Instructions For Form 05-102 - Public Information Report

ADVERTISEMENT

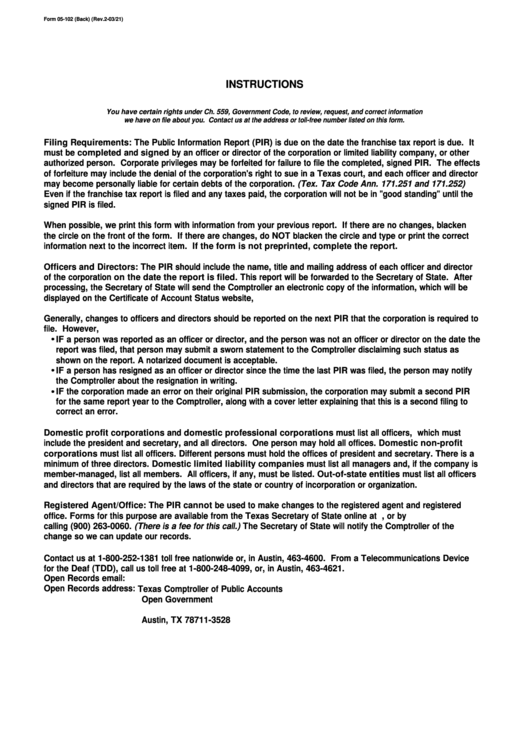

Form 05-102 (Back) (Rev.2-03/21)

INSTRUCTIONS

You have certain rights under Ch. 559, Government Code, to review, request, and correct information

we have on file about you. Contact us at the address or toll-free number listed on this form.

Filing Requirements: The Public Information Report (PIR) is due on the date the franchise tax report is due. It

must be completed and signed by an officer or director of the corporation or limited liability company, or other

authorized person. Corporate privileges may be forfeited for failure to file the completed, signed PIR. The effects

of forfeiture may include the denial of the corporation's right to sue in a Texas court, and each officer and director

may become personally liable for certain debts of the corporation. (Tex. Tax Code Ann. 171.251 and 171.252)

Even if the franchise tax report is filed and any taxes paid, the corporation will not be in "good standing" until the

signed PIR is filed.

When possible, we print this form with information from your previous report. If there are no changes, blacken

the circle on the front of the form. If there are changes, do NOT blacken the circle and type or print the correct

information next to the incorrect item. If the form is not preprinted, complete the report.

Officers and Directors: The PIR should include the name, title and mailing address of each officer and director

of the corporation on the date the report is filed. This report will be forwarded to the Secretary of State. After

processing, the Secretary of State will send the Comptroller an electronic copy of the information, which will be

displayed on the Certificate of Account Status website,

Generally, changes to officers and directors should be reported on the next PIR that the corporation is required to

file. However,

IF a person was reported as an officer or director, and the person was not an officer or director on the date the

report was filed, that person may submit a sworn statement to the Comptroller disclaiming such status as

shown on the report. A notarized document is acceptable.

IF a person has resigned as an officer or director since the time the last PIR was filed, the person may notify

the Comptroller about the resignation in writing.

IF the corporation made an error on their original PIR submission, the corporation may submit a second PIR

for the same report year to the Comptroller, along with a cover letter explaining that this is a second filing to

correct an error.

Domestic profit corporations and domestic professional corporations must list all officers, which must

include the president and secretary, and all directors. One person may hold all offices. Domestic non-profit

corporations must list all officers. Different persons must hold the offices of president and secretary. There is a

minimum of three directors. Domestic limited liability companies must list all managers and, if the company is

member-managed, list all members. All officers, if any, must be listed. Out-of-state entities must list all officers

and directors that are required by the laws of the state or country of incorporation or organization.

Registered Agent/Office: The PIR cannot be used to make changes to the registered agent and registered

office. Forms for this purpose are available from the Texas Secretary of State online at , or by

calling (900) 263-0060. (There is a fee for this call.) The Secretary of State will notify the Comptroller of the

change so we can update our records.

Contact us at 1-800-252-1381 toll free nationwide or, in Austin, 463-4600. From a Telecommunications Device

for the Deaf (TDD), call us toll free at 1-800-248-4099, or, in Austin, 463-4621.

Open Records email: open.records@cpa.state.tx.us

Open Records address: Texas Comptroller of Public Accounts

Open Government

P.O. Box 13528

Austin, TX 78711-3528

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1