Form 201 Fp - Forest Products Harvest Tax Return Sample (2004) - Oregon Department Of Revenue Page 18

ADVERTISEMENT

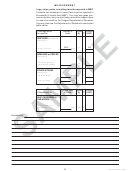

FILING INSTRUCTIONS

Please check the preprinted information on the return. If

Box 11. Subtract box 10 (25 MBF exemption) from box 9

any items are in ac cu rate, print the correction under that

(total volume). Enter the result in box 11 (taxable vol ume).

item. DO NOT white out any information on the re turn.

If zero or less, enter -0- in box 11. Do not enter a neg a tive

<-> amount. You still need to file a re turn.

The Business Identification Number (BIN) located at the

top of your return is your account number and will be the

Box 12. Multiply box 11 by the tax rate preprinted on the

same each year. Please refer to this number on any cor re -

form. Enter the result in box 12.

spon dence or in phone calls.

Box 13. Enter any quarterly estimated payments or oth er

Columns 1 through 7. For ad di tion al areas of har vest op-

prior payments.

er a tion that are not already listed, enter the entire Depart-

ment of Forestry Notification of Op er a tions (for est ry per-

Note: For amended returns, do not enter any prior pay-

mit) number, Operator name, Land own er name, Coun ty,

ments in box 13.

Township, Range, and Section.

Boxes 14 and 15. Subtract box 13 (prior payments) from

If you have any additional permit(s) that are not printed

box 12 (tax). If the re sult is positive, enter in box 14 (tax

on the return, please attach a copy.

due with this re turn). If the result is neg a tive, enter in box

Note: For amended returns, complete columns 1 through

15 (overpayment).

7 for only those Forestry Permits that are changed. This

Note: If you have an overpayment, the de part ment will

in for ma tion is on your prior (original) return.

com pute and pay interest on your re fund.

Measurement

Late filing

Logs and chips must be re port ed in MBF. Products not mea-

sured in board feet must be re port ed in thousands of board

Box 16. Compute penalty if you:

feet (MBF). You may use your conversion factors, but you

• Mail your tax payment after the due date (even if you

must keep records to sup port them in case of an audit by the

have a filing extension).

Department of Revenue. You may also use the Depart ment of

Rev e nue’s con ver sion table on the back of the re turn.

• File your return showing a tax due (box 14) after the due

Column 8. En ter the net (or “ad just ed gross”) thou sand

date.

board feet (MBF) vol ume of tim ber har vest ed for each

The penalty for filing or paying late is five percent of the

per mit. To convert board feet (BF) to MBF, di vide by

unpaid balance of your tax. If you file more than three

1,000—(26,499 bf ÷ 1,000 = 26.499 MBF.) Round MBF to

months late, the penalty is 25 per cent of box 14.

the near est whole number. For ex am ple:

Note: For amended returns, you do not have to pay a pen-

26,499 BF = 26.499 MBF = 26 MBF

al ty if all additional tax and interest are paid with your

26, 500 BF = 26.500 MBF = 27 MBF

amend ed return.

Note: For amended returns, enter only the dif fer ence be-

tween the volumes reported on your prior return and the

Box 17. Compute interest: multiply the number of days late

corrected volumes in column 8. Put brackets < > around

times the daily interest rate (printed on the form) times the

any negative values.

amount in box 14.

Column 8. Enter taxable volume amounts (MBF) in col umn

Note: For amended returns, compute interest from the

8. If you have ad di tion al pages (Form 201A), also enter

orig i nal due date of the return.

those volume amounts in column 8 on these forms.

Box 18. TOTAL PAYMENT. Add boxes 14, 16, and 17. En-

Box 9. Total Volume. Add all the amounts from column 8.

close this amount with your return. Sign, date, and mail

Be sure to in clude all amounts from column 8 on all pag es

your return to the Oregon Department of Rev e nue.

of Form(s) 201A. Enter the total in box 9.

Remember to sign and date your return before filing.

KEEP A COPY OF THE RETURN FOR YOUR FILES!

150-502-202 (Rev. 10-04)

18

150-441-409 (Rev. 2-05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42