certain financial institutions (Schedule F. Ind., Part I, line 4, Column C) (10%)

(05)

(22)

00

00

d)

(06)

Interest from distributions of IRA to Governmental Pensioners (10%) (Schedule F Individual, Part I, line 4, Column E) ………….

(23)

e)

Non-exempt eligible interest paid or credited on bonds, notes, other obligations or mortgage loans (Schedule F Individual, Part

00

00

(07)

(24)

I, line 4, Column A) …...............………………….......................................................................................…………….

00

00

00

f)

(08)

(25)

Eligible distribution of dividends (Schedule F Individual, Part II, line 3, Column A) .........................................................................

(30)

00

00

g)

(09)

Income paid by sport teams of international associations or federations (Schedule F Individual) …….....…………......…….

(14)

00

h)

00

00

(10)

(26)

Total distributions from qualified retirement plans (Schedule D Individual) …….....................................................……………

(15)

00

i)

00

00

00

00

Others ……………………………...............................................……………………………………………………………….

(11)

(16)

(27)

(31)

(19)

00

00

00

00

j)

00

Total (Add lines 2a through 2i of Columns B through E) …..............................................................................…………….

(17)

(28)

(35)

(20)

00

00

00

00

3.

Total income subject to preferential rates (Add line 2j of Columns B through E) (If this line is less than $20,000, enter 100%

00

on line 5A and zero on lines 5B through 5E, and enter the total of line 6a on line 6b) …........……...................……..............……….

(12)

00

4.

Income subject to regular tax (Subtract line 3 from line 1) …..............................................................………………

(13)

5.

Proportion of income according to each tax rate (Column A - Divide line 4 by line 1; Columns B through E - Divide

%

%

%

%

(01)

%

line 2j by line 1) (Round to the nearest whole number) …...................................................................................................…

(10)

(20)

(25)

(15)

23

6.

Deductions and Exemptions:

00

a)

Deductions applicable to individual taxpayers (Schedule A Individual, Part I, line 11) $_____________

00

00

00

00

00

b)

(02)

(21)

(26)

Allowed deduction (Multiply line 6a by line 5 for each Column) ……………......................................................…………

(11)

(16)

00

00

00

00

00

c)

(03)

Special deduction for certain individuals (Line 7, Part 2 of the return) ……….......................................................………..

00

00

00

00

d)

(04)

Personal exemption (Line 8, Part 2 of the return) ………………………………....................................................………..

00

00

00

00

e)

Exemption for dependents (Line 9, Part 2 of the return) ……………………………......................................................…..

(05)

00

00

00

00

f)

Additional personal exemption for veterans (Line 10, Part 2 of the return) ……….....................................................…….

(06)

00

00

00

00

00

g)

Total deductions and exemptions (Add lines 6b through 6f of all Columns) …...............................................................….

(07)

(12)

(22)

(27)

(17)

00

00

00

00

00

7.

Net taxable income (Column A – Subtract line 6g from line 4; Columns B through E – Subtract line 6g from line 2j) ……......

(08)

(13)

(23)

(28)

(18)

00

00

00

00

00

8.

Tax according to the corresponding rate (See instructions) ..........…..…………........................................................…..….

(09)

(14)

(24)

(29)

(19)

00

9.

Total of regular tax and tax at preferential rates (Add line 8 of Columns A through E) ……………...............................................................................................................…………………………

(30)

00

10.

Net income subject to regular tax (Line 12, Part 2 of the return) …………….....................................................................................................................................................................……………….

(31)

00

11.

Tax over line 10 according to regular tax rates (See instructions) ..........................................................................................................................................………………………………..............……..

(32)

12.

Tax determined (Enter the smaller between line 9 and line 11. Transfer to page 2, Part 3 , line 13 of the return or line 15, Column B or C of Schedule CO Individual and fill in (

) “Preferential rates” if you chose

00

the amount on line 9, or (

) “Tax Table” if you chose the amount on line 11) ………………………………………………................................................................................................................…..……

(35)

Retention Period: Ten (10) years

1

1