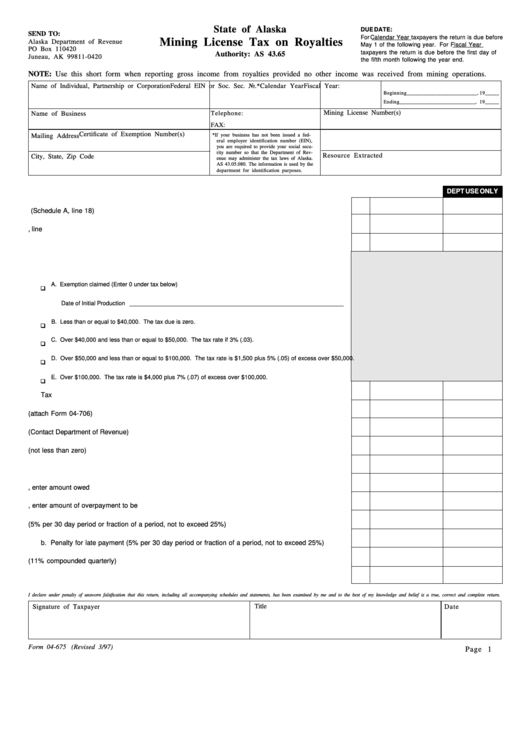

State of Alaska

DUE DATE:

SEND TO:

For Calendar Year taxpayers the return is due before

Mining License Tax on Royalties

Alaska Department of Revenue

May 1 of the following year. For Fiscal Year

PO Box 110420

taxpayers the return is due before the first day of

Authority: AS 43.65

Juneau, AK 99811-0420

the fifth month following the year end.

NOTE: Use this short form when reporting gross income from royalties provided no other income was received from mining operations.

Name of Individual, Partnership or Corporation

Federal EIN or Soc. Sec. No.*

Calendar Year

Fiscal Year:

Beginning_________________________, 19_____

Ending___________________________, 19_____

Mining License Number(s)

Telephone:

Name of Business

FAX:

Certificate of Exemption Number(s)

* If your business has not been issued a fed-

Mailing Address

eral employer identification number (EIN),

you are required to provide your social secu-

rity number so that the Department of Rev-

Resource Extracted

City, State, Zip Code

enue may administer the tax laws of Alaska.

AS 43.05.080. The information is used by the

department for identification purposes.

DEPT USE ONLY

1. Total gross income from royalties. (Schedule A, line 18) ......................................................................

1

2. Depletion. Schedule BR, line 9 ................................................................................................................

2

3. Net income from royalties. Subtract line 2 from line 1 ............................................................................

3

4. Computation of tax based on net income reported on line 3.

A. Exemption claimed (Enter 0 under tax below)

Date of Initial Production _________________________________________________________________

B. Less than or equal to $40,000. The tax due is zero.

C. Over $40,000 and less than or equal to $50,000. The tax rate if 3% (.03).

D. Over $50,000 and less than or equal to $100,000. The tax rate is $1,500 plus 5% (.05) of excess over $50,000.

E. Over $100,000. The tax rate is $4,000 plus 7% (.07) of excess over $100,000.

Tax

.........................................................................................................................................................

4

5. Alaska education credit (attach Form 04-706) ........................................................................................

5

6. Exploration Incentive Credit (Contact Department of Revenue) ..............................................................

6

7. Tax due. Subtract lines 5 and 6 from line 4 (not less than zero) ...........................................................

7

8. Paid with extension ..................................................................................................................................

8

9. Total tax due. If line 7 is larger than line 8, enter amount owed ............................................................

9

10. Overpayment. If line 8 is larger than line 7, enter amount of overpayment to be refunded ..................

10

11. a. Penalty for late filing (5% per 30 day period or fraction of a period, not to exceed 25%) ...............

11a

b. Penalty for late payment (5% per 30 day period or fraction of a period, not to exceed 25%) ........

11b

12. Interest (11% compounded quarterly) .....................................................................................................

12

13. Balance due. Add line 9 plus lines 11 - 12 .............................................................................................

13

I declare under penalty of unsworn falsification that this return, including all accompanying schedules and statements, has been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

Title

Signature of Taxpayer

Date

Form 04-675 (Revised 3/97)

Page 1

1

1