Business Personal Property Return - York County

ADVERTISEMENT

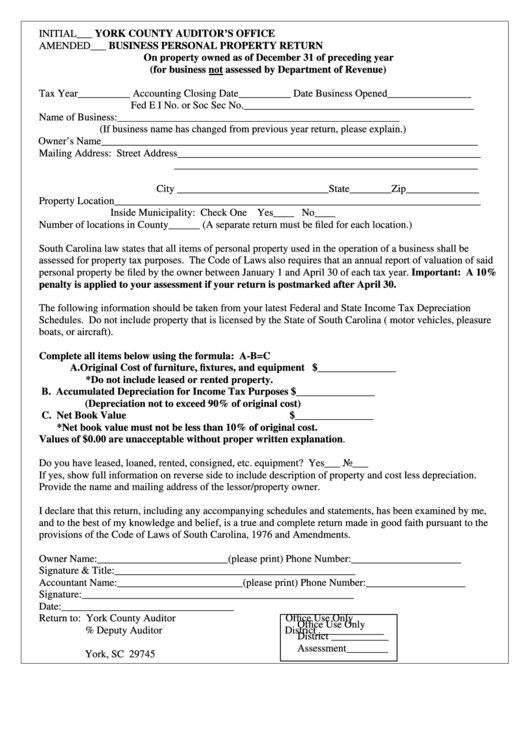

INITIAL___

YORK COUNTY AUDITOR’S OFFICE

AMENDED___

BUSINESS PERSONAL PROPERTY RETURN

On property owned as of December 31 of preceding year

(for business not assessed by Department of Revenue)

Tax Year__________ Accounting Closing Date__________ Date Business Opened________________

Fed E I No. or Soc Sec No.____________________________________________

Name of Business:______________________________________________________

(If business name has changed from previous year return, please explain.)

Owner’s Name________________________________________________________________________

Mailing Address: Street Address__________________________________________________________

__________________________________________________________

P.O. Box __________________________________________________________

City _____________________________State________Zip______________

Property Location______________________________________________________________________

Inside Municipality: Check One Yes____ No____

Number of locations in County______ (A separate return must be filed for each location.)

South Carolina law states that all items of personal property used in the operation of a business shall be

assessed for property tax purposes. The Code of Laws also requires that an annual report of valuation of said

personal property be filed by the owner between January 1 and April 30 of each tax year. Important: A 10%

penalty is applied to your assessment if your return is postmarked after April 30.

The following information should be taken from your latest Federal and State Income Tax Depreciation

Schedules. Do not include property that is licensed by the State of South Carolina ( motor vehicles, pleasure

boats, or aircraft).

Complete all items below using the formula: A-B=C

A. Original Cost of furniture, fixtures, and equipment $_______________

*Do not include leased or rented property.

B. Accumulated Depreciation for Income Tax Purposes $_______________

(Depreciation not to exceed 90% of original cost)

C. Net Book Value

$_______________

*Net book value must not be less than 10% of original cost.

Values of $0.00 are unacceptable without proper written explanation.

Do you have leased, loaned, rented, consigned, etc. equipment? Yes___ No___

If yes, show full information on reverse side to include description of property and cost less depreciation.

Provide the name and mailing address of the lessor/property owner.

I declare that this return, including any accompanying schedules and statements, has been examined by me,

and to the best of my knowledge and belief, is a true and complete return made in good faith pursuant to the

provisions of the Code of Laws of South Carolina, 1976 and Amendments.

Owner Name:_________________________(please print) Phone Number:_____________________

Signature & Title:______________________________________________

Accountant Name:________________________(please print) Phone Number:___________________

Signature:____________________________________________________

Date:_________________________________

Return to: York County Auditor

Office Use Only

Office Use Only

% Deputy Auditor

District_____________

District ___________

P.O. Box 25

Assessment__________

Assessment________

York, SC 29745

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2