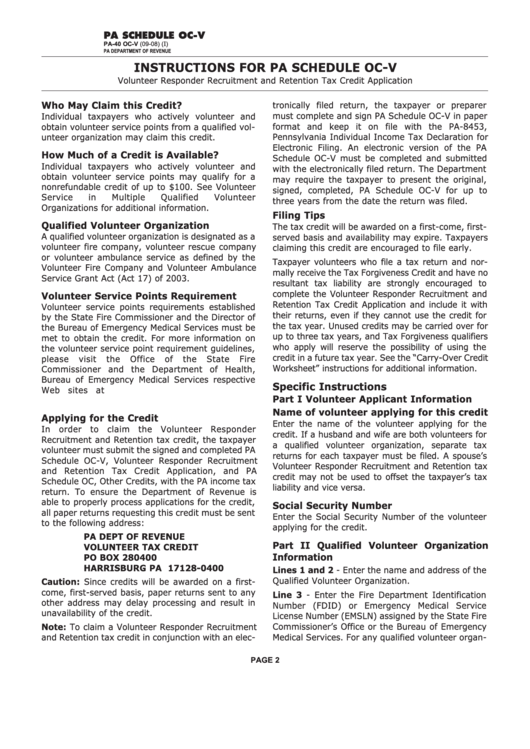

Instructions For Pa Schedule Oc-V

ADVERTISEMENT

PA SCHEDULE OC-V

PA-40 OC-V (09-08) (I)

PA DEPARTMENT OF REVENUE

INSTRUCTIONS FOR PA SCHEDULE OC-V

Volunteer Responder Recruitment and Retention Tax Credit Application

Who May Claim this Credit?

tronically filed return, the taxpayer or preparer

must complete and sign PA Schedule OC-V in paper

Individual taxpayers who actively volunteer and

format and keep it on file with the PA-8453,

obtain volunteer service points from a qualified vol-

unteer organization may claim this credit.

Pennsylvania Individual Income Tax Declaration for

Electronic Filing. An electronic version of the PA

How Much of a Credit is Available?

Schedule OC-V must be completed and submitted

Individual taxpayers who actively volunteer and

with the electronically filed return. The Department

obtain volunteer service points may qualify for a

may require the taxpayer to present the original,

nonrefundable credit of up to $100. See Volunteer

signed, completed, PA Schedule OC-V for up to

Service

in

Multiple

Qualified

Volunteer

three years from the date the return was filed.

Organizations for additional information.

Filing Tips

Qualified Volunteer Organization

The tax credit will be awarded on a first-come, first-

A qualified volunteer organization is designated as a

served basis and availability may expire. Taxpayers

volunteer fire company, volunteer rescue company

claiming this credit are encouraged to file early.

or volunteer ambulance service as defined by the

Taxpayer volunteers who file a tax return and nor-

Volunteer Fire Company and Volunteer Ambulance

mally receive the Tax Forgiveness Credit and have no

Service Grant Act (Act 17) of 2003.

resultant tax liability are strongly encouraged to

complete the Volunteer Responder Recruitment and

Volunteer Service Points Requirement

Retention Tax Credit Application and include it with

Volunteer service points requirements established

their returns, even if they cannot use the credit for

by the State Fire Commissioner and the Director of

the tax year. Unused credits may be carried over for

the Bureau of Emergency Medical Services must be

up to three tax years, and Tax Forgiveness qualifiers

met to obtain the credit. For more information on

who apply will reserve the possibility of using the

the volunteer service point requirement guidelines,

credit in a future tax year. See the “Carry-Over Credit

please

visit

the

Office

of

the

State

Fire

Worksheet” instructions for additional information.

Commissioner and the Department of Health,

Bureau of Emergency Medical Services respective

Specific Instructions

Web sites at and

Part I Volunteer Applicant Information

Name of volunteer applying for this credit

Applying for the Credit

Enter the name of the volunteer applying for the

In order to claim the Volunteer Responder

credit. If a husband and wife are both volunteers for

Recruitment and Retention tax credit, the taxpayer

a qualified volunteer organization, separate tax

volunteer must submit the signed and completed PA

returns for each taxpayer must be filed. A spouse’s

Schedule OC-V, Volunteer Responder Recruitment

Volunteer Responder Recruitment and Retention tax

and Retention Tax Credit Application, and PA

credit may not be used to offset the taxpayer’s tax

Schedule OC, Other Credits, with the PA income tax

liability and vice versa.

return. To ensure the Department of Revenue is

able to properly process applications for the credit,

Social Security Number

all paper returns requesting this credit must be sent

Enter the Social Security Number of the volunteer

to the following address:

applying for the credit.

PA DEPT OF REVENUE

Part II Qualified Volunteer Organization

VOLUNTEER TAX CREDIT

Information

PO BOX 280400

HARRISBURG PA 17128-0400

Lines 1 and 2 - Enter the name and address of the

Qualified Volunteer Organization.

Caution: Since credits will be awarded on a first-

come, first-served basis, paper returns sent to any

Line 3 - Enter the Fire Department Identification

other address may delay processing and result in

Number (FDID) or Emergency Medical Service

unavailability of the credit.

License Number (EMSLN) assigned by the State Fire

Commissioner’s Office or the Bureau of Emergency

Note: To claim a Volunteer Responder Recruitment

and Retention tax credit in conjunction with an elec-

Medical Services. For any qualified volunteer organ-

PAGE 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2