General Instructions - Credit For Investing In Machinery And Equipment (Form Cd-478b)

ADVERTISEMENT

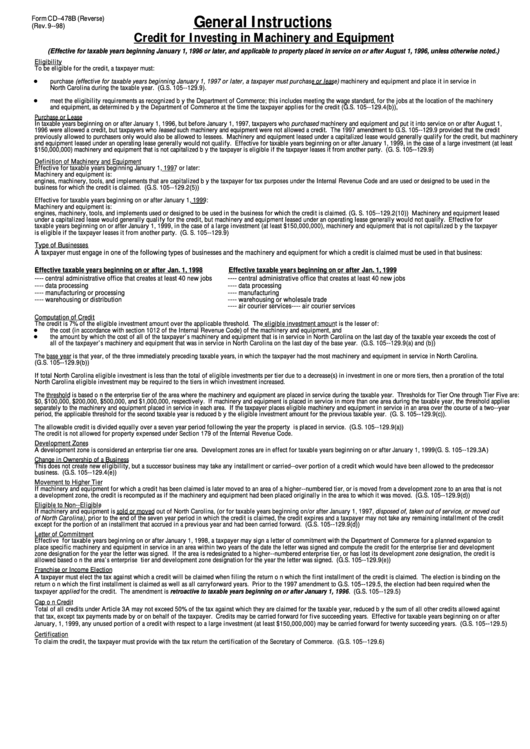

General Instructions

Form CD--478B (Reverse)

(Rev. 9--98)

Credit for Investing in Machinery and Equipment

(Effective for taxable years beginning January 1, 1996 or later, and applicable to property placed in service on or after August 1, 1996, unless otherwise noted.)

Eligibility

To be eligible for the credit, a taxpayer must:

purchase (effective for taxable years beginning January 1, 1997 or later, a taxpayer must purchase or lease) machinery and equipment and place it in service in

D

North Carolina during the taxable year. (G.S. 105--129.9).

meet the eligibility requirements as recognized by the Department of Commerce; this includes meeting the wage standard, for the jobs at the location of the machinery

D

and equipment, as determined by the Department of Commerce at the time the taxpayer applies for the credit (G.S. 105--129.4(b)),

Purchase or Lease

In taxable years beginning on or after January 1, 1996, but before January 1, 1997, taxpayers who purchased machinery and equipment and put it into service on or after August 1,

1996 were allowed a credit, but taxpayers who leased such machinery and equipment were not allowed a credit. The 1997 amendment to G.S. 105--129.9 provided that the credit

previously allowed to purchasers only would also be allowed to lessees. Machinery and equipment leased under a capitalized lease would generally qualify for the credit, but machinery

and equipment leased under an operating lease generally would not qualify. Effective for taxable years beginning on or after January 1, 1999, in the case of a large investment (at least

$150,000,000) machinery and equipment that is not capitalized by the taxpayer is eligible if the taxpayer leases it from another party. (G. S. 105--129.9)

Definition of Machinery and Equipment

Effective for taxable years beginning January 1, 1997 or later:

Machinery and equipment is:

engines, machinery, tools, and implements that are capitalized by the taxpayer for tax purposes under the Internal Revenue Code and are used or designed to be used in the

business for which the credit is claimed. (G.S. 105--129.2(5))

Effective for taxable years beginning on or after January 1, 1999:

Machinery and equipment is:

engines, machinery, tools, and implements used or designed to be used in the business for which the credit is claimed. (G. S. 105--129.2(10)) Machinery and equipment leased

under a capitalized lease would generally qualify for the credit, but machinery and equipment leased under an operating lease generally would not qualify. Effective for

taxable years beginning on or after January 1, 1999, in the case of a large investment (at least $150,000,000), machinery and equipment that is not capitalized by the taxpayer

is eligible if the taxpayer leases it from another party. (G. S. 105--129.9)

Type of Businesses

A taxpayer must engage in one of the following types of businesses and the machinery and equipment for which a credit is claimed must be used in that business:

Effective taxable years beginning on or after Jan. 1, 1998

Effective taxable years beginning on or after Jan. 1, 1999

---- central administrative office that creates at least 40 new jobs

---- central administrative office that creates at least 40 new jobs

---- data processing

---- data processing

---- manufacturing or processing

---- manufacturing

---- warehousing or distribution

---- warehousing or wholesale trade

---- air courier services

---- air courier services

Computation of Credit

The credit is 7% of the eligible investment amount over the applicable threshold. The eligible investment amount is the lesser of:

the cost (in accordance with section 1012 of the Internal Revenue Code) of the machinery and equipment, and

