Instructions For Form Wv/ap-1

ADVERTISEMENT

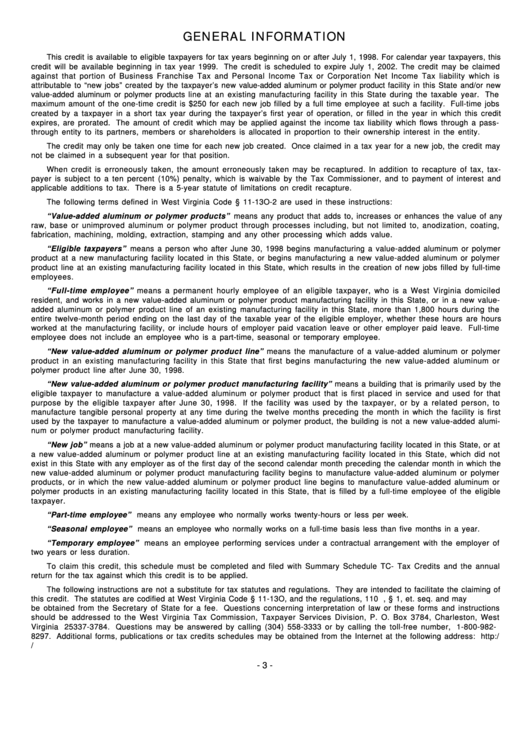

GENERAL INFORMATION

This credit is available to eligible taxpayers for tax years beginning on or after July 1, 1998. For calendar year taxpayers, this

credit will be available beginning in tax year 1999. The credit is scheduled to expire July 1, 2002. The credit may be claimed

against that portion of Business Franchise Tax and Personal Income Tax or Corporation Net Income Tax liability which is

attributable to “new jobs” created by the taxpayer’s new value-added aluminum or polymer product facility in this State and/or new

value-added aluminum or polymer products line at an existing manufacturing facility in this State during the taxable year. The

maximum amount of the one-time credit is $250 for each new job filled by a full time employee at such a facility. Full-time jobs

created by a taxpayer in a short tax year during the taxpayer’s first year of operation, or filled in the year in which this credit

expires, are prorated. The amount of credit which may be applied against the income tax liability which flows through a pass-

through entity to its partners, members or shareholders is allocated in proportion to their ownership interest in the entity.

The credit may only be taken one time for each new job created. Once claimed in a tax year for a new job, the credit may

not be claimed in a subsequent year for that position.

When credit is erroneously taken, the amount erroneously taken may be recaptured. In addition to recapture of tax, tax-

payer is subject to a ten percent (10%) penalty, which is waivable by the Tax Commissioner, and to payment of interest and

applicable additions to tax. There is a 5-year statute of limitations on credit recapture.

The following terms defined in West Virginia Code § 11-13O-2 are used in these instructions:

“Value-added aluminum or polymer products” means any product that adds to, increases or enhances the value of any

raw, base or unimproved aluminum or polymer product through processes including, but not limited to, anodization, coating,

fabrication, machining, molding, extraction, stamping and any other processing which adds value.

“Eligible taxpayers” means a person who after June 30, 1998 begins manufacturing a value-added aluminum or polymer

product at a new manufacturing facility located in this State, or begins manufacturing a new value-added aluminum or polymer

product line at an existing manufacturing facility located in this State, which results in the creation of new jobs filled by full-time

employees.

“Full-time employee” means a permanent hourly employee of an eligible taxpayer, who is a West Virginia domiciled

resident, and works in a new value-added aluminum or polymer product manufacturing facility in this State, or in a new value-

added aluminum or polymer product line of an existing manufacturing facility in this State, more than 1,800 hours during the

entire twelve-month period ending on the last day of the taxable year of the eligible employer, whether these hours are hours

worked at the manufacturing facility, or include hours of employer paid vacation leave or other employer paid leave. Full-time

employee does not include an employee who is a part-time, seasonal or temporary employee.

“New value-added aluminum or polymer product line” means the manufacture of a value-added aluminum or polymer

product in an existing manufacturing facility in this State that first begins manufacturing the new value-added aluminum or

polymer product line after June 30, 1998.

“New value-added aluminum or polymer product manufacturing facility” means a building that is primarily used by the

eligible taxpayer to manufacture a value-added aluminum or polymer product that is first placed in service and used for that

purpose by the eligible taxpayer after June 30, 1998. If the facility was used by the taxpayer, or by a related person, to

manufacture tangible personal property at any time during the twelve months preceding the month in which the facility is first

used by the taxpayer to manufacture a value-added aluminum or polymer product, the building is not a new value-added alumi-

num or polymer product manufacturing facility.

“New job” means a job at a new value-added aluminum or polymer product manufacturing facility located in this State, or at

a new value-added aluminum or polymer product line at an existing manufacturing facility located in this State, which did not

exist in this State with any employer as of the first day of the second calendar month preceding the calendar month in which the

new value-added aluminum or polymer product manufacturing facility begins to manufacture value-added aluminum or polymer

products, or in which the new value-added aluminum or polymer product line begins to manufacture value-added aluminum or

polymer products in an existing manufacturing facility located in this State, that is filled by a full-time employee of the eligible

taxpayer.

“Part-time employee” means any employee who normally works twenty-hours or less per week.

“Seasonal employee” means an employee who normally works on a full-time basis less than five months in a year.

“Temporary employee” means an employee performing services under a contractual arrangement with the employer of

two years or less duration.

To claim this credit, this schedule must be completed and filed with Summary Schedule TC- Tax Credits and the annual

return for the tax against which this credit is to be applied.

The following instructions are not a substitute for tax statutes and regulations. They are intended to facilitate the claiming of

this credit. The statutes are codified at West Virginia Code § 11-13O, and the regulations, 110 C.S.R. 13, § 1, et. seq. and may

be obtained from the Secretary of State for a fee. Questions concerning interpretation of law or these forms and instructions

should be addressed to the West Virginia Tax Commission, Taxpayer Services Division, P. O. Box 3784, Charleston, West

Virginia 25337-3784. Questions may be answered by calling (304) 558-3333 or by calling the toll-free number, 1-800-982-

8297. Additional forms, publications or tax credits schedules may be obtained from the Internet at the following address: http:/

/

- 3 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2