Form Co-419 Line-By-Line Instructions - 2005

ADVERTISEMENT

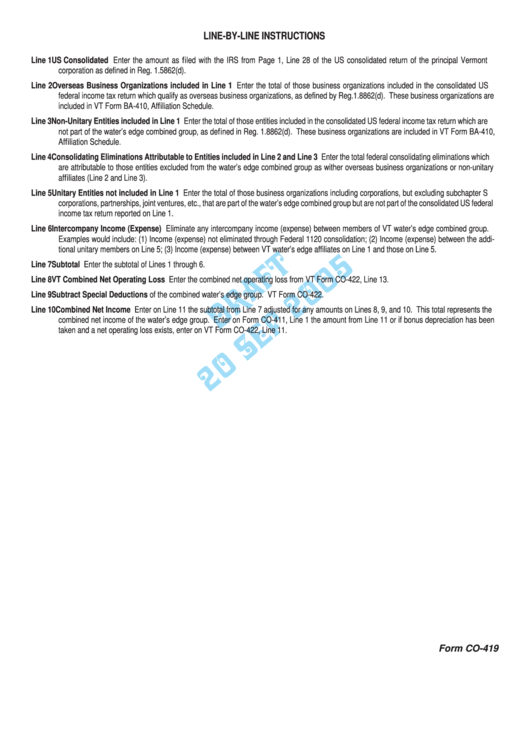

LINE-BY-LINE INSTRUCTIONS

Line 1 US Consolidated Enter the amount as filed with the IRS from Page 1, Line 28 of the US consolidated return of the principal Vermont

corporation as defined in Reg. 1.5862(d).

Line 2 Overseas Business Organizations included in Line 1 Enter the total of those business organizations included in the consolidated US

federal income tax return which qualify as overseas business organizations, as defined by Reg.1.8862(d). These business organizations are

included in VT Form BA-410, Affiliation Schedule.

Line 3 Non-Unitary Entities included in Line 1 Enter the total of those entities included in the consolidated US federal income tax return which are

not part of the water’s edge combined group, as defined in Reg. 1.8862(d). These business organizations are included in VT Form BA-410,

Affiliation Schedule.

Line 4 Consolidating Eliminations Attributable to Entities included in Line 2 and Line 3 Enter the total federal consolidating eliminations which

are attributable to those entities excluded from the water’s edge combined group as wither overseas business organizations or non-unitary

affiliates (Line 2 and Line 3).

Line 5 Unitary Entities not included in Line 1 Enter the total of those business organizations including corporations, but excluding subchapter S

corporations, partnerships, joint ventures, etc., that are part of the water’s edge combined group but are not part of the consolidated US federal

income tax return reported on Line 1.

Line 6 Intercompany Income (Expense) Eliminate any intercompany income (expense) between members of VT water’s edge combined group.

Examples would include: (1) Income (expense) not eliminated through Federal 1120 consolidation; (2) Income (expense) between the addi-

tional unitary members on Line 5; (3) Income (expense) between VT water’s edge affiliates on Line 1 and those on Line 5.

Line 7 Subtotal Enter the subtotal of Lines 1 through 6.

Line 8 VT Combined Net Operating Loss Enter the combined net operating loss from VT Form CO-422, Line 13.

Line 9 Subtract Special Deductions of the combined water’s edge group. VT Form CO-422.

Line 10 Combined Net Income Enter on Line 11 the subtotal from Line 7 adjusted for any amounts on Lines 8, 9, and 10. This total represents the

combined net income of the water’s edge group. Enter on Form CO-411, Line 1 the amount from Line 11 or if bonus depreciation has been

taken and a net operating loss exists, enter on VT Form CO-422, Line 11.

Form CO-419

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1