Form 1041-Qft - General Instructions - 2006

ADVERTISEMENT

2

Form 1041-QFT (2006)

Page

General Instructions

for funeral or burial goods and services and

Composite Return

does not change over the life of the trust. Use

A trustee may file a single, composite

Section references are to the Internal

the table below to determine the contribution

Form 1041-QFT for some or all QFTs of

Revenue Code.

limit for each QFT.

which he or she is the trustee, including QFTs

What’s New

that had a short tax year.

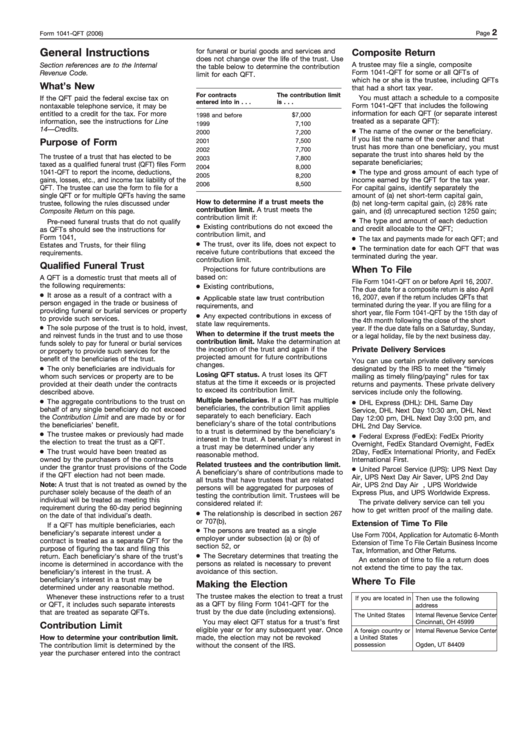

For contracts

The contribution limit

If the QFT paid the federal excise tax on

You must attach a schedule to a composite

entered into in . . .

is . . .

Form 1041-QFT that includes the following

nontaxable telephone service, it may be

entitled to a credit for the tax. For more

information for each QFT (or separate interest

1998 and before

$7,000

treated as a separate QFT):

information, see the instructions for Line

1999

7,100

14—Credits.

The name of the owner or the beneficiary.

2000

7,200

If you list the name of the owner and that

Purpose of Form

2001

7,500

trust has more than one beneficiary, you must

2002

7,700

separate the trust into shares held by the

The trustee of a trust that has elected to be

2003

7,800

separate beneficiaries;

taxed as a qualified funeral trust (QFT) files Form

2004

8,000

1041-QFT to report the income, deductions,

The type and gross amount of each type of

2005

8,200

income earned by the QFT for the tax year.

gains, losses, etc., and income tax liability of the

2006

8,500

QFT. The trustee can use the form to file for a

For capital gains, identify separately the

amount of (a) net short-term capital gain,

single QFT or for multiple QFTs having the same

How to determine if a trust meets the

trustee, following the rules discussed under

(b) net long-term capital gain, (c) 28% rate

contribution limit. A trust meets the

Composite Return on this page.

gain, and (d) unrecaptured section 1250 gain;

contribution limit if:

The type and amount of each deduction

Pre-need funeral trusts that do not qualify

Existing contributions do not exceed the

and credit allocable to the QFT;

as QFTs should see the instructions for

contribution limit, and

Form 1041, U.S. Income Tax Return for

The tax and payments made for each QFT; and

The trust, over its life, does not expect to

Estates and Trusts, for their filing

The termination date for each QFT that was

receive future contributions that exceed the

requirements.

terminated during the year.

contribution limit.

Qualified Funeral Trust

When To File

Projections for future contributions are

based on:

A QFT is a domestic trust that meets all of

File Form 1041-QFT on or before April 16, 2007.

the following requirements:

Existing contributions,

The due date for a composite return is also April

It arose as a result of a contract with a

16, 2007, even if the return includes QFTs that

Applicable state law trust contribution

person engaged in the trade or business of

terminated during the year. If you are filing for a

requirements, and

providing funeral or burial services or property

short year, file Form 1041-QFT by the 15th day of

Any expected contributions in excess of

to provide such services.

the 4th month following the close of the short

state law requirements.

