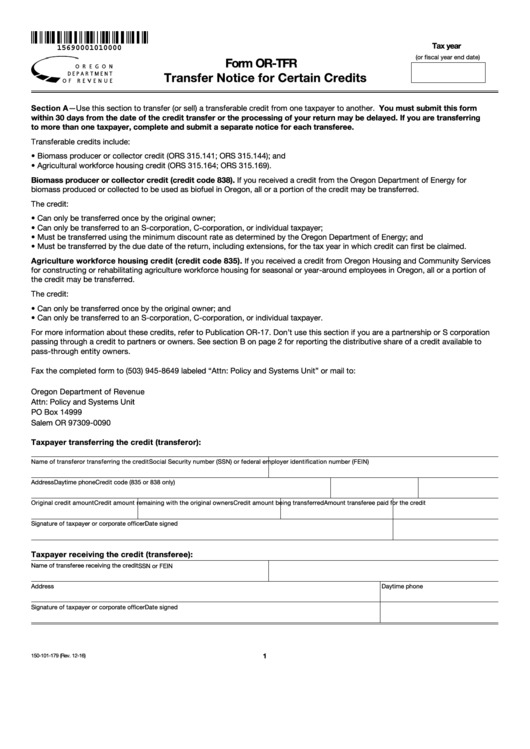

Form Or-Tfr - Transfer Notice For Certain Credits

ADVERTISEMENT

Tax year

15690001010000

(or fiscal year end date)

Form OR-TFR

Transfer Notice for Certain Credits

Section A—Use this section to transfer (or sell) a transferable credit from one taxpayer to another. You must submit this form

within 30 days from the date of the credit transfer or the processing of your return may be delayed. If you are transferring

to more than one taxpayer, complete and submit a separate notice for each transferee.

Transferable credits include:

• Biomass producer or collector credit (ORS 315.141; ORS 315.144); and

• Agricultural workforce housing credit (ORS 315.164; ORS 315.169).

Biomass producer or collector credit (credit code 838). If you received a credit from the Oregon Department of Energy for

biomass produced or collected to be used as biofuel in Oregon, all or a portion of the credit may be transferred.

The credit:

• Can only be transferred once by the original owner;

• Can only be transferred to an S-corporation, C-corporation, or individual taxpayer;

• Must be transferred using the minimum discount rate as determined by the Oregon Department of Energy; and

• Must be transferred by the due date of the return, including extensions, for the tax year in which credit can first be claimed.

Agriculture workforce housing credit (credit code 835). If you received a credit from Oregon Housing and Community Services

for constructing or rehabilitating agriculture workforce housing for seasonal or year-around employees in Oregon, all or a portion of

the credit may be transferred.

The credit:

• Can only be transferred once by the original owner; and

• Can only be transferred to an S-corporation, C-corporation, or individual taxpayer.

For more information about these credits, refer to Publication OR-17. Don’t use this section if you are a partnership or S corporation

passing through a credit to partners or owners. See section B on page 2 for reporting the distributive share of a credit available to

pass-through entity owners.

Fax the completed form to (503) 945-8649 labeled “Attn: Policy and Systems Unit” or mail to:

Oregon Department of Revenue

Attn: Policy and Systems Unit

PO Box 14999

Salem OR 97309-0090

Taxpayer transferring the credit (transferor):

Name of transferor transferring the credit

Social Security number (SSN) or federal employer identification number (FEIN)

Address

Daytime phone

Credit code (835 or 838 only)

Original credit amount

Credit amount remaining with the original owners Credit amount being transferred

Amount transferee paid for the credit

Signature of taxpayer or corporate officer

Date signed

Taxpayer receiving the credit (transferee):

Name of transferee receiving the credit

SSN or FEIN

Address

Daytime phone

Signature of taxpayer or corporate officer

Date signed

1

150-101-179 (Rev. 12-16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2