Form 2 - Montana Individual Income Tax Return - 2000 Page 2

ADVERTISEMENT

Column A (for single

Column B (for spouse

Form 2 Page 2 - 2000

Social Security Number

/

/

only when filing

joint, separate, or head

separate, and box 3

of household)

is checked

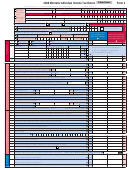

37. Montana Adjusted gross Income (From line 36) ......................................................

37.

37.

Deductions

Check only one

Montana's standard and itemized

deductions are different than

38. (A) Standard Deduction:

(A)

}

federal deductions. See instructions

(B)

Itemized Deductions:

(B)

38.

38.

for this line.

39. Subtract line 38 from 37 and enter balance......................................................................

=>

39.

39.

Exemptions (All filers are entitled to at least one exemption)

40. Multiply $1,670 times the number of exemptions on line 5 ................................................

40.

40.

41. Taxable Income. Subtract line 40 from line 39 ......................................................

41.

=>

41.

Nonresidents and Part-Year Residents complete and attach Schedules III & IV Form 2A, before proceeding

42.

Tax from table below. Non/part year residents enter the amount from line 129, Schedule IV. If

42.

42.

line 41 is less than zero, enter zero here.

43.

43.

43. Tax on lump sum distributions (see instructions for this line).

Attach Federal Form 4972

=>

44.

44.

44.

Subtotal—Add lines 42 & 43.............................................................................Subtotal

45.

45.

45.

Credits from Form 2A, line 111, Schedule II ....................................................................

=>

46.

46.

46. Balance—Subtract line 45 from 44 and enter difference

(but not less than zero)

.

47.

47.

47.

Investment credit recapture ..........................................................

Attach Form R.I.C.

48.

For each of the programs below enter any amount you and your spouse want to contribute.

Enter totals in boxes. (see instructions for details)

Nongame Wildlife

Child Abuse

Agriculture in

Program

Prevention

Schools

Enter total amount

in boxes.............

48.

48.

49.

50.

51.

=>

52.

52. Total Tax —Add lines 46, 47, and 48.........................................................................Total

52.

53. Combine amounts shown on line 52 columns A & B.......................................................

=>

53.

53.

54.

54. Montana tax withheld ......................................................

Attach withholding statements

54.

55. Payments of 2000 estimated tax, amounts credited from previous year

and/or payments made with extension ...............................................................

55.

55.

56. Elderly Homeowner/ Renter Credit ........................ Attach Form 2EC and receipts

56.

56.

57. Total of lines 54 thru 56 ............................................................................. Total

57.

57.

=>

58.

58. Combine amounts shown on line 57 columns A & B .......................................................

58.

59. If line 58 is larger than line 53 enter the difference. This is your OVERPAYMENT ..................................

59.

59.

60. Amount on line 59 to be applied to 2001 estimate 60.

61. Enter the amount on line 59 you want refunded to you

(refunds more than $1.00 will be issued)

REFUND.........

61.

61.

Refund Returns: Mail to Dept. of Revenue, PO Box 6577, Helena, MT 59604-6577

If you wish to use direct deposit enter your RTN# and ACCT# below. See instructions on page 6.

Checking

RTN#

ACCT#

Savings

62

62.

. If line 53 is larger than line 58 enter TAX DUE (If you owe see instructions for this line) ...................................

TAX DUE

62.

Include your check or money order and the payment coupon provided in this booklet.

TAX DUE RETURNS: Make check payable and remit to: Dept. of Revenue, PO Box 6308, Helena, MT 59604-6308

•

•

Underpayment penalty

Check this box if at least 2/3 of your gross income is from farming.

63.

(attach breakdown of computations)

63.

See Worksheet VII, Schedule W......

•

Check here if estimated payments were made using the

Late filing penalty-See page 2..........

64.

64.

annualization method. (Attach Montana Form EST-P)

65.

•

65.

Late payment penalty-See page 2....

Check here if you do not need state income tax forms

and instructions mailed to you next year. Tax forms

66.

66.

Interest 1% (.01) per month.......

are also available on the internet.

67.

67.

Total of lines 62 through 66...........

Note:

New Extension Law - Check this box and attach

copies of federal extension(s) to receive a valid Montana

extension. See Page 2 of instructions for details

Name, address & telephone number of preparer

.

My/our initials authorize the State to contact the preparer regarding this return

Questions? Please call (406) 444-6900 or TDD (406) 444-2830 for hearing impaired.

I/we waive my/our constitutional right of privacy for this limited purpose.

X

X

Your signature

Date

Daytime Telephone Number

Spouse signature

Date

I declare under penalty of false swearing that the information in this return and attachments is true, correct and complete.

TAX TABLE

If Taxable Income is:

If Taxable Income is:

Over

But not over

Multiply by and Subtract = Tax

Over

But not over

Multiply by and Subtract = Tax

$

0 .........

$ 2,100 .... X .... 2 % ........ $

0 ..............

$16,700 ...... $20,800 ..... X ...... 7 % .............. $

438

$ 2,100 ..........

$ 4,200 .... X .... 3 % ........ $ 21 .............

$20,800 ...... $29,200 ..... X ...... 8 % .............. $

646

$ 4,200 ..........

$ 8,300 .... X .... 4 % ........ $ 63 .............

$29,200 ...... $41,700 ..... X ...... 9 % .............. $

938

$ 8,300 ..........

$12,500 .... X .... 5 % ........ $ 146 ..............

$41,700 ...... $73,000 ..... X ...... 10 % .............. $ 1,355

$12,500 ..........

$16,700 .... X .... 6 % ........ $ 271 ..............

$73,000 ........................ X ...... 11 % .............. $ 2,085

Example = taxable income $2,400 x 3% (.03) = $72 subtract $21 = $51 tax

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2