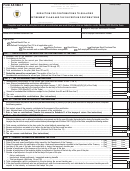

Form As 2916.1 - Certificate For Exempt Purchases And For Services Subject To The 4% Special-Sut Page 4

ADVERTISEMENT

The purchaser must provide this form to the seller at the moment of the purchase together with copy of the Merchant’s Registration Certificate,

Reseller Certificate, Eligible Reseller Certificate, Exemption Certificate or any other document evidencing the exemption requested on this

Certificate. The purchaser must keep a copy for his or her records. This Certificate should not be sent to the Department of the Treasury.

Instructions to the Purchaser

In order to be valid, all parts of this certificate must be completed. In addition, this certificate must be signed by the owner, partner, corporate official or other person duly

authorized to represent the purchaser.

If you intentionally issue a fraudulent Certificate for Exempt Purchases and for Services Subject to the 4% Special-SUT, you will be responsible for the payment of

the sales and use tax, and the applicable penalties.

Instructions to the Merchant Seller

If you are a seller registered in the Merchant’s Registry of the Department of the Treasury and accept a Certificate for Exempt Purchases and for Services Subject

to the 4% Special-SUT, you will be released from your obligation of collecting and remitting the Basic-SUT or the 4% Special-SUT or will be required to collect and

remit the 4% Special-SUT instead of the Basic-SUT, as applicable. You are required to keep a copy of this certificate in your files for a period of 6 years, counted from

the filing date of the Sales and Use Tax Monthly Return, in which the transaction for which this Certificate is completed is reported.

For your convenience, a space is provided in the upper right corner of this form so that the merchant seller can identify the invoice, receipt or transaction number

related to the transaction for which this Certificate is issued.

Additional Information

Exempt sales or sales subjec to the 4% Special-SUT which are not supported by a valid Certificate for Exempt Purchases and for Services Subject to the 4% Special-

SUT will be subject to the corresponding Basic-SUT.

For additional information regarding this certificate, please contact the Department of the Treasury at 787-722-0216, option 8, or visit any of the Merchant's

Service Centers.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4