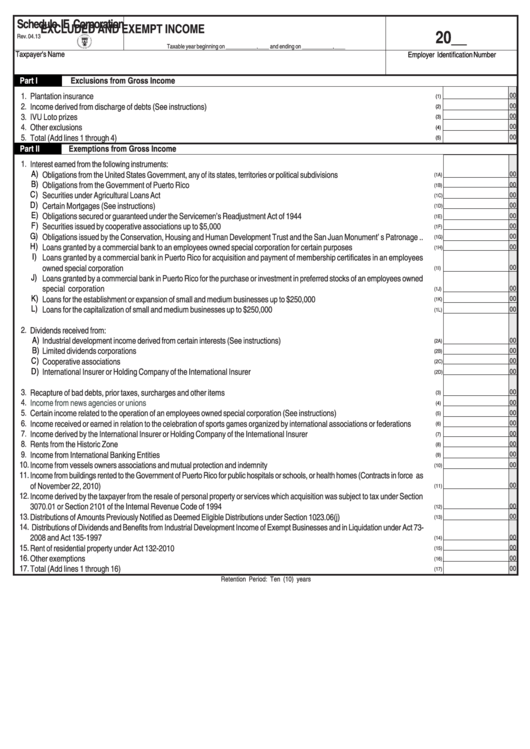

Schedule Ie Corporation - Excluded And Exempt Income - Puerto Rico Department Of Treasury

ADVERTISEMENT

Schedule IE Corporation

EXCLUDED AND EXEMPT INCOME

20__

Rev. 04.13

Taxable year beginning on ___________,____ and ending on ___________,____

Taxpayer's Name

Employer Identification Number

Part I

Exclusions from Gross Income

1.

Plantation insurance .......................................................................................................................................................................

00

(1)

2.

Income derived from discharge of debts (See instructions) ..............................................................................................................

00

(2)

3.

IVU Loto prizes ...............................................................................................................................................................................

00

(3)

4.

Other exclusions .............................................................................................................................................................................

00

(4)

5.

Total (Add lines 1 through 4) ...........................................................................................................................................................

00

(5)

Part II

Exemptions from Gross Income

1.

Interest earned from the following instruments:

A)

Obligations from the United States Government, any of its states, territories or political subdivisions ............................................

00

(1A)

B)

Obligations from the Government of Puerto Rico .......................................................................................................................

00

(1B)

C)

Securities under Agricultural Loans Act ......................................................................................................................................

00

(1C)

D)

Certain Mortgages (See instructions) ........................................................................................................................................

00

(1D)

E)

Obligations secured or guaranteed under the Servicemen’s Readjustment Act of 1944 ..............................................................

00

(1E)

F)

Securities issued by cooperative associations up to $5,000 .......................................................................................................

00

(1F)

G)

Obligations issued by the Conservation, Housing and Human Development Trust and the San Juan Monument’ s Patronage ..

00

(1G)

H)

Loans granted by a commercial bank to an employees owned special corporation for certain purposes ...................................

00

(1H)

I)

Loans granted by a commercial bank in Puerto Rico for acquisition and payment of membership certificates in an employees

owned special corporation .......................................................................................................................................................

00

(1I)

J)

Loans granted by a commercial bank in Puerto Rico for the purchase or investment in preferred stocks of an employees owned

special corporation ........................................................................................................................................................

00

(1J)

K)

Loans for the establishment or expansion of small and medium businesses up to $250,000 .......................................................

00

(1K)

L)

Loans for the capitalization of small and medium businesses up to $250,000 .............................................................................

00

(1L)

2.

Dividends received from:

A)

Industrial development income derived from certain interests (See instructions) .........................................................................

00

(2A)

B)

Limited dividends corporations ..................................................................................................................................................

00

(2B)

C)

Cooperative associations ..........................................................................................................................................................

00

(2C)

D)

International Insurer or Holding Company of the International Insurer .......................................................................................

00

(2D)

3.

Recapture of bad debts, prior taxes, surcharges and other items ....................................................................................................

00

(3)

4.

Income from news agencies or unions ............................................................................................................................................

00

(4)

5.

Certain income related to the operation of an employees owned special corporation (See instructions) ............................................

00

(5)

6.

Income received or earned in relation to the celebration of sports games organized by international associations or federations .....

00

(6)

7.

Income derived by the International Insurer or Holding Company of the International Insurer ..........................................................

00

(7)

8.

Rents from the Historic Zone ...........................................................................................................................................................

00

(8)

9.

Income from International Banking Entities .......................................................................................................................................

00

(9)

10.

Income from vessels owners associations and mutual protection and indemnity .................................................................................

00

(10)

11.

Income from buildings rented to the Government of Puerto Rico for public hospitals or schools, or health homes (Contracts in force as

of November 22, 2010) ...................................................................................................................................................................

00

(11)

12.

Income derived by the taxpayer from the resale of personal property or services which acquisition was subject to tax under Section

3070.01 or Section 2101 of the Internal Revenue Code of 1994 .....................................................................................................

00

(12)

13.

Distributions of Amounts Previously Notified as Deemed Eligible Distributions under Section 1023.06(j) ...........................................

00

(13)

14.

Distributions of Dividends and Benefits from Industrial Development Income of Exempt Businesses and in Liquidation under Act 73-

2008 and Act 135-1997 ..................................................................................................................................................................

00

(14)

15.

Rent of residential property under Act 132-2010 ...............................................................................................................................

00

(15)

16.

Other exemptions ............................................................................................................................................................................

00

(16)

17.

Total (Add lines 1 through 16) .........................................................................................................................................................

00

(17)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1