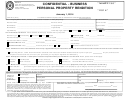

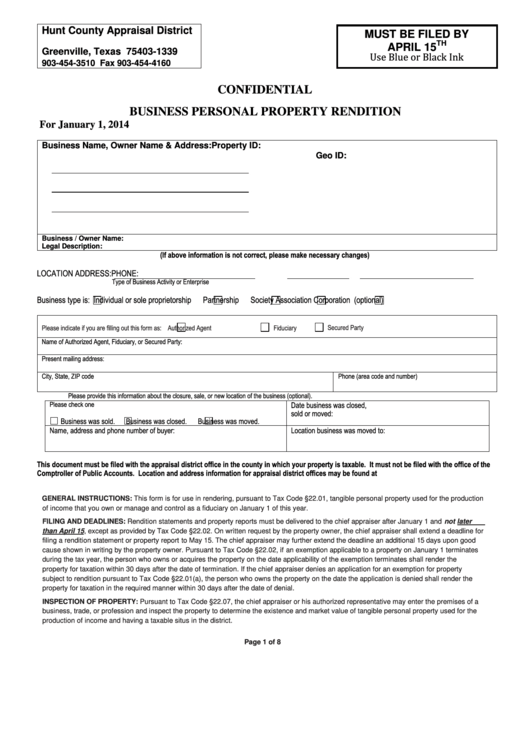

Confidential Business Personal Property Rendition - Hunt County Appraisal District - 2014

ADVERTISEMENT

Hunt County Appraisal District

MUST BE FILED BY

P.O. Box 1339

TH

APRIL 15

Greenville, Texas 75403-1339

Use Blue or Black Ink

903-454-3510 Fax 903-454-4160

CONFIDENTIAL

BUSINESS PERSONAL PROPERTY RENDITION

For January 1, 2014

Business Name, Owner Name & Address:

Property ID:

Geo ID:

Business / Owner Name:

Legal Description:

(If above information is not correct, please make necessary changes)

LOCATION ADDRESS:

PHONE:

Type of Business Activity or Enterprise

Business type is:

Individual or sole proprietorship

Partnership

Society

Association

Corporation (optional)

Please indicate if you are filling out this form as:

Authorized Agent

Fiduciary

Secured Party

Name of Authorized Agent, Fiduciary, or Secured Party:

Present mailing address:

City, State, ZIP code

Phone (area code and number)

Please provide this information about the closure, sale, or new location of the business (optional).

Please check one

Date business was closed,

sold or moved:

Business was sold.

Business was closed.

Business was moved.

Name, address and phone number of buyer:

Location business was moved to:

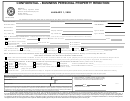

This document must be filed with the appraisal district office in the county in which your property is taxable. It must not be filed with the office of the

Comptroller

of

Public

Accounts.

Location

and

address

information

for

appraisal

district

offices

may

be

found

at

GENERAL INSTRUCTIONS: This form is for use in rendering, pursuant to Tax Code §22.01, tangible personal property used for the production

of income that you own or manage and control as a fiduciary on January 1 of this year.

FILING AND DEADLINES: Rendition statements and property reports must be delivered to the chief appraiser after January 1 and not later

than April 15, except as provided by Tax Code §22.02. On written request by the property owner, the chief appraiser shall extend a deadline for

filing a rendition statement or property report to May 15. The chief appraiser may further extend the deadline an additional 15 days upon good

cause shown in writing by the property owner. Pursuant to Tax Code §22.02, if an exemption applicable to a property on January 1 terminates

during the tax year, the person who owns or acquires

the property on the date applicability of the exemption terminates shall render the

property for taxation within 30 days after the date of termination. If the chief appraiser denies an application for an exemption for property

subject to rendition pursuant to Tax Code §22.01(a), the person who owns the property on the date the application is denied shall render the

property for taxation in the required manner within 30 days after the date of denial.

INSPECTION OF PROPERTY: Pursuant to Tax Code §22.07, the chief appraiser or his authorized representative may enter the premises of a

business, trade, or profession and inspect the property to determine the existence and market value of tangible personal property used for the

production of income and having a taxable situs in the district.

Page 1 of 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8