Instructions For Schedule Nj-K-1

ADVERTISEMENT

2007-S - Page 23

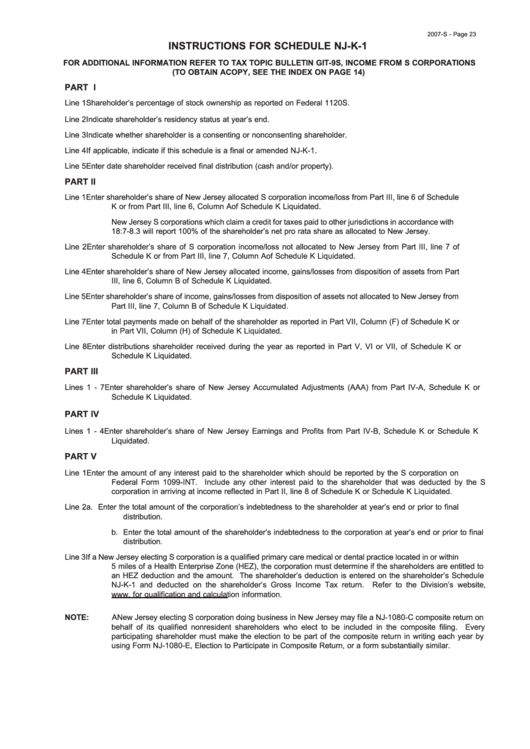

INSTRUCTIONS FOR SCHEDULE NJ-K-1

FOR ADDITIONAL INFORMATION REFER TO TAX TOPIC BULLETIN GIT-9S, INCOME FROM S CORPORATIONS

(TO OBTAIN A COPY, SEE THE INDEX ON PAGE 14)

PART I

Line 1

Shareholder’s percentage of stock ownership as reported on Federal 1120S.

Line 2

Indicate shareholder’s residency status at year’s end.

Line 3

Indicate whether shareholder is a consenting or nonconsenting shareholder.

Line 4

If applicable, indicate if this schedule is a final or amended NJ-K-1.

Line 5

Enter date shareholder received final distribution (cash and/or property).

PART II

Line 1

Enter shareholder’s share of New Jersey allocated S corporation income/loss from Part III, line 6 of Schedule

K or from Part III, line 6, Column A of Schedule K Liquidated.

New Jersey S corporations which claim a credit for taxes paid to other jurisdictions in accordance with N.J.A.C.

18:7-8.3 will report 100% of the shareholder’s net pro rata share as allocated to New Jersey.

Line 2

Enter shareholder’s share of S corporation income/loss not allocated to New Jersey from Part III, line 7 of

Schedule K or from Part III, line 7, Column A of Schedule K Liquidated.

Line 4

Enter shareholder’s share of New Jersey allocated income, gains/losses from disposition of assets from Part

III, line 6, Column B of Schedule K Liquidated.

Line 5

Enter shareholder’s share of income, gains/losses from disposition of assets not allocated to New Jersey from

Part III, line 7, Column B of Schedule K Liquidated.

Line 7

Enter total payments made on behalf of the shareholder as reported in Part VII, Column (F) of Schedule K or

in Part VII, Column (H) of Schedule K Liquidated.

Line 8

Enter distributions shareholder received during the year as reported in Part V, VI or VII, of Schedule K or

Schedule K Liquidated.

PART III

Lines 1 - 7

Enter shareholder’s share of New Jersey Accumulated Adjustments (AAA) from Part IV-A, Schedule K or

Schedule K Liquidated.

PART IV

Lines 1 - 4

Enter shareholder’s share of New Jersey Earnings and Profits from Part IV-B, Schedule K or Schedule K

Liquidated.

PART V

Line 1

Enter the amount of any interest paid to the shareholder which should be reported by the S corporation on

Federal Form 1099-INT. Include any other interest paid to the shareholder that was deducted by the S

corporation in arriving at income reflected in Part II, line 8 of Schedule K or Schedule K Liquidated.

Line 2

a. Enter the total amount of the corporation’s indebtedness to the shareholder at year’s end or prior to final

distribution.

b. Enter the total amount of the shareholder’s indebtedness to the corporation at year’s end or prior to final

distribution.

Line 3

If a New Jersey electing S corporation is a qualified primary care medical or dental practice located in or within

5 miles of a Health Enterprise Zone (HEZ), the corporation must determine if the shareholders are entitled to

an HEZ deduction and the amount. The shareholder’s deduction is entered on the shareholder’s Schedule

NJ-K-1 and deducted on the shareholder’s Gross Income Tax return.

Refer to the Division’s website,

, for qualification and calculation information.

NOTE:

A New Jersey electing S corporation doing business in New Jersey may file a NJ-1080-C composite return on

behalf of its qualified nonresident shareholders who elect to be included in the composite filing. Every

participating shareholder must make the election to be part of the composite return in writing each year by

using Form NJ-1080-E, Election to Participate in Composite Return, or a form substantially similar.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1