Form 27 - Net Profits Tax Return

Download a blank fillable Form 27 - Net Profits Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 27 - Net Profits Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

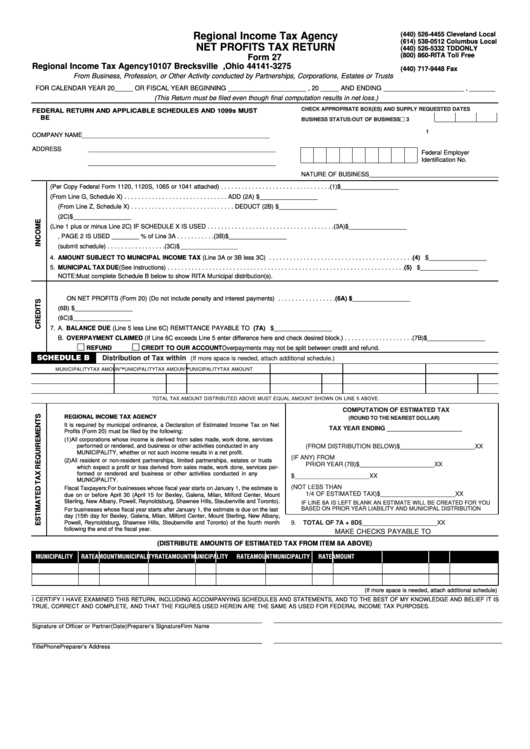

Regional Income Tax Agency

(440) 526-4455 Cleveland Local

(614) 538-0512 Columbus Local

NET PROFITS TAX RETURN

(440) 526-5332 TDD ONLY

(800) 860-RITA Toll Free

Form 27

Regional Income Tax Agency

10107 Brecksville Rd.

Brecksville, Ohio 44141-3275

(440) 717-9448 Fax

From Business, Profession, or Other Activity conducted by Partnerships, Corporations, Estates or Trusts

FOR CALENDAR YEAR 20_____ OR FISCAL YEAR BEGINNING ______________________ , 20 _____ AND ENDING ______________________ , _______

(This Return must be filed even though final computation results in net loss.)

CHECK APPROPRIATE BOX(ES) AND SUPPLY REQUESTED DATES

FEDERAL RETURN AND APPLICABLE SCHEDULES AND 1099s MUST

BE ATTACHED. PARTNERSHIPS MUST COMPLETE SCHEDULE Z.

BUSINESS STATUS: OUT OF BUSINESS

3

MO.

DAY

YR.

1

COMPANY NAME

_______________________________________________________

ADDRESS

_______________________________________________________

Federal Employer

Identification No.

_______________________________________________________

NATURE OF BUSINESS ______________________________________

1. TOTAL TAXABLE INCOME (Per Copy Federal Form 1120, 1120S, 1065 or 1041 attached) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(1) $ _________________

2. A. ITEMS NOT DEDUCTIBLE (From Line G, Schedule X) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ADD (2A) $ _________________

B. ITEMS NOT TAXABLE (From Line Z, Schedule X) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . DEDUCT (2B) $ _________________

C. ENTER EXCESS OF LINE 2A or 2B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2C) $ _________________

3. A. ADJUSTED INCOME (Line 1 plus or minus Line 2C) IF SCHEDULE X IS USED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3A) $ _________________

B. AMOUNT ALLOCABLE TO R.I.T.A. MUNICIPALITIES IF SCHEDULE Y, PAGE 2 IS USED ________ % of Line 3A . . . . . . . . . . . (3B) $ _________________

C. LESS ALLOCABLE NET LOSS PER PREVIOUS MUNICIPAL INCOME TAX RETURNS (submit schedule) . . . . . . . . . . . . . . . . . (3C) $ _________________

4. AMOUNT SUBJECT TO MUNICIPAL INCOME TAX (Line 3A or 3B less 3C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(4) $ _________________

5. MUNICIPAL TAX DUE (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(5) $ _________________

NOTE: Must complete Schedule B below to show RITA Municipal distribution(s).

