Form 201 Fp - Forest Products Harvest Tax Return Sample (2004) - Oregon Department Of Revenue Page 6

ADVERTISEMENT

Who Is Responsible

Oregon law requires the owner of timber at the time logs are first mea-

sured (scaled or weighed) to pay any timber taxes that may be due. Gen-

for Paying Timber

erally, logs are first measured when they are delivered and sold to a mill.

When timber is to be sold, it is important that the parties involved under-

Taxes?

stand who will be responsible for payment of timber taxes.

The following information is used in determining the timber owner, and

therefore who is responsible for payment:

• The name of the party owning the logs when they are measured should

appear as timber owner on the “Notification of Operations” (referred

to as the logging permit) when the Department of Forestry is notified

of plans to harvest. This ensures that the party responsible for filing

returns and paying the tax receives filing instructions and tax forms

from the Oregon Department of Revenue.

• Mill records stating the person who received money for the harvested

timber. The legal owner of timber (taxpayer) may not “contract away”

any responsibility to pay a tax liability. An arrangement of this type may

be enforceable between parties but the Oregon Department of Revenue

will not recognize any attempt to shift liability from the legal taxpayer

to another party. Department of Revenue may look at the contract to

determine if the ownership of the timber has changed. If there was not

a change of ownership, then the Oregon Department of Revenue will

not recognize an agreement to shift tax liability to a party other than the

timber owner.

If you are unsure about who is legally responsible to pay timber taxes,

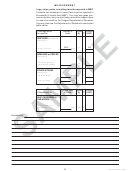

the table below may help:

Type of Transaction

Responsible Taxpayer

Outright sale of standing timber

Timber purchaser (at the tax rate

only.

of the landowner).

Sale of land and timber by deed.

Purchaser of property.

Sale of land and timber by land

Purchaser of property.

sales contract.

Sale of logs prior to any measure,

Purchaser of the logs (at the tax

for example from the landing.

rate of the landowner).

Trading timber for services, such

Person receiving timber (at the

as logging, land clearing–refores-

tax rate of the landowner).

tation and/or materials.

Sale of delivered logs to a mill or

Legal owner of the logs.

conversion center.

Timber given as a gift.

Recipient of gift (at the tax rate

of the landowner).

6

150-441-409 (Rev. 2-05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42