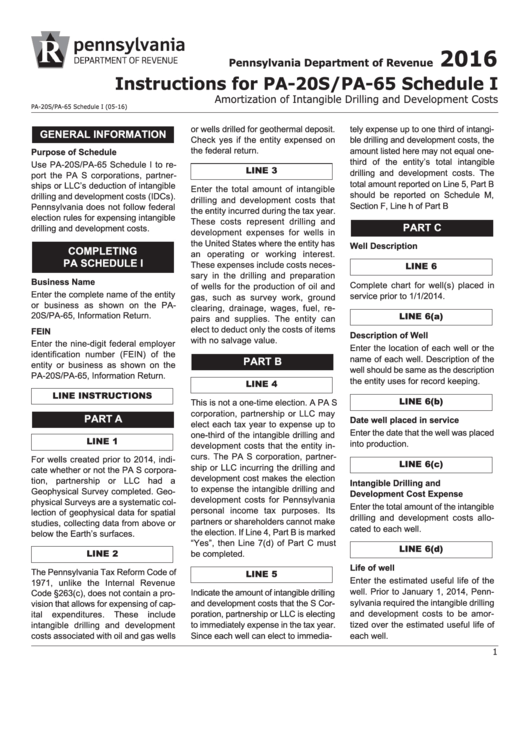

Instructions For Pa-20s/pa-65 Schedule I - Amortization Of Intangible Drilling And Development Costs - 2016

ADVERTISEMENT

2016

Pennsylvania Department of Revenue

Instructions for PA-20S/PA-65 Schedule I

Amortization of Intangible Drilling and Development Costs

PA-20S/PA-65 Schedule I (05-16)

or wells drilled for geothermal deposit.

tely expense up to one third of intangi-

GENERAL INFORMATION

Check yes if the entity expensed on

ble drilling and development costs, the

the federal return.

amount listed here may not equal one-

Purpose of Schedule

third of the entity’s total intangible

Use PA-20S/PA-65 Schedule I to re-

LINE 3

drilling and development costs. The

port the PA S corporations, partner-

total amount reported on Line 5, Part B

ships or LLC’s deduction of intangible

Enter the total amount of intangible

should be reported on Schedule M,

drilling and development costs (IDCs).

drilling and development costs that

Section F, Line h of Part B

Pennsylvania does not follow federal

the entity incurred during the tax year.

election rules for expensing intangible

These costs represent drilling and

PART C

drilling and development costs.

development expenses for wells in

the United States where the entity has

Well Description

COMPLETING

an operating or working interest.

PA SCHEDULE I

These expenses include costs neces-

LINE 6

sary in the drilling and preparation

Business Name

Complete chart for well(s) placed in

of wells for the production of oil and

Enter the complete name of the entity

service prior to 1/1/2014.

gas, such as survey work, ground

or business as shown on the PA-

clearing, drainage, wages, fuel, re-

20S/PA-65, Information Return.

LINE 6(a)

pairs and supplies. The entity can

elect to deduct only the costs of items

FEIN

Description of Well

with no salvage value.

Enter the nine-digit federal employer

Enter the location of each well or the

identification number (FEIN) of the

name of each well. Description of the

PART B

entity or business as shown on the

well should be same as the description

PA-20S/PA-65, Information Return.

the entity uses for record keeping.

LINE 4

LINE INSTRUCTIONS

LINE 6(b)

This is not a one-time election. A PA S

corporation, partnership or LLC may

PART A

Date well placed in service

elect each tax year to expense up to

Enter the date that the well was placed

one-third of the intangible drilling and

LINE 1

into production.

development costs that the entity in-

curs. The PA S corporation, partner-

For wells created prior to 2014, indi-

LINE 6(c)

ship or LLC incurring the drilling and

cate whether or not the PA S corpora-

development cost makes the election

tion, partnership or LLC had a

Intangible Drilling and

to expense the intangible drilling and

Geophysical Survey completed. Geo-

Development Cost Expense

development costs for Pennsylvania

physical Surveys are a systematic col-

Enter the total amount of the intangible

personal income tax purposes. Its

lection of geophysical data for spatial

drilling and development costs allo-

partners or shareholders cannot make

studies, collecting data from above or

cated to each well.

the election. If Line 4, Part B is marked

below the Earth’s surfaces.

“Yes”, then Line 7(d) of Part C must

LINE 6(d)

LINE 2

be completed.

Life of well

The Pennsylvania Tax Reform Code of

LINE 5

Enter the estimated useful life of the

1971, unlike the Internal Revenue

well. Prior to January 1, 2014, Penn-

Indicate the amount of intangible drilling

Code §263(c), does not contain a pro-

sylvania required the intangible drilling

and development costs that the S Cor-

vision that allows for expensing of cap-

poration, partnership or LLC is electing

and development costs to be amor-

ital

expenditures.

These

include

intangible drilling and development

to immediately expense in the tax year.

tized over the estimated useful life of

costs associated with oil and gas wells

Since each well can elect to immedia-

each well.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2