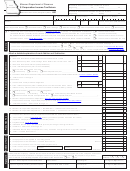

Form Mo-1120 - 2013 Corporation Income Tax Return - State Of Missouri Page 2

ADVERTISEMENT

1a

00

1a. State and local bond interest (except Missouri)

1b. Less: related expenses (omit if less than $500). Enter Line 1a less Line 1b on Line 1 1b

00

1

00

2. Fiduciary and partnership adjustment (enter share of adjustment from

MO-1065, Line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

Form

MO-1041, Page 2, Part 1, Line 18 or

Form

3. Net operating loss modification

(Section 143.431.4,

RSMo) (Do not enter NOL carryover) . . . . . . . . . . . .

3

00

4. Donations claimed for the Food Pantry Tax Credit that were deducted from federal taxable income,

4

00

Section 135.647, RSMo

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Total - Add Lines 1 through 4. Enter here and on Page 1, Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

1a. Interest from exempt federal obligations (must attach a detailed schedule)

1a

00

1b. Less: related expenses (omit if less than $500). Enter Line 1a less Line 1b on Line 1 1b

00

1

00

2. Federally taxable - Missouri exempt obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3. Reduction in gain due to basis difference (See

12 CSR 10-2.020

and

Section 143.121.3(2),

RSMo) . . .

3

00

4. Previously taxed income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5. Amount of any state income tax refund included in federal taxable income . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6. Capital gain exclusion from the sale of low income housing project . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7. Fiduciary and partnership adjustment (enter share of adjustment from Form MO-1041, Page 2, Part 1,

Line 19 or Form MO-1065, Line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8. Missouri depreciation basis adjustment

(Section 143.121.3(7),

RSMo) . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9. Subtraction Modification offsetting previous Addition Modification from a Net Operating Loss (NOL)

deduction from an applicable year

(Section 143.121.2(4),

RSMo). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10. Depreciation recovery on qualified property that is sold

(Section 143.121.3(9),

RSMo) . . . . . . . . . . . . . . .

10

00

11. Build America and Recovery Zone Bond Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12. Missouri Public-Private Partnerships Transportation Act . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

13. Total - Add Lines 1 through 12. Enter here and on Page 1, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

Consolidated Federal and Separate Missouri Return — See Instructions

1. Federal tax from Federal Form 1120, Schedule J, Line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2. Foreign tax credit (from Federal Form 1120, Schedule J, Line 5a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3. Federal income tax - add Lines 1 and 2; multiply the total by 50%; and enter here and on Page 1, Line 8.

3

00

Consolidated federal and separate Missouri returns must complete Lines 4–6

4. Numerator (the amount of separate company federal taxable income) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5. Denominator (enter the total positive separate company federal taxable income) . . . . . . . . . . . . . . . . . . .

5

00

6. Divide Line 4 by Line 5.

Multiply by Line 3. Enter here and on Page 1, Line 8.

(Consolidated federal and separate Missouri return filers must attach consolidated Federal Form 1120,

Schedule J, and an income statement or summary of profit companies.

If information is not sent, the federal income tax deduction may be reduced to zero.) . . . . . . . . . . . . . . . .

6

00

If this is an amended return, select one box indicating the reason.

r

r

r

A. Missouri Correction Only

B. Federal Correction

C. Loss Carryback (Complete Part 5)

r

r

DOR Only

D. Federal Tax Credit Carryback

E. IRS Audit (RAR)

r

F. Missouri Tax Credit Carryback* (* Enter on Part 5, Line 1 the first year that the credit became available.)

If this is an amended return and if a loss carryback or federal tax credit carryback is involved in this amended return, complete the following

section. Consolidated federal and separate Missouri filers should report figures attributable to this separate Missouri return and attach a copy of the

Federal Consolidated amended Form 1139 or

Form 1120X

showing the carryback or page 1 of the Federal Consolidated

Form 1120

for the year

of the loss to verify that only the separate company had the loss. Also, enclose a copy of the consolidated income statement for this year and the

year of the loss. (If NOL or Missouri tax credit carryback, enter year that the credit first became available.)

M

M

D

D

Y

Y

1. Year of loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2. Total net capital loss carryback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3. Total net operating loss carryback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4. Federal income tax adjustment - Consolidated federal and separate Missouri filers must attach computations

4

00

Form MO-1120 (Revised 05-2014)

Mail To:

Balance Due:

Refund or No Amount Due:

Missouri Department of Revenue

Missouri Department of Revenue

Phone: (573) 751-4541

P.O. Box 3365

P.O. Box 700

Fax: (573) 522-1721

Jefferson City, MO 65105-3365

Jefferson City, MO 65105-0700

E-mail:

corporate@dor.mo.gov

Visit

for additional information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2