Form As 2916.1 - Certificate For Exempt Purchases And For Services Subject To The 4% Special-Sut Page 3

ADVERTISEMENT

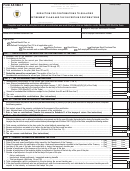

CERTIFICATE FOR EXEMPT PURCHASES AND FOR SERVICES SUBJECT TO THE 4% SPECIAL-SUT

INSTRUCTIONS

Who must complete this form?

This form must be completed by:

1.

A purchaser registered in the Merchant’s Registry of the Department of the Treasury, that holds a valid Reseller Certificate, Eligible Reseller Certificate or

Exemption Certificate and purchases tangible personal property for resale (exemption from Municipal SUT only), raw materials and equipment used in

manufacturing;

2.

A purchaser registered in the Merchant’s Registry of the Department of the Treasury, that receives services from another merchant that is also registered in said

registry, including those subcontracted services (that is, when the merchant providing the service, Contractor, provides such services through another merchant,

Subcontractor), and such services are subject to the 4% Special-SUT (except the designated professional services, even if these services are provided to other

merchants, and the services indicated in Section 4010.01(bbb)(1) of the Code);

3.

A merchant that receives capitalized repair services to tangible personal property or real property, that are subject to the 4% Special-SUT;

4.

An agency of the Commonwealth of Puerto Rico or the Federal Government that acquires taxable items for its official use, including services subject to the 4%

Special-SUT;

5.

A bona fide farmers, duly certified by the Department of Agriculture, that acquires services, agricultural goods, and machinery and equipment used for said

agricultural activity;

A merchant that holds a Total Exemption Certificate, which allows him or her to pay the sales and use tax directly to the Secretary of the Treasury instead of paying

6.

it to the seller;

A housing cooperative ruled by Act 239-2004, that acquires materials, equipment or services to render the services compatible with its ends and purposes,

7.

provided that in order for the cooperative to be eligible for the Basic-SUT or 4% Special-SUT exemption, as applicable, on the services received, its units must

be used at least 85% for residential purposes;

A diplomat who holds a valid exemption card issued by the United States Department of State, that entitles him or her to claim an exemption from the sales and

8.

use tax;

A person covered by any special act that provides an exemption from the payment of the sales and use tax;

9.

A person who acquires taxable items for use or consumption outside of Puerto Rico;

10.

An individual affected by a disaster who acquires taxable items that constitute basic need articles required for the restoration, repair and needs supply and

11.

damages caused by reason of the disaster;

A residents’ associations, board of owners of residential condominiums, and associations of residential owners, as defined in Section 1101.01(a)(5)(A) of the

12.

Code, for the common benefit of its residents, provided that the units of the association or board are used at least 85% for residential purposes;

A social interest housing residential project that receives federal or state rent subsidies, which residents pay directly a maintenance fee, that holds a current

13.

Exemption Certificate issued by the Department;

A person engaged in industry or business or for the production of income in Puerto Rico that receives services from another person engaged in industry or

14.

business or for the production of income in Puerto Rico and is part of a controlled group of corporations or a controlled group or group of related entities, as

defined in Sections 1010.04 and 1010.05 of the Code, including partnerships or excluded members engaged in industry or business or for the production of

income in Puerto Rico, that if applying the group of related entities rules, will be considered a component member of such group;

15.

A person engaged in the repair, maintenance and conditioning of airships business that is covered by an exemption decree under Act 73-2008, known as the

“Economic Incentives for the Development of Puerto Rico Act”, or any previous or subsequent similar act that makes purchases of raw material, machinery and

equipment used in manufacturing or receives services;

16.

A person engaged exclusively in the storage or processing of gasoline, jet fuel, aviation fuel, gas oil or diesel oil, crude oil, partially elaborated or finished products

derived from oil, and any other hydrocarbon mixture, mentioned in Subtitle C of the Code, provided that the storage or handling of fuel takes place in a foreign

trade zone or subzone, as this term is defined in Section 3010.01(a)(16) of the Code, that acquires services;

17.

A labor or workers’ organization organized under the provisions of Act 130 of May 8, 1945, as amended, known as the Puerto Rico Labor Relations Act, and Act

45-1998, as amended, known as the Labor Relations for Puerto Rico Public Service Act, that receives designated professional services, provided that it is in

compliance with subparagraphs (A), (B) or (C) of paragraph (4) of subsection (a) of Section 1101.01 of the Code;

18.

A public or private entity, which Organic Law provides that it is exempt from any kind of taxes, that receives services;

19.

A merchant that subcontracts services as part of a commercial, touristic or residential construction project; and

20.

A merchant engaged in providing telecommunications services that subcontracts telecommunications services.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4