D

the amount by which the cost of all of the taxpayer’ s machinery and equipment that is in service in North Carolina on the last day of the taxable year exceeds the cost of

D

all of the taxpayer’ s machinery and equipment that was in service in North Carolina on the last day of the base year. (G.S. 105--129.9(a) and (b))

The base year is that year, of the three immediately preceding taxable years, in which the taxpayer had the most machinery and equipment in service in North Carolina.

(G.S. 105--129.9(b))

If total North Carolina eligible investment is less than the total of eligible investments per tier due to a decrease(s) in investment in one or more tiers, then a proration of the total

North Carolina eligible investment may be required to the tiers in which investment increased.

The threshold is based on the enterprise tier of the area where the machinery and equipment are placed in service during the taxable year. Thresholds for Tier One through Tier Five are:

$0, $100,000, $200,000, $500,000, and $1,000,000, respectively. If machinery and equipment is placed in service in more than one area during the taxable year, the threshold applies

separately to the machinery and equipment placed in service in each area. If the taxpayer places eligible machinery and equipment in service in an area over the course of a two--year

period, the applicable threshold for the second taxable year is reduced by the eligible investment amount for the previous taxable year. (G. S. 105--129.9(c)).

The allowable credit is divided equally over a seven year period following the year the property is placed in service. (G.S. 105--129.9(a))

The credit is not allowed for property expensed under Section 179 of the Internal Revenue Code.

Development Zones

A development zone is considered an enterprise tier one area. Development zones are in effect for taxable years beginning on or after January 1, 1999 (G. S. 105--129.3A)

Change in Ownership of a Business

This does not create new eligibility, but a successor business may take any installment or carried--over portion of a credit which would have been allowed to the predecessor

business. (G.S. 105--129.4(e))

Movement to Higher Tier

If machinery and equipment for which a credit has been claimed is later moved to an area of a higher--numbered tier, or is moved from a development zone to an area that is not

a development zone, the credit is recomputed as if the machinery and equipment had been placed originally in the area to which it was moved. (G.S. 105--129.9(d))

Eligible to Non--Eligible

If machinery and equipment is sold or moved out of North Carolina, (or for taxable years beginning on/or after January 1, 1997, disposed of, taken out of service, or moved out

of North Carolina), prior to the end of the seven year period in which the credit is claimed, the credit expires and a taxpayer may not take any remaining installment of the credit

except for the portion of an installment that accrued in a previous year and had been carried forward. (G.S. 105--129.9(d))

Letter of Commitment

Effective for taxable years beginning on or after January 1, 1998, a taxpayer may sign a letter of commitment with the Department of Commerce for a planned expansion to

place specific machinery and equipment in service in an area within two years of the date the letter was signed and compute the credit for the enterprise tier and development

zone designation for the year the letter was signed. If the area is redesignated to a higher--numbered enterprise tier, or has lost its development zone designation, the credit is

allowed based on the area’ s enterprise tier and development zone designation for the year the letter was signed. (G.S. 105--129.9(e))

Franchise or Income Election

A taxpayer must elect the tax against which a credit will be claimed when filing the return on which the first installment of the credit is claimed. The election is binding on the

return on which the first installment is claimed as well as all carryforward years. Prior to the 1997 amendment to G.S. 105--129.5, the election had been required when the

taxpayer applied for the credit. The amendment is retroactive to taxable years beginning on or after January 1, 1996. (G.S. 105--129.5)

Cap on Credit

Total of all credits under Article 3A may not exceed 50% of the tax against which they are claimed for the taxable year, reduced by the sum of all other credits allowed against

that tax, except tax payments made by or on behalf of the taxpayer. Credits may be carried forward for five succeeding years. Effective for taxable years beginning on or after

January, 1, 1999, any unused portion of a credit with respect to a large investment (at least $150,000,000) may be carried forward for twenty succeeding years. (G.S. 105--129.5)

Certification

To claim the credit, the taxpayer must provide with the tax return the certification of the Secretary of Commerce. (G.S. 105--129.6)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1