The sole purpose of the trust is to hold, invest,

year. If the due date falls on a Saturday, Sunday,

When to determine if the trust meets the

and reinvest funds in the trust and to use those

or a legal holiday, file by the next business day.

contribution limit. Make the determination at

funds solely to pay for funeral or burial services

the inception of the trust and again if the

Private Delivery Services

or property to provide such services for the

projected amount for future contributions

benefit of the beneficiaries of the trust.

You can use certain private delivery services

changes.

The only beneficiaries are individuals for

designated by the IRS to meet the “timely

Losing QFT status. A trust loses its QFT

whom such services or property are to be

mailing as timely filing/paying” rules for tax

status at the time it exceeds or is projected

provided at their death under the contracts

returns and payments. These private delivery

to exceed its contribution limit.

described above.

services include only the following.

Multiple beneficiaries. If a QFT has multiple

The aggregate contributions to the trust on

DHL Express (DHL): DHL Same Day

beneficiaries, the contribution limit applies

behalf of any single beneficiary do not exceed

Service, DHL Next Day 10:30 am, DHL Next

separately to each beneficiary. Each

the Contribution Limit and are made by or for

Day 12:00 pm, DHL Next Day 3:00 pm, and

beneficiary’s share of the total contributions

the beneficiaries’ benefit.

DHL 2nd Day Service.

to a trust is determined by the beneficiary’s

The trustee makes or previously had made

Federal Express (FedEx): FedEx Priority

interest in the trust. A beneficiary’s interest in

the election to treat the trust as a QFT.

Overnight, FedEx Standard Overnight, FedEx

a trust may be determined under any

The trust would have been treated as

2Day, FedEx International Priority, and FedEx

reasonable method.

owned by the purchasers of the contracts

International First.

Related trustees and the contribution limit.

under the grantor trust provisions of the Code

United Parcel Service (UPS): UPS Next Day

A beneficiary’s share of contributions made to

if the QFT election had not been made.

Air, UPS Next Day Air Saver, UPS 2nd Day

all trusts that have trustees that are related

Note: A trust that is not treated as owned by the

Air, UPS 2nd Day Air A.M., UPS Worldwide

persons will be aggregated for purposes of

purchaser solely because of the death of an

Express Plus, and UPS Worldwide Express.

testing the contribution limit. Trustees will be

individual will be treated as meeting this

The private delivery service can tell you

considered related if:

requirement during the 60-day period beginning

how to get written proof of the mailing date.

The relationship is described in section 267

on the date of that individual’s death.

or 707(b),

Extension of Time To File

If a QFT has multiple beneficiaries, each

The persons are treated as a single

beneficiary’s separate interest under a

Use Form 7004, Application for Automatic 6-Month

employer under subsection (a) or (b) of

contract is treated as a separate QFT for the

Extension of Time To File Certain Business Income

section 52, or

purpose of figuring the tax and filing this

Tax, Information, and Other Returns.

The Secretary determines that treating the

return. Each beneficiary’s share of the trust’s

An extension of time to file a return does

persons as related is necessary to prevent

income is determined in accordance with the

not extend the time to pay the tax.

avoidance of this section.

beneficiary’s interest in the trust. A

beneficiary’s interest in a trust may be

Where To File

Making the Election

determined under any reasonable method.

The trustee makes the election to treat a trust

Whenever these instructions refer to a trust

If you are located in

Then use the following

as a QFT by filing Form 1041-QFT for the

or QFT, it includes such separate interests

address

trust by the due date (including extensions).

that are treated as separate QFTs.

The United States

Internal Revenue Service Center

You may elect QFT status for a trust’s first

Cincinnati, OH 45999

Contribution Limit

eligible year or for any subsequent year. Once

A foreign country or

Internal Revenue Service Center

How to determine your contribution limit.

made, the election may not be revoked

a United States

P.O. Box 409101

possession

Ogden, UT 84409

The contribution limit is determined by the

without the consent of the IRS.

year the purchaser entered into the contract

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3