Instructions For Form 12-A - Estate Tax Forms - County Auditor

ADVERTISEMENT

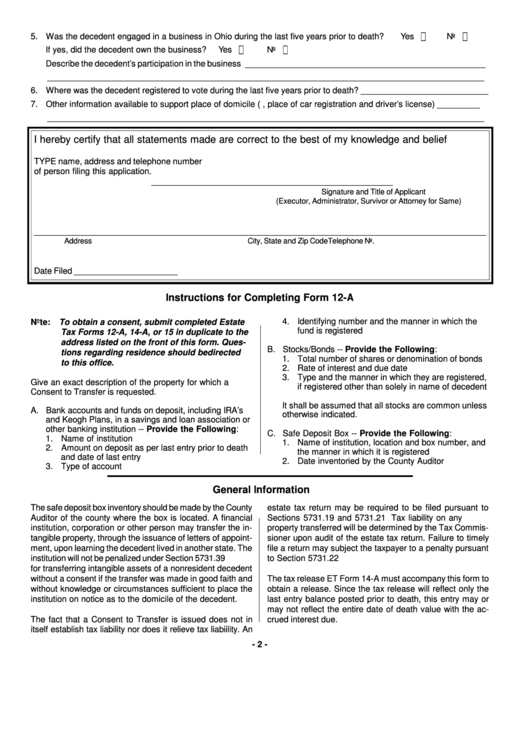

Yes c

No c

5. Was the decedent engaged in a business in Ohio during the last five years prior to death?

Yes c

No c

If yes, did the decedent own the business?

Describe the decedent’ s participation in the business ___________________________________________________

______________________________________________________________________________________________

6. Where was the decedent registered to vote during the last five years prior to death? ___________________________

7. Other information available to support place of domicile (i.e., place of car registration and driver’ s license) _________

______________________________________________________________________________________________

I hereby certify that all statements made are correct to the best of my knowledge and belief

TYPE name, address and telephone number

of person filing this application.

____________________________________________________

Signature and Title of Applicant

(Executor, Administrator, Survivor or Attorney for Same)

__________________________________________________________________________________________________

Address

City, State and Zip Code

Telephone No.

Date Filed ______________________

Instructions for Completing Form 12-A

4. Identifying number and the manner in which the

Note: To obtain a consent, submit completed Estate

fund is registered

Tax Forms 12-A, 14-A, or 15 in duplicate to the

address listed on the front of this form. Ques-

B. Stocks/Bonds -- Provide the Following:

tions regarding residence should be directed

1. Total number of shares or denomination of bonds

to this office.

2. Rate of interest and due date

3. Type and the manner in which they are registered,

Give an exact description of the property for which a

if registered other than solely in name of decedent

Consent to Transfer is requested.

It shall be assumed that all stocks are common unless

A. Bank accounts and funds on deposit, including IRA’ s

otherwise indicated.

and Keogh Plans, in a savings and loan association or

other banking institution -- Provide the Following:

C. Safe Deposit Box -- Provide the Following:

1. Name of institution

1. Name of institution, location and box number, and

2. Amount on deposit as per last entry prior to death

the manner in which it is registered

and date of last entry

2. Date inventoried by the County Auditor

3. Type of account

General Information

The safe deposit box inventory should be made by the County

estate tax return may be required to be filed pursuant to

Auditor of the county where the box is located. A financial

Sections 5731.19 and 5731.21 O.R.C. Tax liability on any

institution, corporation or other person may transfer the in-

property transferred will be determined by the Tax Commis-

tangible property, through the issuance of letters of appoint-

sioner upon audit of the estate tax return. Failure to timely

ment, upon learning the decedent lived in another state. The

file a return may subject the taxpayer to a penalty pursuant

institution will not be penalized under Section 5731.39 O.R.C.

to Section 5731.22 O.R.C.

for transferring intangible assets of a nonresident decedent

without a consent if the transfer was made in good faith and

The tax release ET Form 14-A must accompany this form to

without knowledge or circumstances sufficient to place the

obtain a release. Since the tax release will reflect only the

institution on notice as to the domicile of the decedent.

last entry balance posted prior to death, this entry may or

may not reflect the entire date of death value with the ac-

The fact that a Consent to Transfer is issued does not in

crued interest due.

itself establish tax liability nor does it relieve tax liabiility. An

- 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1