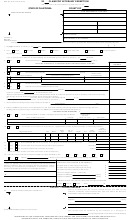

BOE-267 (P2) REV. 14 (10-16)

5. USE OF PROPERTY

a. Operation of a store, thrift shop, or other facility (since January 1 of the prior year)

(1) Is any portion of the property identified under Section 1 used to operate a store, thrift shop, or other facility that sells goods to members of the

organization or to the general public?

If Yes, (A) list the hours per week the business is operated and (B) describe the type of goods sold:

Yes

No

(2) Is the property used as a thrift shop as part of a planned, formal rehabilitation program?

Yes

No

If Yes, submit BOE-267-R.

b. Living Quarters (since January 1 of prior year)

Is any portion of the property identified under Section 1 used for living quarters (other than low-income or elderly or handicapped housing)?

If Yes, describe that portion. Submit documentation that the housing is incidental to and reasonably necessary for the exempt

Yes

No

purposes of the organization. If living quarters are associated with a rehabilitation program, submit BOE-267-R.

c. Low-Income Housing

Is any portion of the property identified under Section 1 used as low-income housing?

If Yes, submit BOE-267-L if owned by a nonprofit organization or limited liability company; submit BOE-267-L1 if owned by a

Yes

No

limited partnership.

d. Elderly or Handicapped Housing

Is any portion of the property identified under Section 1 used as a facility for the elderly or handicapped?

If Yes, submit BOE-267-H, unless care or services are provided or the property is financed by the federal government under,

Yes

No

including but not limited to, sections 202, 231, 236, or 811 of the Federal Public Laws. Submit documentation on the type of

financing or care/services provided.

6. UNRELATED BUSINESS TAXABLE INCOME

Is the property for which exemption is sought used for activities that produce income that is “unrelated business taxable income,” as defined in section

512 of the Internal Revenue Code (IRC), and that is subject to the tax imposed by section 511 of the IRC?

Yes

No

If Yes, attach each of the following:

1. The organization’s information and tax returns filed with the Internal Revenue Service for the preceding fiscal year.

2. A statement setting forth the amount of time devoted to the organization’s income producing and non-income producing activities, and, where

applicable, a description of the portion of the property on which those activities are conducted.

3. A statement listing the specific activities which produce the unrelated business taxable income.

4. A statement setting forth the amount of income of the organization that is attributable to activities in the state and is exempt from income or

franchise taxation, and the amount of total income of the organization that is attributable to activities in the state.

7. EXPANSION

Do you contemplate any capital investment in the property within the next year?

Yes

No

If Yes, explain:

8. FINANCIAL STATEMENTS

Claimant must attach a copy of its operating statement (income and expenses) and balance sheet (assets and liabilities), which relate exclusively to

the property identified under Section 1, for the calendar or fiscal year preceding the claim year.

9. OTHER - EXEMPT ACTIVITY AND USE

Please check all boxes that are applicable:

The property is used for the actual operation of the exempt activity.

The property is not used or operated by the owner or by any other person or organization so as to benefit any officer, trustee, director, shareholder,

member, employee, contributor, or bondholder of the owner or operator, or any other person, through the distribution of profits, payment of

excessive charges or compensations, or the more advantageous pursuit of the business or profession.

The property is not used by the owners, operators, or members for fraternal or lodge purposes, or for social club purposes except where such

use is clearly incidental to a primary religious, hospital, scientific, or charitable purpose.

Whom should we contact during normal business hours for additional information?

NAME

TITLE

DAYTIME TELEPHONE

EMAIL ADDRESS

(

)

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon, including any

accompanying statements or documents, is true, correct, and complete to the best of my knowledge and belief.

SIGNATURE OF CLAIMANT

TITLE

t

NAME OF PERSON MAKING CLAIM

DATE

1

1 2

2