Instructions For Wyoming Property Tax Relief Program Form

ADVERTISEMENT

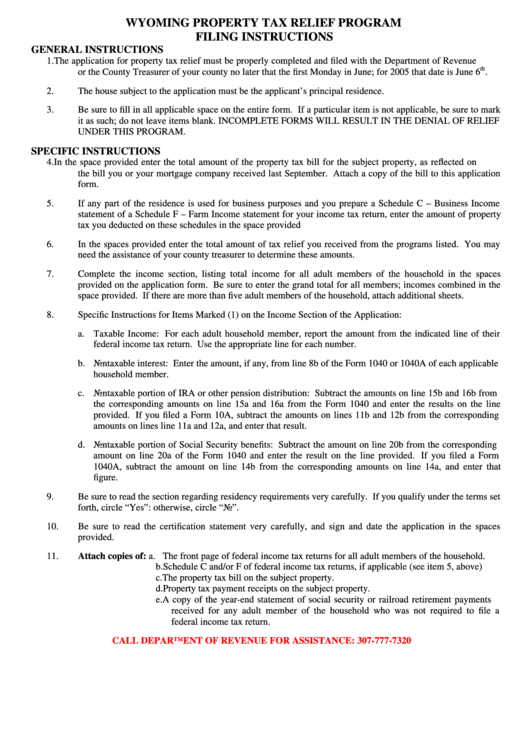

WYOMING PROPERTY TAX RELIEF PROGRAM

FILING INSTRUCTIONS

GENERAL INSTRUCTIONS

1.

The application for property tax relief must be properly completed and filed with the Department of Revenue

th

or the County Treasurer of your county no later that the first Monday in June; for 2005 that date is June 6

.

2.

The house subject to the application must be the applicant’s principal residence.

3.

Be sure to fill in all applicable space on the entire form. If a particular item is not applicable, be sure to mark

it as such; do not leave items blank. INCOMPLETE FORMS WILL RESULT IN THE DENIAL OF RELIEF

UNDER THIS PROGRAM.

SPECIFIC INSTRUCTIONS

4.

In the space provided enter the total amount of the property tax bill for the subject property, as reflected on

the bill you or your mortgage company received last September. Attach a copy of the bill to this application

form.

5.

If any part of the residence is used for business purposes and you prepare a Schedule C – Business Income

statement of a Schedule F – Farm Income statement for your income tax return, enter the amount of property

tax you deducted on these schedules in the space provided

6.

In the spaces provided enter the total amount of tax relief you received from the programs listed. You may

need the assistance of your county treasurer to determine these amounts.

7.

Complete the income section, listing total income for all adult members of the household in the spaces

provided on the application form. Be sure to enter the grand total for all members; incomes combined in the

space provided. If there are more than five adult members of the household, attach additional sheets.

8.

Specific Instructions for Items Marked (1) on the Income Section of the Application:

a. Taxable Income: For each adult household member, report the amount from the indicated line of their

federal income tax return. Use the appropriate line for each number.

b. Nontaxable interest: Enter the amount, if any, from line 8b of the Form 1040 or 1040A of each applicable

household member.

c. Nontaxable portion of IRA or other pension distribution: Subtract the amounts on line 15b and 16b from

the corresponding amounts on line 15a and 16a from the Form 1040 and enter the results on the line

provided. If you filed a Form 10A, subtract the amounts on lines 11b and 12b from the corresponding

amounts on lines line 11a and 12a, and enter that result.

d. Nontaxable portion of Social Security benefits: Subtract the amount on line 20b from the corresponding

amount on line 20a of the Form 1040 and enter the result on the line provided. If you filed a Form

1040A, subtract the amount on line 14b from the corresponding amounts on line 14a, and enter that

figure.

9.

Be sure to read the section regarding residency requirements very carefully. If you qualify under the terms set

forth, circle “Yes”: otherwise, circle “No”.

10.

Be sure to read the certification statement very carefully, and sign and date the application in the spaces

provided.

11.

Attach copies of: a. The front page of federal income tax returns for all adult members of the household.

b. Schedule C and/or F of federal income tax returns, if applicable (see item 5, above)

c. The property tax bill on the subject property.

d. Property tax payment receipts on the subject property.

e. A copy of the year-end statement of social security or railroad retirement payments

received for any adult member of the household who was not required to file a

federal income tax return.

CALL DEPARTMENT OF REVENUE FOR ASSISTANCE: 307-777-7320

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1