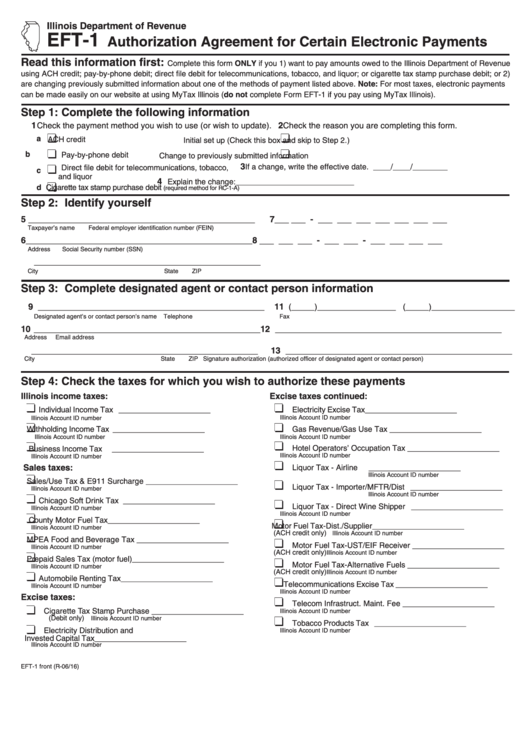

Illinois Department of Revenue

EFT‑1

Authorization Agreement for Certain Electronic Payments

Read this information first:

Complete this form ONLY if you 1) want to pay amounts owed to the Illinois Department of Revenue

using ACH credit; pay-by-phone debit; direct file debit for telecommunications, tobacco, and liquor; or cigarette tax stamp purchase debit; or 2)

are changing previously submitted information about one of the methods of payment listed above. Note: For most taxes, electronic payments

can be made easily on our website at tax.illinois.gov using MyTax Illinois (do not complete Form EFT-1 if you pay using MyTax Illinois).

Step 1: Complete the following information

1

2

Check the payment method you wish to use (or wish to update).

Check the reason you are completing this form.

a

ACH credit

Initial set up (Check this box and skip to Step 2.)

b

Pay-by-phone debit

Change to previously submitted information

3

If a change, write the effective date. ____/____/________

Direct file debit for telecommunications, tobacco

,

c

and liquor

4

Explain the change:___________________________

d

Cigarette tax stamp purchase debit

(required method for RC-1-A)

Step 2: Identify yourself

5

7 ___ ___ ‑ ___ ___ ___ ___ ___ ___ ___

_________________________________________________

Taxpayer’s name

Federal employer identification number (FEIN)

6

8 ___ ___ ___ ‑ ___ ___ ‑ ___ ___ ___ ___

_________________________________________________

Address

Social Security number (SSN)

_________________________________________________

City

State

ZIP

Step 3: Complete designated agent or contact person information

9

11

_________________________________________________

(_____)_________________ (_____)__________________

Designated agent’s or contact person’s name

Telephone

Fax

10

12

_________________________________________________

_________________________________________________

Address

Email address

13

_________________________________________________

_________________________________________________

City

State

ZIP

Signature authorization (authorized officer of designated agent or contact person)

Step 4: Check the taxes for which you wish to authorize these payments

Illinois income taxes:

Excise taxes continued:

Individual Income Tax

_____________________

Electricity Excise Tax

_____________________

Illinois Account ID number

Illinois Account ID number

Withholding Income Tax

_____________________

Gas Revenue/Gas Use Tax

_____________________

Illinois Account ID number

Illinois Account ID number

Hotel Operators’ Occupation Tax

_____________________

Business Income Tax

_____________________

Illinois Account ID number

Illinois Account ID number

Sales taxes:

Liquor Tax - Airline

_____________________

Illinois Account ID number

Sales/Use Tax & E911 Surcharge

_____________________

Liquor Tax - Importer/MFTR/Dist

_____________________

Illinois Account ID number

Illinois Account ID number

Chicago Soft Drink Tax

_____________________

Liquor Tax - Direct Wine Shipper

_____________________

Illinois Account ID number

Illinois Account ID number

County Motor Fuel Tax

_____________________

Motor Fuel Tax-Dist./Supplier

_____________________

Illinois Account ID number

(ACH credit only)

Illinois Account ID number

MPEA Food and Beverage Tax

_____________________

Motor Fuel Tax-UST/EIF Receiver _____________________

Illinois Account ID number

(ACH credit only)

Illinois Account ID number

Prepaid Sales Tax (motor fuel)

_____________________

Motor Fuel Tax-Alternative Fuels

_____________________

Illinois Account ID number

(ACH credit only)

Illinois Account ID number

Automobile Renting Tax

_____________________

Telecommunications Excise Tax

_____________________

Illinois Account ID number

Illinois Account ID number

Excise taxes:

Telecom Infrastruct. Maint. Fee

_____________________

Cigarette Tax Stamp Purchase

_____________________

Illinois Account ID number

(Debit only)

Illinois Account ID number

Tobacco Products Tax

_____________________

Electricity Distribution and

Illinois Account ID number

Invested Capital Tax

_____________________

Illinois Account ID number

EFT-1 front (R-06/16)

1

1 2

2