6. A. PAYMENTS ON DECLARATION OF ESTIMATED MUNICIPAL TAX FOR THE YEAR 20 ____

ON NET PROFITS (Form 20) (Do not include penalty and interest payments) . . . . . . . . . . . . . . . . .(6A) $ _________________

B. AMOUNT OF PREVIOUS YEAR CREDITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(6B) $ _________________

C. TOTAL CREDITS ALLOWABLE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6C) $ _________________

7. A. BALANCE DUE (Line 5 less Line 6C) REMITTANCE PAYABLE TO R.I.T.A. MUST ACCOMPANY THIS FORM . . . . . . . . . . . . . . (7A) $ _________________

B. OVERPAYMENT CLAIMED (If Line 6C exceeds Line 5 enter difference here and check desired block.) . . . . . . . . . . . . . . . . . . . . (7B) $ _________________

REFUND

CREDIT TO OUR ACCOUNT

Overpayments may not be split between credit and refund.

SCHEDULE B

Distribution of Tax within R.I.T.A. MUNICIPALITIES

(If more space is needed, attach additional schedule.)

MUNICIPALITY

TAX AMOUNT

MUNICIPALITY

TAX AMOUNT

MUNICIPALITY

TAX AMOUNT

TOTAL TAX AMOUNT DISTRIBUTED ABOVE MUST EQUAL AMOUNT SHOWN ON LINE 5 ABOVE.

COMPUTATION OF ESTIMATED TAX

8.

DECLARATION OF ESTIMATED MUNICIPAL TAX ON NET PROFITS

REGIONAL INCOME TAX AGENCY

(ROUND TO THE NEAREST DOLLAR)

It is required by municipal ordinance, a Declaration of Estimated Income Tax on Net

TAX YEAR ENDING ______________________

Profits (Form 20) must be filed by the following:

(1) All corporations whose income is derived from sales made, work done, services

8A. ESTIMATED TAX

performed or rendered, and business or other activities conducted in any R.I.T.A.

(FROM DISTRIBUTION BELOW)

$______________________XX

MUNICIPALITY, whether or not such income results in a net profit.

8B. CREDIT (IF ANY) FROM

(2) All resident or non-resident partnerships, limited partnerships, estates or trusts

PRIOR YEAR (7B)

$______________________XX

which expect a profit or loss derived from sales made, work done, services per-

formed or rendered and business or other activities conducted in any R.I.T.A.

8C. LINE A LESS LINE B

$______________________XX

MUNICIPALITY.

8D. AMOUNT PAID (NOT LESS THAN

Fiscal Taxpayers: For businesses whose fiscal year starts on January 1, the estimate is

1/4 OF ESTIMATED TAX)

$______________________XX

due on or before April 30 (April 15 for Bexley, Galena, Milan, Milford Center, Mount

Sterling, New Albany, Powell, Reynoldsburg, Shawnee Hills, Steubenville and Toronto).

IF LINE 8A IS LEFT BLANK AN ESTIMATE WILL BE CREATED FOR YOU

BASED ON PRIOR YEAR LIABILITY AND MUNICIPAL DISTRIBUTION

For businesses whose fiscal year starts after January 1, the estimate is due on the last

day (15th day for Bexley, Galena, Milan, Milford Center, Mount Sterling, New Albany,

9.

TOTAL OF 7A + 8D

$______________________XX

Powell, Reynoldsburg, Shawnee Hills, Steubenville and Toronto) of the fourth month

following the end of the fiscal year.

MAKE CHECKS PAYABLE TO R.I.T.A.

(DISTRIBUTE AMOUNTS OF ESTIMATED TAX FROM ITEM 8A ABOVE)

MUNICIPALITY

RATE

AMOUNT

MUNICIPALITY

RATE

AMOUNT

MUNICIPALITY

RATE

AMOUNT

MUNICIPALITY

RATE

AMOUNT

(If more space is needed, attach additional schedule)

I CERTIFY I HAVE EXAMINED THIS RETURN, INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS

TRUE, CORRECT AND COMPLETE, AND THAT THE FIGURES USED HEREIN ARE THE SAME AS USED FOR FEDERAL INCOME TAX PURPOSES.

___________________________________________________________

___________________________________________________________________

Signature of Officer or Partner

(Date)

Preparer’s Signature

Firm Name

___________________________________________________________

___________________________________________________________________

Title

Phone

Preparer’s Address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2